Answered step by step

Verified Expert Solution

Question

1 Approved Answer

65 or 1. Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV

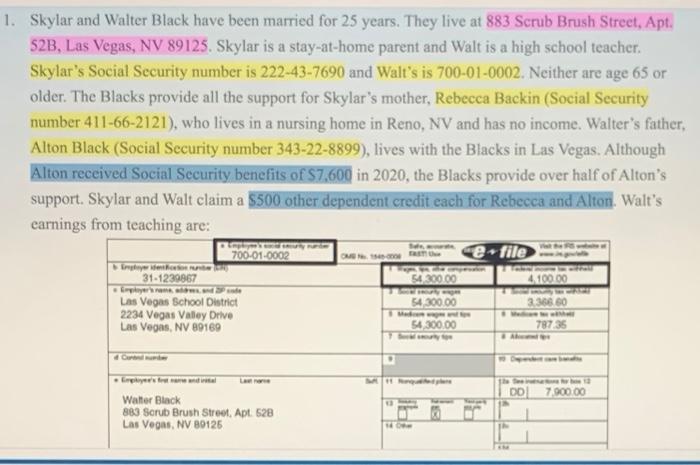

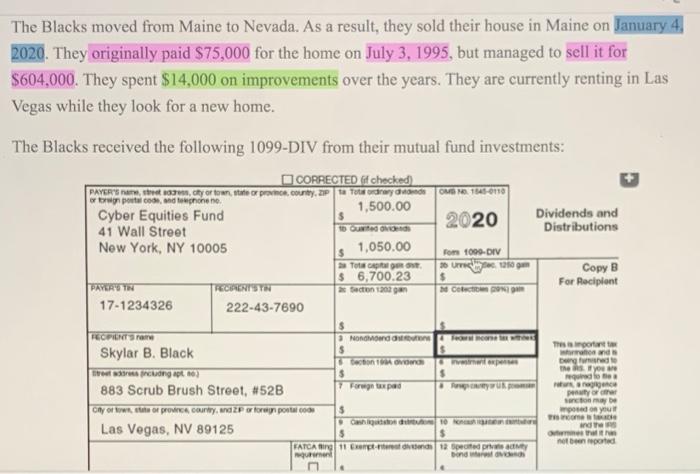

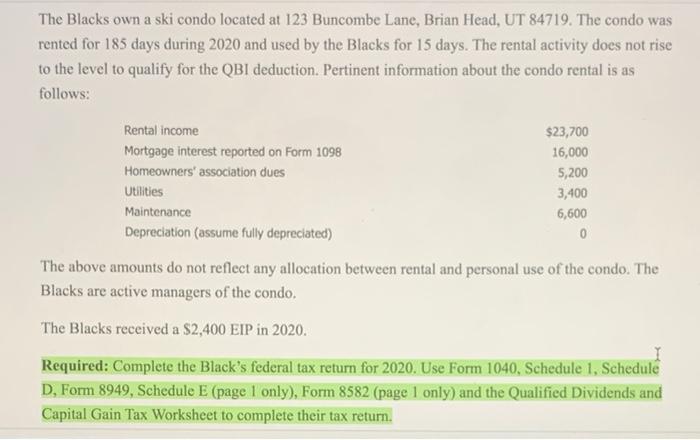

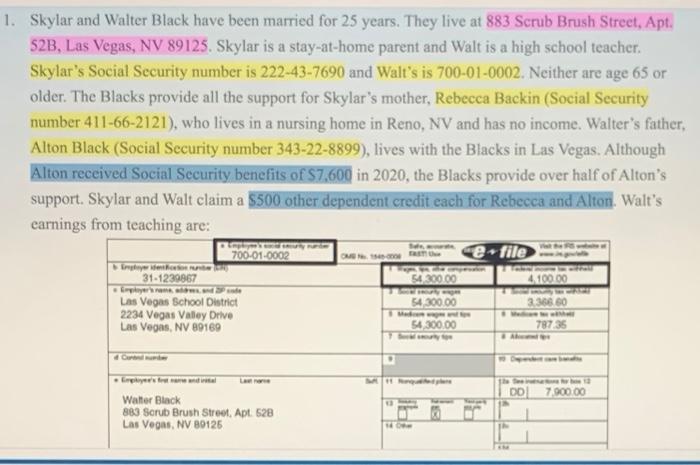

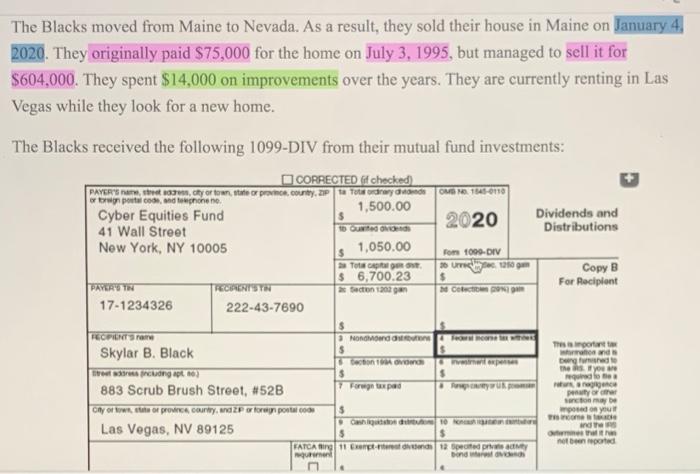

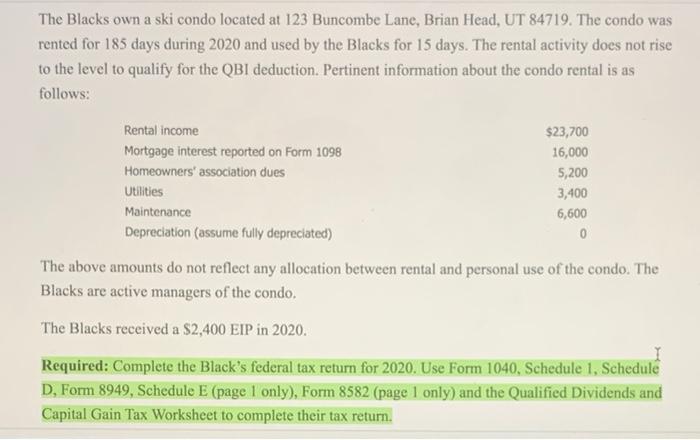

65 or 1. Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01-0002. Neither are age older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of S7,600 in 2020, the Blacks provide over half of Alton's support. Skylar and Walt claim a $500 other dependent credit each for Rebecca and Alton. Walt's earnings from teaching are: e file 700-01-0002 54,300.00 1,100.00 31-1239867 Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 54,300.00 54,300.00 78735 DO 7.900.00 Walter Black 883 Scrub Brush Street, Apt. 628 Las Vegas, NV 80126 The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2020. They originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604.000. They spent $14.000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home. or w postal, and phone ne The Blacks received the following 1099-DIV from their mutual fund investments: O CORRECTED (if checked) PAYERS PAR rode ogren.ctyor town, state or pronon, County, ZP a Tots ordinary Gnome 1846-0170 1,500.00 Cyber Equities Fund 2020 Dividends and 41 Wall Street Distributions New York, NY 10005 1,050.00 Copy B $ 6,700.23 PAYERS TN For Recipient 17-1234326 222-43-7690 Guido $ TOON om 1090-DIV 30 UN 210 CARIST faction 1200 COGON The important and berge you wordt FECPIENTS NOGO Skylar B. Black tection OG AL ) 883 Scrub Brush Street, #52B Forward on or the province, country, and ZP or foreign portal Go To Las Vegas, NV 89125 FATCA ing 11 - 12 Speed bond schoenen YOU! come need The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the Blacks for 15 days. The rental activity does not rise to the level to qualify for the QBI deduction. Pertinent information about the condo rental is as follows: Rental income $23,700 Mortgage interest reported on Form 1098 16,000 Homeowners' association dues 5,200 Utilities 3,400 Maintenance 6,600 Depreciation (assume fully deprecated) 0 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. The Blacks received a $2,400 EIP in 2020. Required: Complete the Black's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule D, Form 8949, Schedule E (page 1 only), Form 8582 (page 1 only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return. 