Answered step by step

Verified Expert Solution

Question

1 Approved Answer

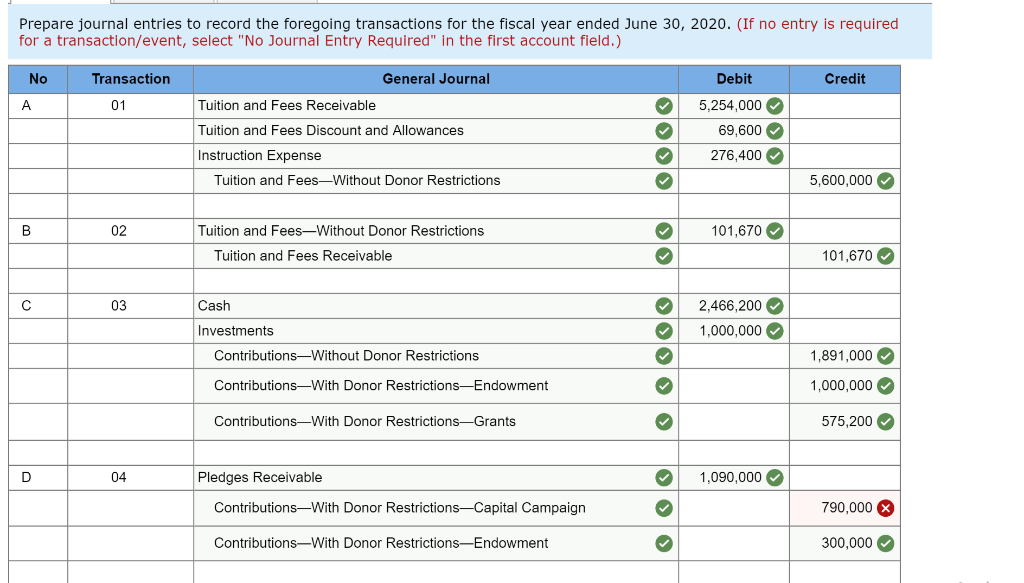

6-4--please help with the incorrect answers Elizabeth College, a small private college, had the following transactions in fiscal year 2020. Gross tuition and fees revenue

6-4--please help with the incorrect answers

Elizabeth College, a small private college, had the following transactions in fiscal year 2020.

- Gross tuition and fees revenue totaled $5,600,000. Tuition waivers and scholarships of $346,000 were granted. Of the tuition waivers granted, $276,400 was for teaching assistantships, which is an instruction expense.

- Students received tuition refunds of $101,670.

- During the year, the college received $1,891,000 cash in unrestricted private gifts, $575,200 cash restricted for grants, and $1,000,000 in securities for an endowment.

- A pledge campaign generated $1,090,000 in pledges. Of the amount pledged, $573,200 was for the capital construction campaign, $300,000 was for endowments, and the remainder of the pledges had no purpose restrictions. The pledges will all be collected in 2021.

- Auxiliary enterprises provided goods and services that generated $94,370 in cash.

- Collections of tuition receivable totaled $5,080,000.

- Unrestricted cash of $1,000,000 was invested.

- The college purchased computer equipment at a cost of $10,580.

- During the year, the following expenses were paid:

| Instruction | $ | 3,566,040 | |

| Academic support | 1,987,000 | ||

| Student services | 87,980 | ||

| Institutional support | 501,130 | ||

| Auxiliary enterprises | 92,410 | ||

- Instruction provided $450,000 in services related to the restricted grant recorded in transaction 2.

- At year-end, the allowance for uncollectible tuition and fees was increased by $7,200. The fair value of investments had increased $11,540; of this amount, $3,040 was associated with endowment investments and allocated to net assets with donor restrictions, with the remainder allocated to net assets without donor restrictions. Depreciation on plant and equipment was allocated $34,750 to instruction, $41,000 to auxiliary enterprises, and $12,450 to academic support.

