Question

6.(30points)Ratios: Answer the following questions.a. Galaxy Sales has sales of $746,700, cost of goods sold of $603,200, and inventory of $94,300. How long on average

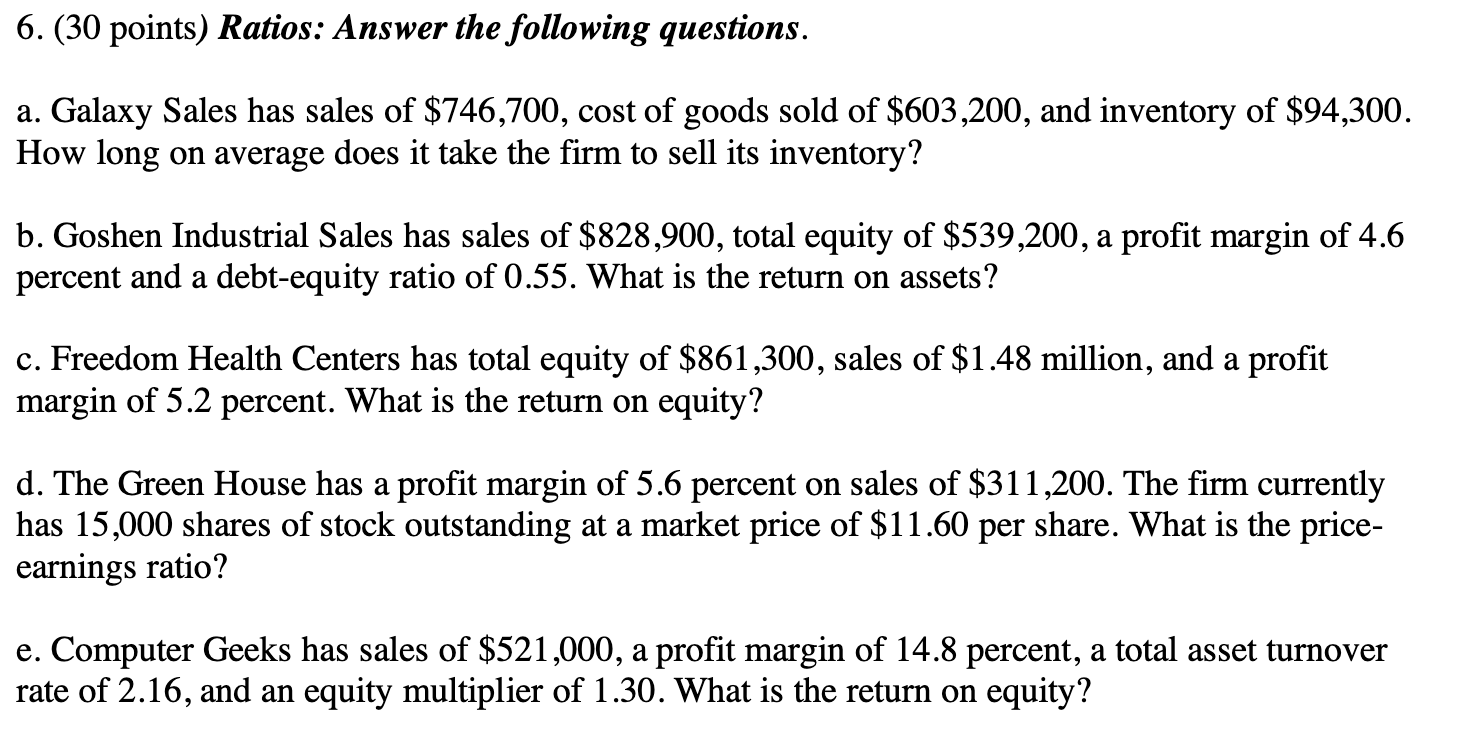

6.(30points)Ratios: Answer the following questions.a. Galaxy Sales has sales of $746,700, cost of goods sold of $603,200, and inventory of $94,300. How long on average does it take the firm to sell its inventory?b. Goshen Industrial Sales has sales of $828,900, total equity of $539,200, a profit margin of 4.6 percent and a debt-equity ratio of 0.55. What is the return on assets?c. Freedom Health Centers has total equity of $861,300, sales of $1.48 million, and a profit margin of 5.2 percent. What is the return on equity?d. The Green House has a profit margin of 5.6 percent on sales of $311,200. The firm currently has 15,000 shares of stock outstanding at a marketprice of $11.60 per share. What is the price-earnings ratio? e. Computer Geeks has sales of $521,000, a profit margin of 14.8 percent, a total asset turnover rate of 2.16, and an equity multiplier of 1.30. What is the return on equity? . Hoagland Corp's stock price at the end of last year was $33.50, and its book value per share was $25.00. What was its market/book ratio?

6.(30points)Ratios: Answer the following questions.a. Galaxy Sales has sales of $746,700, cost of goods sold of $603,200, and inventory of $94,300. How long on average does it take the firm to sell its inventory?b. Goshen Industrial Sales has sales of $828,900, total equity of $539,200, a profit margin of 4.6 percent and a debt-equity ratio of 0.55. What is the return on assets?c. Freedom Health Centers has total equity of $861,300, sales of $1.48 million, and a profit margin of 5.2 percent. What is the return on equity?d. The Green House has a profit margin of 5.6 percent on sales of $311,200. The firm currently has 15,000 shares of stock outstanding at a marketprice of $11.60 per share. What is the price-earnings ratio? e. Computer Geeks has sales of $521,000, a profit margin of 14.8 percent, a total asset turnover rate of 2.16, and an equity multiplier of 1.30. What is the return on equity? . Hoagland Corp's stock price at the end of last year was $33.50, and its book value per share was $25.00. What was its market/book ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started