65 or 1. Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01-0002. Neither are age older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of S7,600 in 2020, the Blacks provide over half of Alton's support. Skylar and Walt claim a $500 other dependent credit each for Rebecca and Alton. Walt's earnings from teaching are: e file 700-01-0002 54,300.00 1,100.00 31-1239867 Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 54,300.00 54,300.00 78735 DO 7.900.00 Walter Black 883 Scrub Brush Street, Apt. 628 Las Vegas, NV 80126 The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2020. They originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604.000. They spent $14.000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home. or w postal, and phone ne The Blacks received the following 1099-DIV from their mutual fund investments: O CORRECTED (if checked) PAYERS PAR rode ogren.ctyor town, state or pronon, County, ZP a Tots ordinary Gnome 1846-0170 1,500.00 Cyber Equities Fund 2020 Dividends and 41 Wall Street Distributions New York, NY 10005 1,050.00 Copy B $ 6,700.23 PAYERS TN For Recipient 17-1234326 222-43-7690 Guido $ TOON om 1090-DIV 30 UN 210 CARIST faction 1200 COGON The important and berge you wordt FECPIENTS NOGO Skylar B. Black tection OG AL ) 883 Scrub Brush Street, #52B Forward on or the province, country, and ZP or foreign portal Go To Las Vegas, NV 89125 FATCA ing 11 - 12 Speed bond schoenen YOU! come need The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the Blacks for 15 days. The rental activity does not rise to the level to qualify for the QBI deduction. Pertinent information about the condo rental is as follows: Rental income $23,700 Mortgage interest reported on Form 1098 16,000 Homeowners' association dues 5,200 Utilities 3,400 Maintenance 6,600 Depreciation (assume fully deprecated) 0 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. The Blacks received a $2,400 EIP in 2020. Required: Complete the Black's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule D, Form 8949, Schedule E (page 1 only), Form 8582 (page 1 only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return

