Answered step by step

Verified Expert Solution

Question

1 Approved Answer

69-74 69. On November 30, Janoch's Dog Kennel purchased $600 of merchandise on account from the Ganster Company. The goods were shipped F.O.8. shipping point.

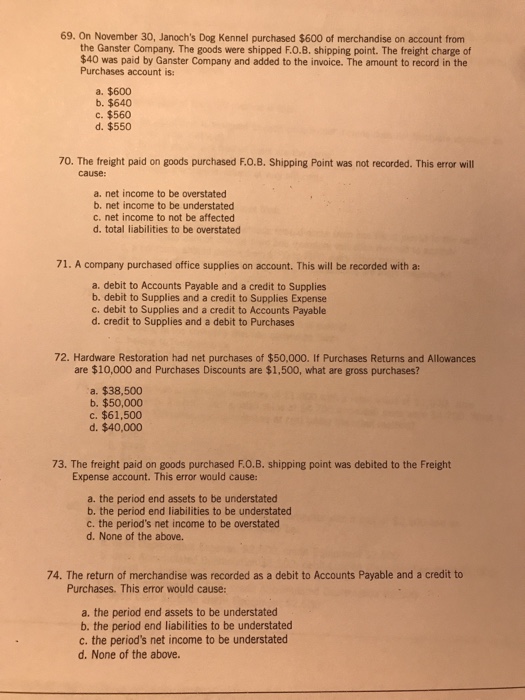

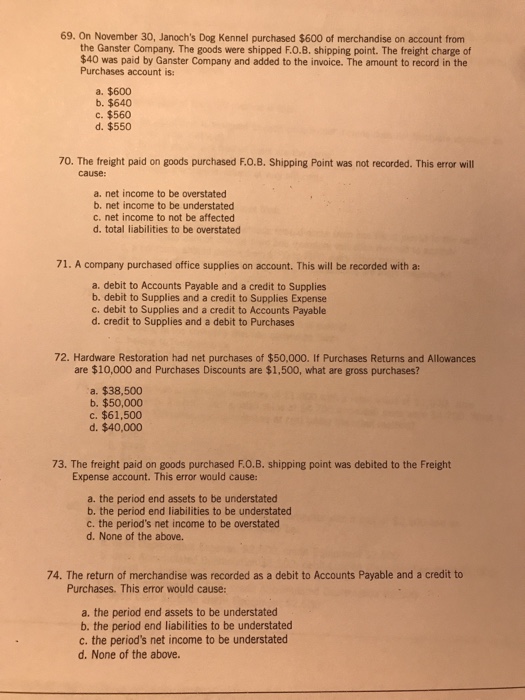

69-74

69. On November 30, Janoch's Dog Kennel purchased $600 of merchandise on account from the Ganster Company. The goods were shipped F.O.8. shipping point. The freight charge of $40 was paid by Ganster Company and added to the invoice. The amount to record in the Purchases account is: a. $600 b. $640 c. $560 d. $550 70. The freight paid on goods purchased F.O.B. Shipping Point was not recorded. This error will cause: a. net income to be overstated b. net income to be understated c. net income to not be affected d. total liabilities to be overstated 71. A company purchased office supplies on account. This will be recorded with a: a. debit to Accounts Payable and a credit to Supplies b. debit to Supplies and a credit to Supplies Expense c. debit to Supplies and a credit to Accounts Payable d. credit to Supplies and a debit to Purchases 72. Hardware Restoration had net purchases of $50,000. If Purchases Returns and Allowances are $10,000 and Purchases Discounts are $1,500, what are gross purchases? a. $38,500 b. $50,000 c. $61,500 d. $40,000 73. The freight paid on goods purchased F.0.B. shipping point was debited to the Freight Expense account. This error would cause: a. the period end assets to be understated b. the period end liabilities to be understated c. the period's net income to be overstated d. None of the above. 74. The return of merchandise was recorded as a debit to Accounts Payable and a credit to Purchases. This error would cause: a. the period end assets to be understated b. the period end liabilities to be understated c. the period's net income to be understated d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started