66 & 67

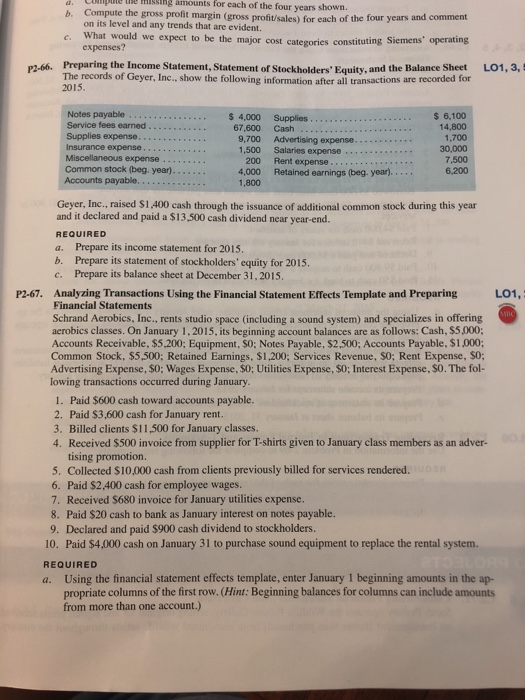

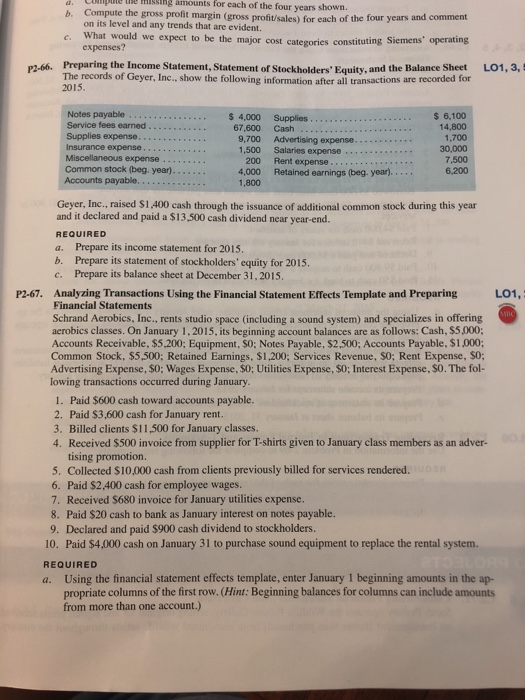

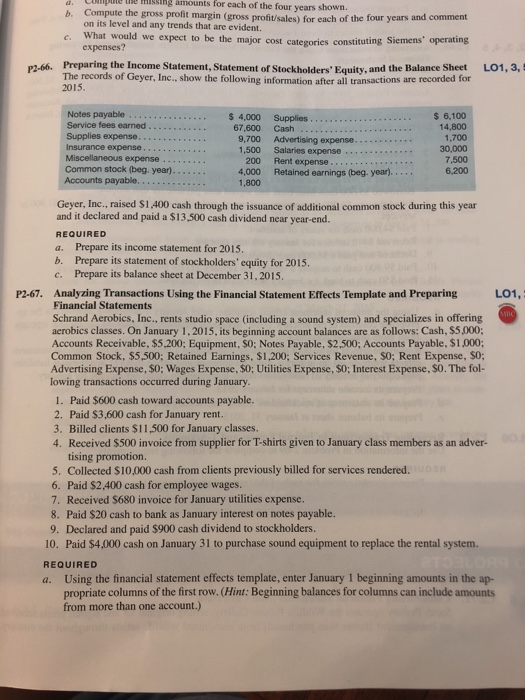

a. Compute we missing amounts for each of the four years shown. b. Compute the gross profit margin (gross profit/sales for each of the four years and comment on its level and any trends that are evident. c. What would we expect to be the major cost enteenries constituting Siemens' operating expenses? Preparing the Income Statement, Statement of Stockholders' Equity, and the Balance Sheet The records of Geyer, Inc., show the following information after all transactions are recorded for 2015. P2-66. Notes payable ............. Service fees earned .... Supplies expense......... Insurance expense.... Miscellaneous expense ..., Common stock (beg year)...... Accounts payable... $ 4,000 67.600 9,700 1,500 200 4,000 1.800 Supplies .... . Cash ............... ... Advertising expense... Salaries expense ......... Rent expense Retained earnings (beg. year)..... $ 6,100 14,800 1.700 30,000 7,500 6,200 LO1, SIDC Geyer, Inc., raised $1.400 cash through the issuance of additional common stock during this year and it declared and paid a $13,500 cash dividend near year-end. REQUIRED a. Prepare its income statement for 2015. b. Prepare its statement of stockholders' equity for 2015. c. Prepare its balance sheet at December 31, 2015 P2-67. Analyzing Transactions Using the Financial Statement Effects Template and Preparing Financial Statements Schrand Aerobics, Inc., rents studio space (including a sound system) and specializes in offering aerobics classes. On January 1, 2015, its beginning account balances are as follows: Cash, $5,000; Accounts Receivable, $5,200; Equipment, So; Notes Payable, $2,500, Accounts Payable, $1,000: Common Stock, $5,500: Retained Earnings. $1,200; Services Revenue, SO; Rent Expense, $0; Advertising Expense, $0; Wages Expense, $0; Utilities Expense, $0; Interest Expense, $0. The fol- lowing transactions occurred during January. 1. Paid $600 cash toward accounts payable. 2. Paid $3,600 cash for January rent. 3. Billed clients $11,500 for January classes. 4. Received $500 invoice from supplier for T-shirts given to January class members as an adver- tising promotion 5. Collected $10,000 cash from clients previously billed for services rendered. 6. Paid $2,400 cash for employee wages. 7. Received $680 invoice for January utilities expense. 8. Paid $20 cash to bank as January interest on notes payable. 9. Declared and paid $900 cash dividend to stockholders. 10. Paid $4.000 cash on January 31 to purchase sound equipment to replace the rental system. REQUIRED a. Using the financial statement effects template, enter January 1 beginning amounts in the ap- propriate columns of the first row. (Hint: Beginning balances for columns can include amounts from more than one account.)