51. Revised budget and Variances - Jackson Ple Jackson Plc manufactures and retails leather bags. It follows the standard costing method for performance analysis.

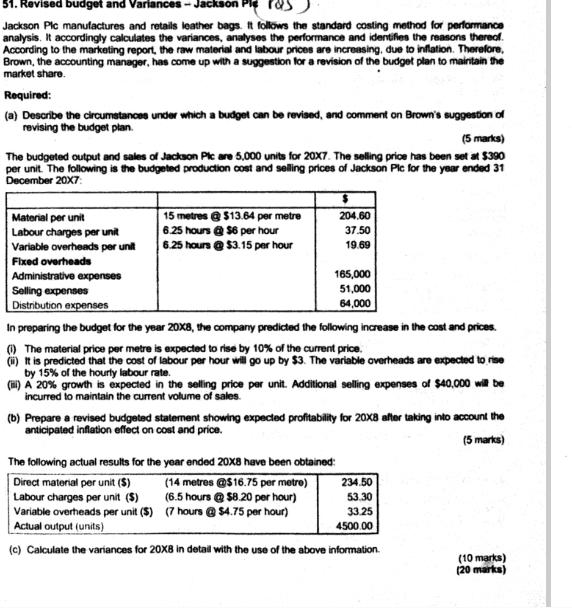

51. Revised budget and Variances - Jackson Ple Jackson Plc manufactures and retails leather bags. It follows the standard costing method for performance analysis. It accordingly calculates the variances, analyses the performance and identifies the reasons thereof. According to the marketing report, the raw material and labour prices are increasing, due to inflation. Therefore, Brown, the accounting manager, has come up with a suggestion for a revision of the budget plan to maintain the market share. Required: (a) Describe the circumstances under which a budget can be revised, and comment on Brown's suggestion of revising the budget plan. (5 marks) The budgeted output and sales of Jackson Plc are 5,000 units for 20x7. The selling price has been set at $390 per unit. The following is the budgeted production cost and selling prices of Jackson Pic for the year ended 31 December 20X7 Material per unit 204.60 Labour charges per unit 15 metres @ $13.64 per metre 6.25 hours @ $6 per hour 6.25 hours@ $3.15 per hour 37.50 Variable overheads per unit 19.69 Fixed overheads 165,000 Administrative expenses Selling expenses 51,000 Distribution expenses 64,000 In preparing the budget for the year 20X8, the company predicted the following increase in the cost and prices. (1) The material price per metre is expected to rise by 10% of the current price. (ii) It is predicted that the cost of labour per hour will go up by $3. The variable overheads are expected to rise by 15% of the hourly labour rate. () A 20% growth is expected in the selling price per unit. Additional selling expenses of $40,000 will be incurred to maintain the current volume of sales. (b) Prepare a revised budgeted statement showing expected profitability for 20X8 after taking into account the anticipated inflation effect on cost and price. (5 marks) The following actual results for the year ended 20X8 have been obtained: 234.50 Direct material per unit ($) Labour charges per unit ($) Variable overheads per unit ($) Actual output (units) (14 metres @$16.75 per metre) (6.5 hours @ $8.20 per hour) (7 hours @ $4.75 per hour) 53.30 33.25 4500.00 (c) Calculate the variances for 20X8 in detail with the use of the above information. (10 marks) (20 marks)

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Ansa Budgets are based on certain assumptions These assumptions are basis the visibility as on budge...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started