Answered step by step

Verified Expert Solution

Question

1 Approved Answer

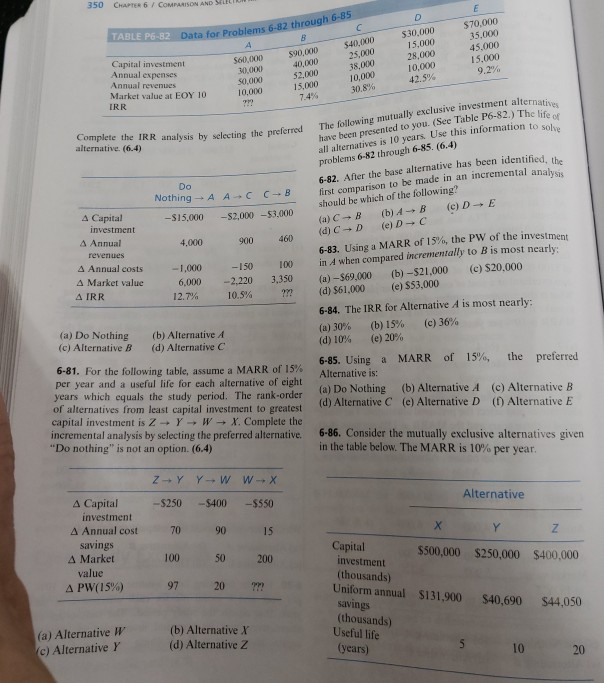

6-82 - 6 -85 350 CHAPTER 6 / COMPARISON AND SELE TABLE P6-82 Data for Problems 6-82 through 6-85 $70,000 35.000 45,000 15,000 9.2% C

6-82 - 6-85

350 CHAPTER 6 / COMPARISON AND SELE TABLE P6-82 Data for Problems 6-82 through 6-85 $70,000 35.000 45,000 15,000 9.2% C $30,000 15,000 28,000 10,000 42.5% $40,000 25,000 38,000 10,000 30.8% 4 S90,000 40,000 52,000 15,000 7.4 % $60,000 30,000 Capital investment Annual expenses Annual revenues 50,000 Market value at EOY 10 10,000 IRR The following mutually exclusive investment alternatives have been presented to you. (See Table P6-82.) The life of all alternatives is 10 years Use this information to solve Complete the IRR analysis by selecting the preferred alternative. (6.4) problems 6-82 through 6-85. (6.4) 6-82. After the base alternative has been identified, the first comparison to be made in an incremental analysis should be which of the following? (a) CB (d) C D Do NothingA A C C-B A Capital -S15,000 -$2,000 -$3.000 (b) AB (e) D C (e) D E investment A Annual 900 4,000 460 6-83. Using a MARR of 15%, the PW of the investment in A when compared incrementally to B is most nearly revenues A Annual costs -1,000 100 -150 A Market value (b)-$21,000 (e) $53,000 (c) $20,000 6,000 (a)-$69,000 (d) $61,000 -2,220 3,350 A IRR 12.7% 10.5% m 6-84. The IRR for Alternative A is most nearly: (a) Do Nothing (c) Alternative B (b) 15 % (e) 20% (a) 30% (d) 10 % (c) 36 % (b) Alternative A (d) Alternative C 6-81. For the following table, assume a MARR of 15% per year and a useful life for each alternative of eight years which equals the study period. The rank-order of alternatives from least capital investment to greatest capital investment is Z -Y WX. Complete the incremental analysis by selecting the preferred alternative. "Do nothing" is not an option. (6.4) 6-85. Using a Alternative is: MARR of 15%, the preferred (a) Do Nothing (d) Alternative C (b) Alternative A (e) Alternative D (c) Alternative B () Alternative E 6-86. Consider the mutually exclusive alternatives given in the table below. The MARR is 10 % per year. zY Y W WX A Capital -$250 -$400 Alternative -$550 investment A Annual cost 70 90 15 X savings A Market value A PW(15%) Y Capital investment (thousands) Uniform annual $131,900 $40,690 savings (thousands) Useful life 100 $500,000 $250,000 $400,000 50 200 97 20 S44,050 (a) Alternative W (c) Alternative Y (b) Alternative X (d) Alternative Z (years) 10 20 350 CHAPTER 6 / COMPARISON AND SELE TABLE P6-82 Data for Problems 6-82 through 6-85 $70,000 35.000 45,000 15,000 9.2% C $30,000 15,000 28,000 10,000 42.5% $40,000 25,000 38,000 10,000 30.8% 4 S90,000 40,000 52,000 15,000 7.4 % $60,000 30,000 Capital investment Annual expenses Annual revenues 50,000 Market value at EOY 10 10,000 IRR The following mutually exclusive investment alternatives have been presented to you. (See Table P6-82.) The life of all alternatives is 10 years Use this information to solve Complete the IRR analysis by selecting the preferred alternative. (6.4) problems 6-82 through 6-85. (6.4) 6-82. After the base alternative has been identified, the first comparison to be made in an incremental analysis should be which of the following? (a) CB (d) C D Do NothingA A C C-B A Capital -S15,000 -$2,000 -$3.000 (b) AB (e) D C (e) D E investment A Annual 900 4,000 460 6-83. Using a MARR of 15%, the PW of the investment in A when compared incrementally to B is most nearly revenues A Annual costs -1,000 100 -150 A Market value (b)-$21,000 (e) $53,000 (c) $20,000 6,000 (a)-$69,000 (d) $61,000 -2,220 3,350 A IRR 12.7% 10.5% m 6-84. The IRR for Alternative A is most nearly: (a) Do Nothing (c) Alternative B (b) 15 % (e) 20% (a) 30% (d) 10 % (c) 36 % (b) Alternative A (d) Alternative C 6-81. For the following table, assume a MARR of 15% per year and a useful life for each alternative of eight years which equals the study period. The rank-order of alternatives from least capital investment to greatest capital investment is Z -Y WX. Complete the incremental analysis by selecting the preferred alternative. "Do nothing" is not an option. (6.4) 6-85. Using a Alternative is: MARR of 15%, the preferred (a) Do Nothing (d) Alternative C (b) Alternative A (e) Alternative D (c) Alternative B () Alternative E 6-86. Consider the mutually exclusive alternatives given in the table below. The MARR is 10 % per year. zY Y W WX A Capital -$250 -$400 Alternative -$550 investment A Annual cost 70 90 15 X savings A Market value A PW(15%) Y Capital investment (thousands) Uniform annual $131,900 $40,690 savings (thousands) Useful life 100 $500,000 $250,000 $400,000 50 200 97 20 S44,050 (a) Alternative W (c) Alternative Y (b) Alternative X (d) Alternative Z (years) 10 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started