65 or 1. Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01-0002. Neither are age older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of S7,600 in 2020, the Blacks provide over half of Alton's support. Skylar and Walt claim a $500 other dependent credit each for Rebecca and Alton. Walt's earnings from teaching are: e file 700-01-0002 54,300.00 1,100.00 31-1239867 Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 54,300.00 54,300.00 78735 DO 7.900.00 Walter Black 883 Scrub Brush Street, Apt. 628 Las Vegas, NV 80126 The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2020. They originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604.000. They spent $14.000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home. or w postal, and phone ne The Blacks received the following 1099-DIV from their mutual fund investments: O CORRECTED (if checked) PAYERS PAR rode ogren.ctyor town, state or pronon, County, ZP a Tots ordinary Gnome 1846-0170 1,500.00 Cyber Equities Fund 2020 Dividends and 41 Wall Street Distributions New York, NY 10005 1,050.00 Copy B $ 6,700.23 PAYERS TN For Recipient 17-1234326 222-43-7690 Guido $ TOON om 1090-DIV 30 UN 210 CARIST faction 1200 COGON The important and berge you wordt FECPIENTS NOGO Skylar B. Black tection OG AL ) 883 Scrub Brush Street, #52B Forward on or the province, country, and ZP or foreign portal Go To Las Vegas, NV 89125 FATCA ing 11 - 12 Speed bond schoenen YOU! come need The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the Blacks for 15 days. The rental activity does not rise to the level to qualify for the QBI deduction. Pertinent information about the condo rental is as follows: Rental income $23,700 Mortgage interest reported on Form 1098 16,000 Homeowners' association dues 5,200 Utilities 3,400 Maintenance 6,600 Depreciation (assume fully deprecated) 0 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. The Blacks received a $2,400 EIP in 2020. Required: Complete the Black's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule D, Form 8949, Schedule E (page 1 only), Form 8582 (page 1 only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return. 65 or 1. Skylar and Walter Black have been married for 25 years. They live at 883 Scrub Brush Street, Apt. 52B, Las Vegas, NV 89125. Skylar is a stay-at-home parent and Walt is a high school teacher. Skylar's Social Security number is 222-43-7690 and Walt's is 700-01-0002. Neither are age older. The Blacks provide all the support for Skylar's mother, Rebecca Backin (Social Security number 411-66-2121), who lives in a nursing home in Reno, NV and has no income. Walter's father, Alton Black (Social Security number 343-22-8899), lives with the Blacks in Las Vegas. Although Alton received Social Security benefits of S7,600 in 2020, the Blacks provide over half of Alton's support. Skylar and Walt claim a $500 other dependent credit each for Rebecca and Alton. Walt's earnings from teaching are: e file 700-01-0002 54,300.00 1,100.00 31-1239867 Las Vegas School District 2234 Vegas Valley Drive Las Vegas, NV 89169 54,300.00 54,300.00 78735 DO 7.900.00 Walter Black 883 Scrub Brush Street, Apt. 628 Las Vegas, NV 80126 The Blacks moved from Maine to Nevada. As a result, they sold their house in Maine on January 4, 2020. They originally paid $75,000 for the home on July 3, 1995, but managed to sell it for $604.000. They spent $14.000 on improvements over the years. They are currently renting in Las Vegas while they look for a new home. or w postal, and phone ne The Blacks received the following 1099-DIV from their mutual fund investments: O CORRECTED (if checked) PAYERS PAR rode ogren.ctyor town, state or pronon, County, ZP a Tots ordinary Gnome 1846-0170 1,500.00 Cyber Equities Fund 2020 Dividends and 41 Wall Street Distributions New York, NY 10005 1,050.00 Copy B $ 6,700.23 PAYERS TN For Recipient 17-1234326 222-43-7690 Guido $ TOON om 1090-DIV 30 UN 210 CARIST faction 1200 COGON The important and berge you wordt FECPIENTS NOGO Skylar B. Black tection OG AL ) 883 Scrub Brush Street, #52B Forward on or the province, country, and ZP or foreign portal Go To Las Vegas, NV 89125 FATCA ing 11 - 12 Speed bond schoenen YOU! come need The Blacks own a ski condo located at 123 Buncombe Lane, Brian Head, UT 84719. The condo was rented for 185 days during 2020 and used by the Blacks for 15 days. The rental activity does not rise to the level to qualify for the QBI deduction. Pertinent information about the condo rental is as follows: Rental income $23,700 Mortgage interest reported on Form 1098 16,000 Homeowners' association dues 5,200 Utilities 3,400 Maintenance 6,600 Depreciation (assume fully deprecated) 0 The above amounts do not reflect any allocation between rental and personal use of the condo. The Blacks are active managers of the condo. The Blacks received a $2,400 EIP in 2020. Required: Complete the Black's federal tax return for 2020. Use Form 1040, Schedule 1, Schedule D, Form 8949, Schedule E (page 1 only), Form 8582 (page 1 only) and the Qualified Dividends and Capital Gain Tax Worksheet to complete their tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started