Answered step by step

Verified Expert Solution

Question

1 Approved Answer

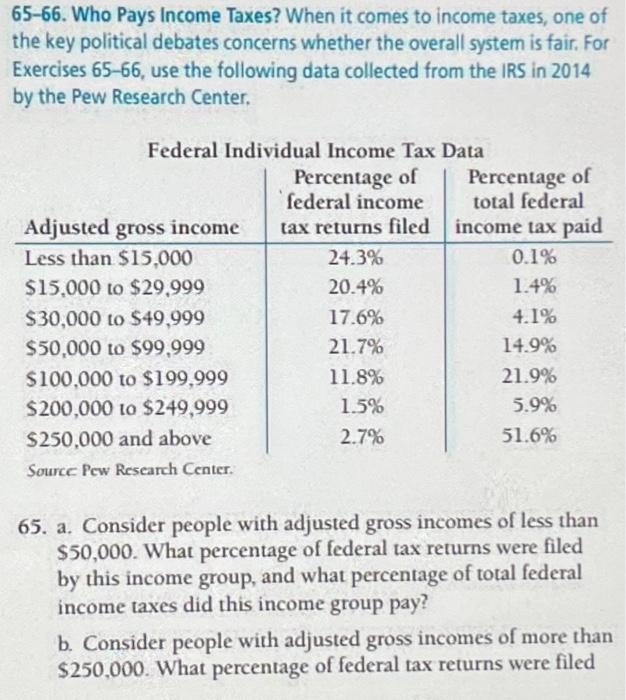

65-66. Who Pays Income Taxes? When it comes to income taxes, one of the key political debates concerns whether the overall system is fair. For

65-66. Who Pays Income Taxes? When it comes to income taxes, one of the key political debates concerns whether the overall system is fair. For Exercises 65-66, use the following data collected from the IRS in 2014 by the Pew Research Center. Federal Individual Income Tax Data Percentage of federal income tax returns filed Adjusted gross income Less than $15,000 $15,000 to $29,999 $30,000 to $49,999 $50,000 to $99,999 $100,000 to $199,999 $200,000 to $249,999 $250,000 and above Source: Pew Research Center. 24.3% 20.4% 17.6% 21.7% 11.8% 1.5% 2.7% Percentage of total federal income tax paid 0.1% 1.4% 4.1% 14.9% 21.9% 5.9% 51.6% 65.

a. Consider people with adjusted gross incomes of less than $50,000. What percentage of federal tax returns were filed by this income group, and what percentage of total federal income taxes did this income group pay?

b. Consider people with adjusted gross incomes of more than $250,000. What percentage of federal tax returns were filed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started