Answered step by step

Verified Expert Solution

Question

1 Approved Answer

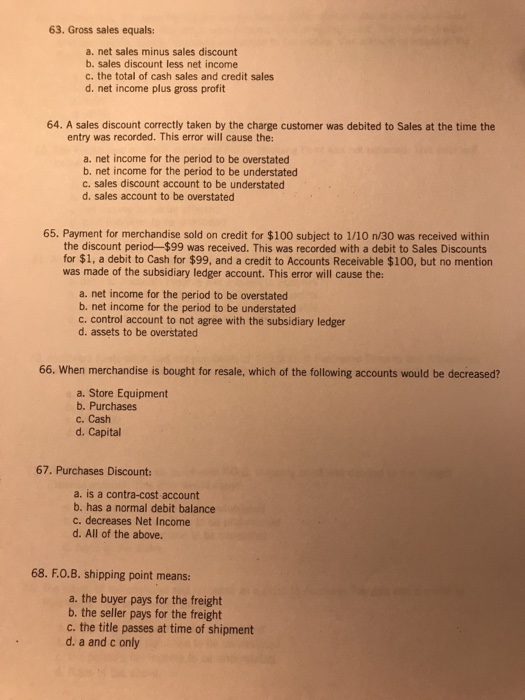

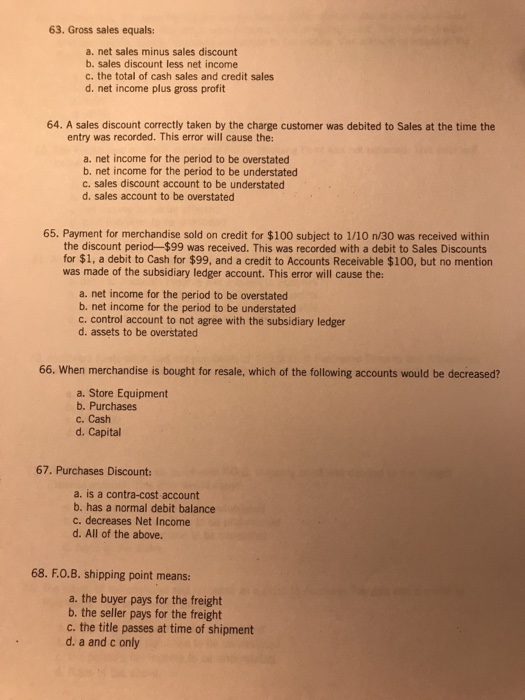

63-68 63. Gross sales equals: a. net sales minus sales discount b. sales discount less net income c. the total of cash sales and credit

63-68

63. Gross sales equals: a. net sales minus sales discount b. sales discount less net income c. the total of cash sales and credit sales d. net income plus gross profit 64. A sales discount correctly taken by the charge customer was debited to Sales at the time the entry was recorded. This error will cause the: a. net income for the period to be overstated b. net income for the period to be understated c. sales discount account to be understated d. sales account to be overstated 65. Payment for merchandise sold on credit for $100 subject to 1/10 n/30 was received within the discount period $99 was received. This was recorded with a debit to Sales Discounts for $1, a debit to Cash for $99, and a credit to Accounts Receivable $100, but no mention was made of the subsidiary ledger account. This error will cause the: a. net income for the period to be overstated b. net income for the period to be understated c. control account to not agree with the subsidiary ledger d. assets to be overstated 66. When merchandise is bought for resale, which of the following accounts would be decreased? a. Store Equipment b. Purchases c. Cash d. Capital 67. Purchases Discount: a. is a contra-cost account b. has a normal debit balance c. decreases Net Income d. All of the above. 68. F.O.B. shipping point means: a. the buyer pays for the freight b. the seller pays for the freight c. the title passes at time of shipment d. a and c only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started