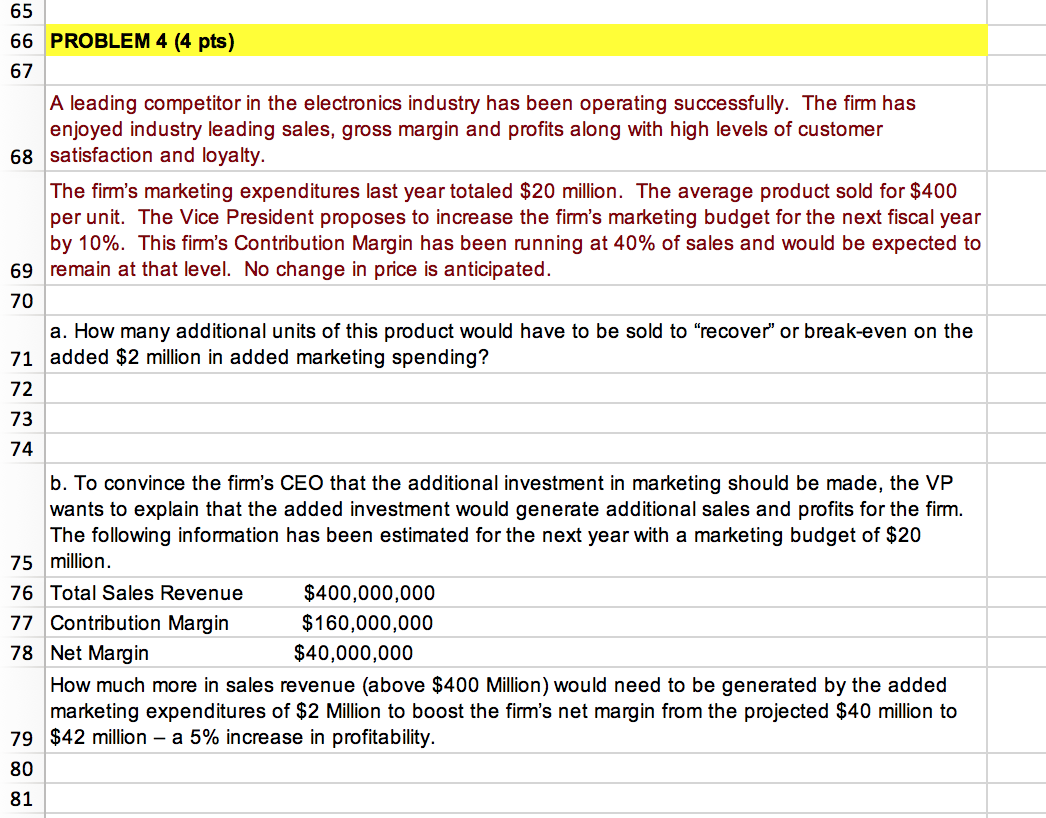

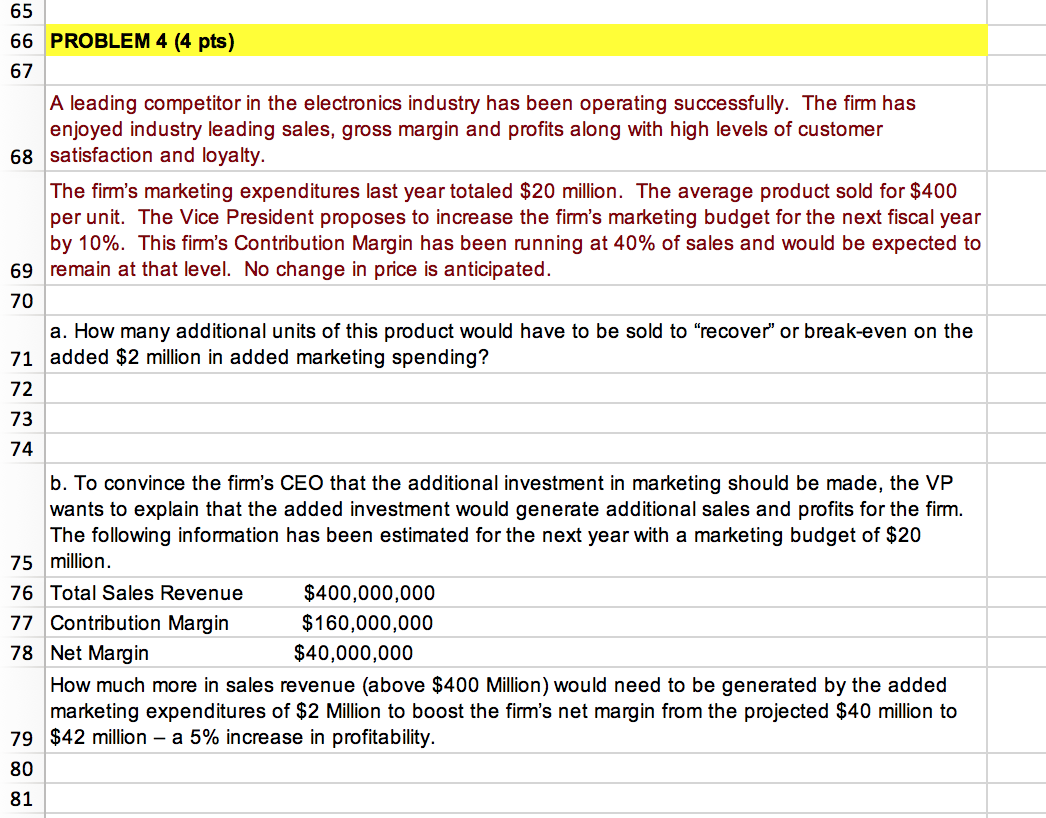

65 PROBLEM 4 (4 pts) 67 A leading competitor in the electronics industry has been operating successfully. The firm has enjoyed industry leading sales, gross margin and profits along with high levels of customer 68 satisfaction and loyalty. The firm's marketing expenditures last year totaled $20 million. The average product sold for $400 per unit. The Vice President proposes to increase the firm's marketing budget for the next fiscal year by 10%. This firm's Contribution Margin has been running at 40% of sales and would be expected to 69 remain at that level. No change in price is anticipated. 70 a. How many additional units of this product would have to be sold to "recover' or break-even on the added $2 million in added marketing spending? b. To convince the firm's CEO that the additional investment in marketing should be made, the VP wants to explain that the added investment would generate additional sales and profits for the firm. The following information has been estimated for the next year with a marketing budget of $20 75 million. 76 Total Sales Revenue $400,000,000 77 Contribution Margin $160,000,000 78 Net Margin $40,000,000 How much more in sales revenue (above $400 Million) would need to be generated by the added marketing expenditures of $2 Million to boost the firm's net margin from the projected $40 million to $42 million - a 5% increase in profitability. 79 65 PROBLEM 4 (4 pts) 67 A leading competitor in the electronics industry has been operating successfully. The firm has enjoyed industry leading sales, gross margin and profits along with high levels of customer 68 satisfaction and loyalty. The firm's marketing expenditures last year totaled $20 million. The average product sold for $400 per unit. The Vice President proposes to increase the firm's marketing budget for the next fiscal year by 10%. This firm's Contribution Margin has been running at 40% of sales and would be expected to 69 remain at that level. No change in price is anticipated. 70 a. How many additional units of this product would have to be sold to "recover' or break-even on the added $2 million in added marketing spending? b. To convince the firm's CEO that the additional investment in marketing should be made, the VP wants to explain that the added investment would generate additional sales and profits for the firm. The following information has been estimated for the next year with a marketing budget of $20 75 million. 76 Total Sales Revenue $400,000,000 77 Contribution Margin $160,000,000 78 Net Margin $40,000,000 How much more in sales revenue (above $400 Million) would need to be generated by the added marketing expenditures of $2 Million to boost the firm's net margin from the projected $40 million to $42 million - a 5% increase in profitability. 79