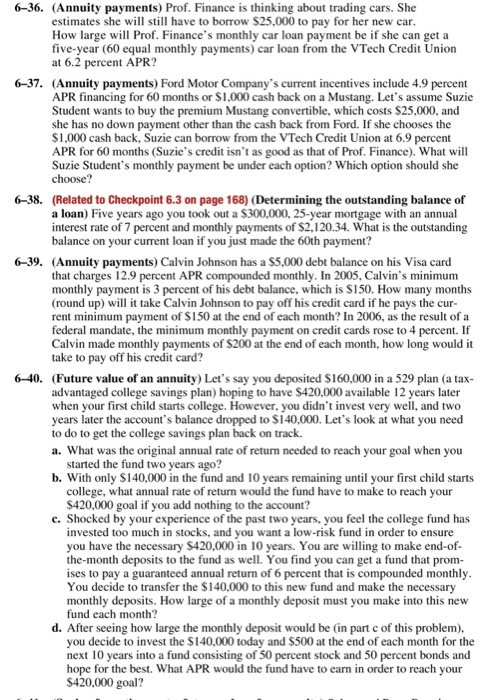

6-36. (Annuity payments) Prof. Finance is thinking about trading cars. She estimates she will still have to borrow $25,000 to pay for her new car How large will Prof. Finance's monthly car loan payment be if she can get a five-year (60 equal monthly payments) car loan from the VTech Credit Union at 6.2 percent APR? 6-37. (Annuity payments) Ford Motor Company's current incentives include 4.9 percent APR financing for 60 months or $1,000 cash back on a Mustang. Let's assume Suzie Student wants to buy the premium Mustang convertible, which costs $25,000, and she has no down payment other than the cash back from Ford. If she chooses the $1,000 cash back, Suzie can borrow from the VTech Credit Union at 6.9 percent APR for 60 months (Suzie's credit isn't as good as that of Prof. Finance). What will Suzie Student's monthly payment be under each option? Which option should she choose? 6-38. (Related to Checkpoint 6.3 on page 168) (Determining the outstanding balance of a loan) Five years ago you took out a $300,000, 25-year mortgage with an annual interest rate of 7 percent and monthly payments of $2,120.34. What is the outstanding balance on your current loan if you just made the 60th payment? 6-39. (Annuity payments) Calvin Johnson has a $5,000 debt balance on his Visa card that charges 12.9 percent APR compounded monthly. In 2005, Calvin's minimum monthly payment is 3 percent of his debt balance, which is $150. How many months (round up) will it take Calvin Johnson to pay off his credit card if he pays the cur rent minimum payment of S150 at the end of each month? In 2006, as the result of a federal mandate, the minimum monthly payment on credit cards rose to 4 percent. If Calvin made monthly payments of $200 at the end of each month, how long would it take to pay off his credit card? 6-40. (Future value of an annuity) Let's say you deposited $160,000 in a 529 plan (a tax- advantaged college savings plan) hoping to have $420,000 available 12 years later when your first child starts college. However, you didn't invest very well, and two years later the account's balance dropped to $140,000. Let's look at what you need to do to get the college savings plan back on track. a. What was the original annual rate of return needed to reach your goal when you started the fund two years ago? b. With only $140,000 in the fund and 10 years remaining until your first child starts college, what annual rate of return would the fund have to make to reach your $420,000 goal if you add nothing to the account? e. Shocked by your experience of the past two years, you feel the college fund has invested too much in stocks, and you want a low-risk fund in order to ensure you have the necessary $420,000 in 10 years. You are willing to make end-of the-month deposits to the fund as well. You find you can get a fund that prom- ises to pay a guaranteed annual return of 6 percent that is compounded monthly You decide to transfer the $140,000 to this new fund and make the necessary monthly deposits. How large of a monthly deposit must you make into this ne fund each month? d. After seeing how large the monthly deposit would be (in part c of this problem) you decide to invest the $140,000 today and $500 at the end of each month for the next 10 years into a fund consisting of 50 percent stock and 50 percent bonds and hope for the best. What APR would the fund have to earn in order to reach your $420,000 goal