Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6-32 Reaching a financial goal Simon, like many college students, recently filled out a credit card application. Not surprisingly, his application was accepted at

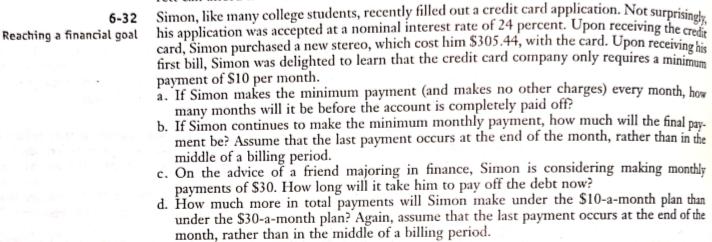

6-32 Reaching a financial goal Simon, like many college students, recently filled out a credit card application. Not surprisingly, his application was accepted at a nominal interest rate of 24 percent. Upon receiving the credit card, Simon purchased a new stereo, which cost him $305.44, with the card. Upon receiving his first bill, Simon was delighted to learn that the credit card company only requires a minimum payment of $10 per month. a. If Simon makes the minimum payment (and makes no other charges) every month, how many months will it be before the account is completely paid off? b. If Simon continues to make the minimum monthly payment, how much will the final pay- ment be? Assume that the last payment occurs at the end of the month, rather than in the middle of a billing period. c. On the advice of a friend majoring in finance, Simon is considering making monthly payments of $30. How long will it take him to pay off the debt now? d. How much more in total payments will Simon make under the $10-a-month plan than under the $30-a-month plan? Again, assume that the last payment occurs at the end of the month, rather than in the middle of a billing period.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Solution Credit card is a source to take the loan by spending the banks money for pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started