Answered step by step

Verified Expert Solution

Question

1 Approved Answer

$697,100. $634,000. $614,000. $610,100. 199 days. 148 days. Less than 100 days. 208 days. Cassy Bud Company has a December 31st year-end. As of December

$697,100.

$634,000.

$614,000.

$610,100.

199 days.

148 days.

Less than 100 days.

208 days.

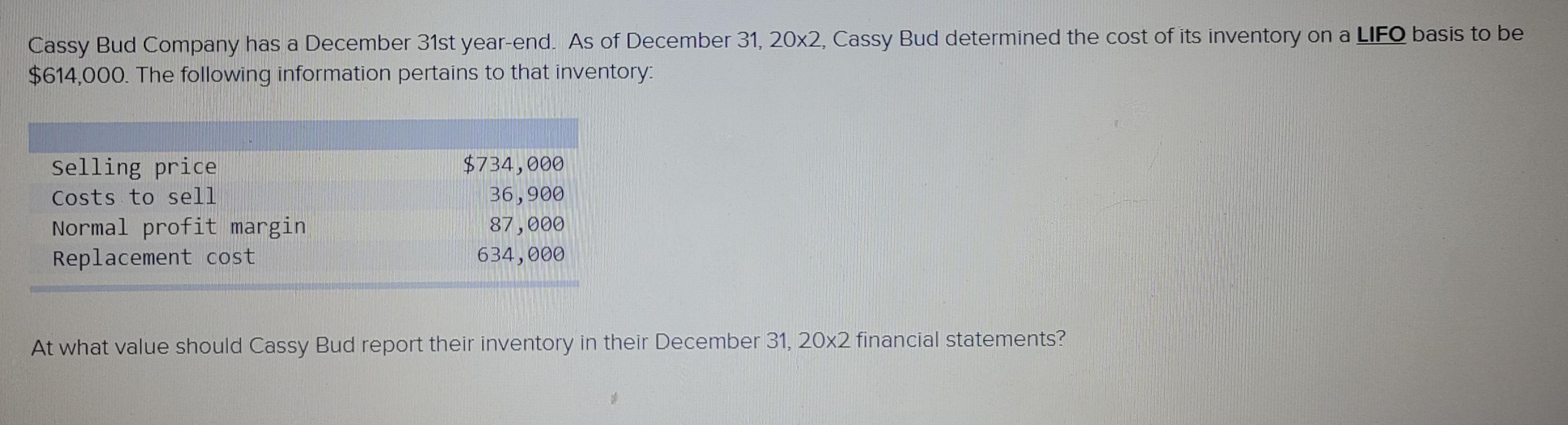

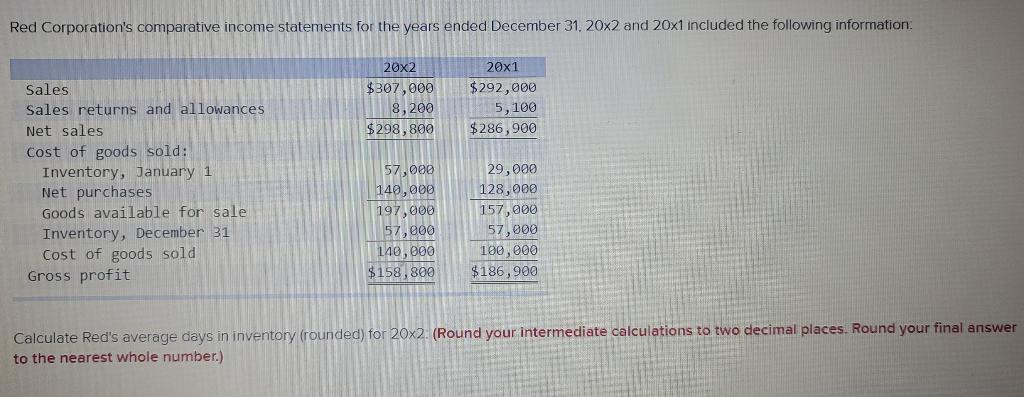

Cassy Bud Company has a December 31st year-end. As of December 31, 20x2, Cassy Bud determined the cost of its inventory on a LIFO basis to be $614,000. The following information pertains to that inventory: Selling price Costs to sell Normal profit margin Replacement cost $734,000 B6,900 87 000 634,000 At what value should Cassy Bud report their inventory in their December 31, 20x2 financial statements? Red Corporation's comparative income statements for the years ended December 31, 20x2 and 20x1 included the following information 20x2 $307,000 8,200 $298,800 20x1 $292,000 5, 100 $286,900 Sales Sales returns and allowances Net sales Cost of goods sold: Inventory, January 1 Net purchases Goods available for sale Inventory, December 31 Cost of goods sold Gross profit 57,000 140,000 197,000 57,000 140,000 $ 158,800 29,000 128,000 157,000 57,000 100,000 $186,900 Calculate Red's average days in inventory (rounded) for 20x2. (Round your intermediate calculations to two decimal places. Round your final answer to the nearest whole number.) Cassy Bud Company has a December 31st year-end. As of December 31, 20x2, Cassy Bud determined the cost of its inventory on a LIFO basis to be $614,000. The following information pertains to that inventory: Selling price Costs to sell Normal profit margin Replacement cost $734,000 B6,900 87 000 634,000 At what value should Cassy Bud report their inventory in their December 31, 20x2 financial statements? Red Corporation's comparative income statements for the years ended December 31, 20x2 and 20x1 included the following information 20x2 $307,000 8,200 $298,800 20x1 $292,000 5, 100 $286,900 Sales Sales returns and allowances Net sales Cost of goods sold: Inventory, January 1 Net purchases Goods available for sale Inventory, December 31 Cost of goods sold Gross profit 57,000 140,000 197,000 57,000 140,000 $ 158,800 29,000 128,000 157,000 57,000 100,000 $186,900 Calculate Red's average days in inventory (rounded) for 20x2. (Round your intermediate calculations to two decimal places. Round your final answer to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started