Answered step by step

Verified Expert Solution

Question

1 Approved Answer

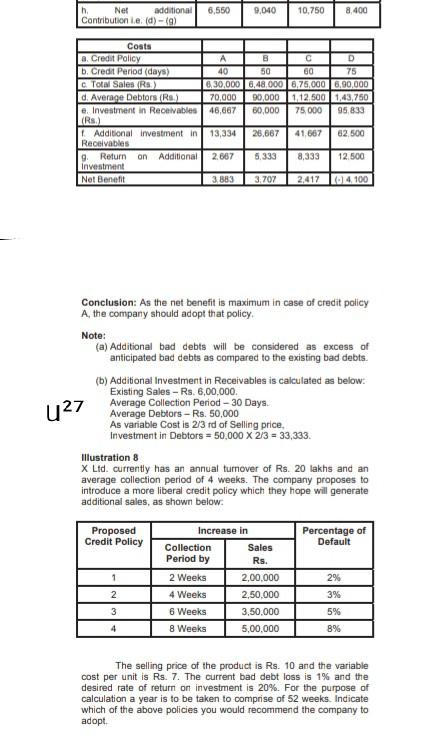

6,550 th Net additional Contribution le. (d) - (9) 9,040 10.750 8.400 Costs a. Credit Policy b. Credit Period (days) C Total Sales (Rs) d.

6,550 th Net additional Contribution le. (d) - (9) 9,040 10.750 8.400 Costs a. Credit Policy b. Credit Period (days) C Total Sales (Rs) d. Average Debtors (Rs.) e Investment in Receivables LRS) Additional investment in Receivables g. Return on Additional Investment Net Benefit A B C D 40 50 60 75 6.30,000 6.48.000 6.76.000 6,00.000 70,000 90,000 1.12.500 1,43,750 46,667 80,000 75 000 95.833 13,334 26,667 41.667 82.500 2.687 5.333 8,333 12.500 3.883 3.707 2,417 0 4 100 Conclusion: As the net benefit is maximum in case of credit policy A, the company should adopt that policy Note: (a) Additional bad debts will be considered as excess of anticipated bad debts as compared to the existing bad debts. (b) Additional Investment in Receivables is calculated as below: Existing Sales - Rs. 6,00,000. Average Collection Period - 30 Days. u27 Average Debtors - Rs. 50,000 As variable Costis 2/3 rd of Selling price, Investment in Debtors = 50.000 X 2/3 33,333 Illustration 8 X Ltd. currently has an annual turnover of Rs. 20 lakhs and an average collection period of 4 weeks. The company proposes to introduce a more liberal credit policy which they hope will generate additional sales, as shown below. Proposed Credit Policy Percentage of Default 1 Increase in Collection Sales Period by Rs. 2 Weeks 2,00.000 4 Weeks 2,50.000 6 Weeks 3,50.000 8 Weeks 5,00,000 2 2% 3% 5% 8% 3 4 The selling price of the product is Rs. 10 and the variable cost per unit is Rs. 7. The current bad debt loss is 1% and the desired rate of return on investment is 20%. For the purpose of calculation a year is to be taken to comprise of 52 weeks. Indicate which of the above policies you would recommend the company to adopt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started