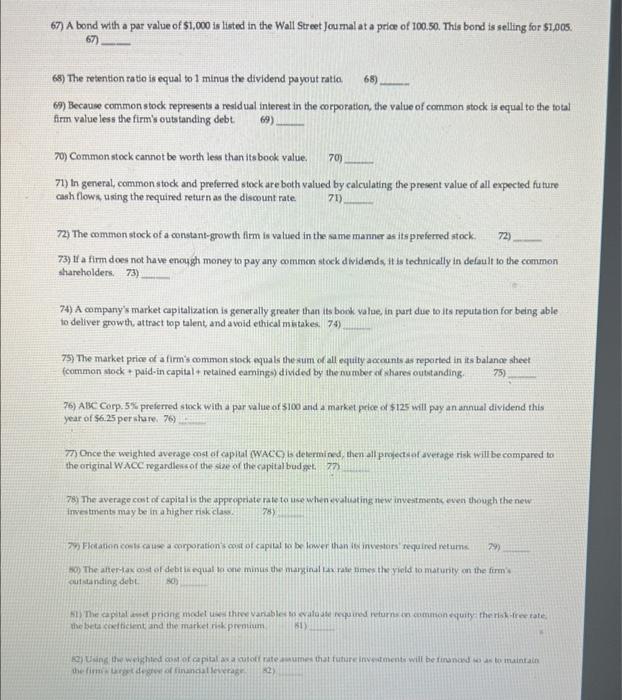

67) A bond with a par value of $1,000 is listed in the Wall Street Joumalat a price of 100.50. This bond is selling for $1.005. 67) 68) The retention ratio is equal to 1 minus the dividend payout ratio, 68) 69) Because common stock represents a residual interest in the corporation, the value of common stock is equal to the total firm value less the firm's outstanding debt. 69) 70) Common stock cannot be worth less than its book value. 70) 71) In general, common stock and preferred stock are both valued by calculating the present value of all expected future cash flows using the required return as the discount rate 71) a 72) The common stock of a constant-growth them is valued in the same manner as its preferred stock. 72) 73) Dla firm does not have enough money to pay any common stock dividends its technically in default to the common shareholders. 73) 74) A company's market capitalization is generally greater than its book value in part due to its reputation for being able to deliver growth, attract top talent, and avoid ethical mistakes. 74) 75) The market price of a firm's common stock equals the sum of all equity accounts as reported in its balance sheet (common stock + paid in capital retained caming) divided by the number of shares outstanding, 75) 76) ABC Corp. 5% preferred stock with a par value of 5100 and a market price of $125 will pay an annual dividend this year of 56.25 per star 70 77) Once the weighted average cost of capital (WACOB determined, then all project average risk will be compared to the original WACC regardless of the size of the capital budget 77 178) The average cost of capital is the appropriate rate to use whenevaliating new investment even though the new investments may be in a higher risk claw 75) 179 Flotation cost cause a corporation cost of capital to be lower than investors required returns 29) s Theater-tax cost of debti equal to one minus the marginal rate me the yield to matunity on the form Outstanding debt SO 1) The capital priang model the variables vaade required returns in commonequity the streetate the beta cicient and the market riik prentum 51) jing the weighled.com or capital auto rate mumes that future investment will be finnad us to maintain the timp degree of finansal leverage 2)