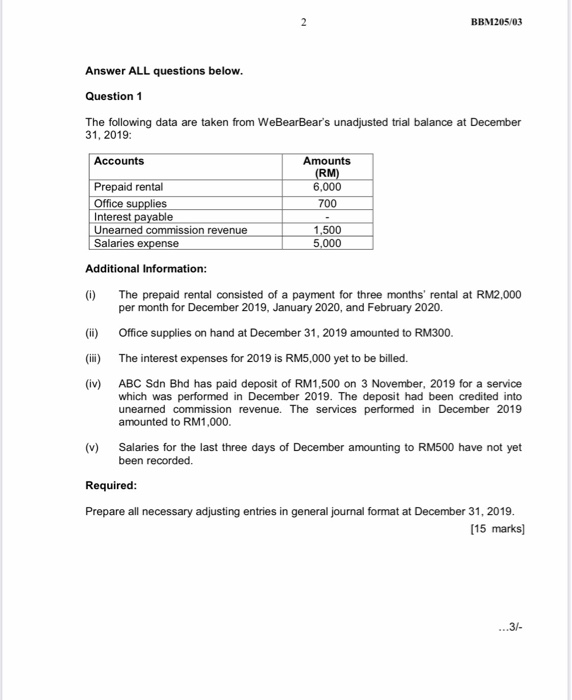

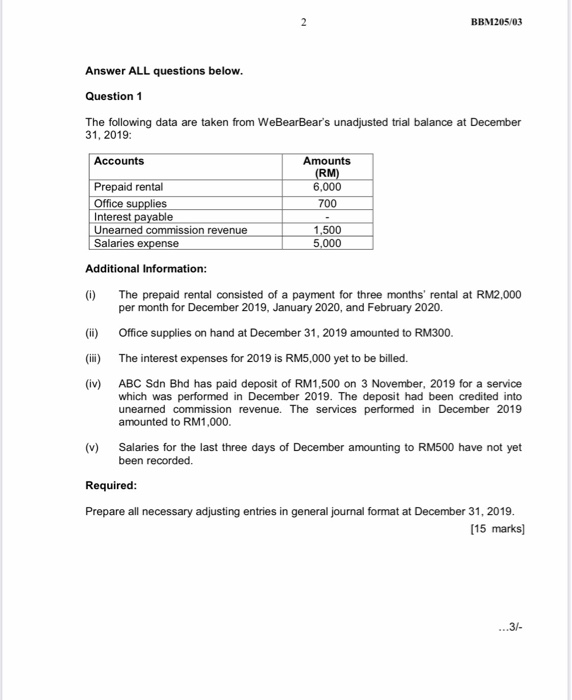

6:45 Done BBM205_03_Assignment 202... Answer ALL questions below. Question 1 The folowing data are taken from WeBearBear's unadjusted trial balance at December 31, 2018 Accounts Amount (RM) Prepaid rental 6.000 Office supplies 700 Interest payable Uneare commission revenue Salaries expense 5,000 Additional Information 00 The prepaid rental consisted of a payment for three months rental RM2,000 per month for December 2019. January 2020 and February 2020 Office supplies on hand at December 31, 2019 amounted to RIO The interest expenses for 2019 is RM5,000 yet to be billed ABC Son Ind has paid deposit of RM1.500 on 3 November 2019 for a service which was performed in December 2019. The deposit had been credited into neamed commission revenue. The services performed in December 2019 amounted to RM1,000 Salaries for the last three days of December amounting to RMS have not yet been recorded Required Prepare al necessary adjusting entries in general journal format at December 31.2010. [15 markal Question 2 The following information is taken from the records of WeBear Bear Sdn Bhd. The company is the perpetual inventory Date Description Units Unit Cost RM Dect Opening inventory 100 Dec 5 Sale 1 2 BBM205/03 Answer ALL questions below. Question 1 The following data are taken from WeBearBear's unadjusted trial balance at December 31, 2019: Accounts Amounts (RM) Prepaid rental 6,000 Office supplies 700 Interest payable Unearned commission revenue 1,500 Salaries expense 5,000 Additional Information: (0) The prepaid rental consisted of a payment for three months' rental at RM2,000 per month for December 2019, January 2020, and February 2020. (ii) Office supplies on hand at December 31, 2019 amounted to RM300. () The interest expenses for 2019 is RM5,000 yet to be billed. (iv) ABC Sdn Bhd has paid deposit of RM1,500 on 3 November, 2019 for a service which was performed in December 2019. The deposit had been credited into unearned commission revenue. The services performed in December 2019 amounted to RM1,000. (v) Salaries for the last three days of December amounting to RM500 have not yet been recorded. Required: Prepare all necessary adjusting entries in general journal format at December 31, 2019. [15 marks] ...3/