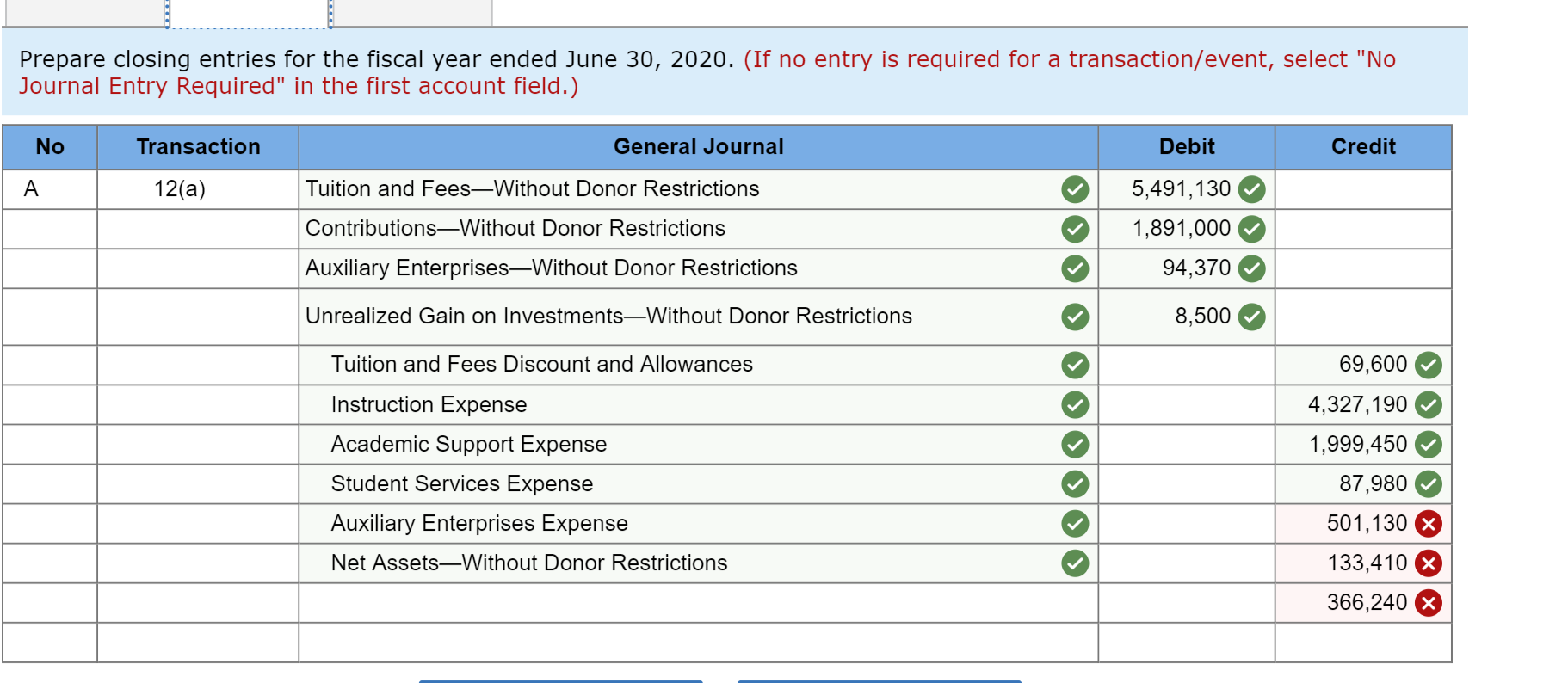

- All nominal accounts were closed.

Required

- a-1. Prepare journal entries to record the foregoing transactions for the fiscal year ended June 30, 2020.

- a-2. Prepare closing entries for the fiscal year ended June 30, 2020.

- b. Prepare a statement of activities for the year ended June 30, 2020. Assume beginning net asset amounts of $7,518,000 without donor restrictions, and $5,200,000 with donor restrictions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started