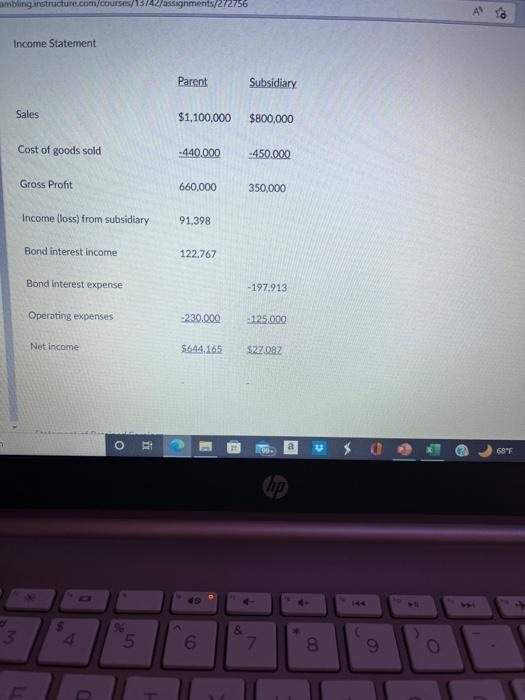

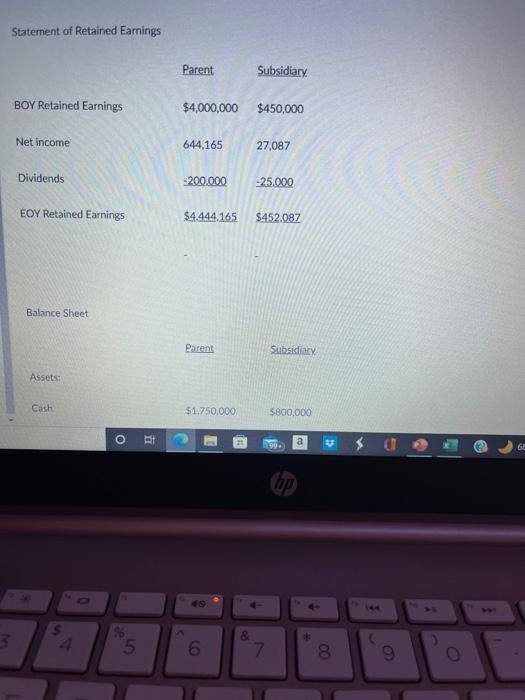

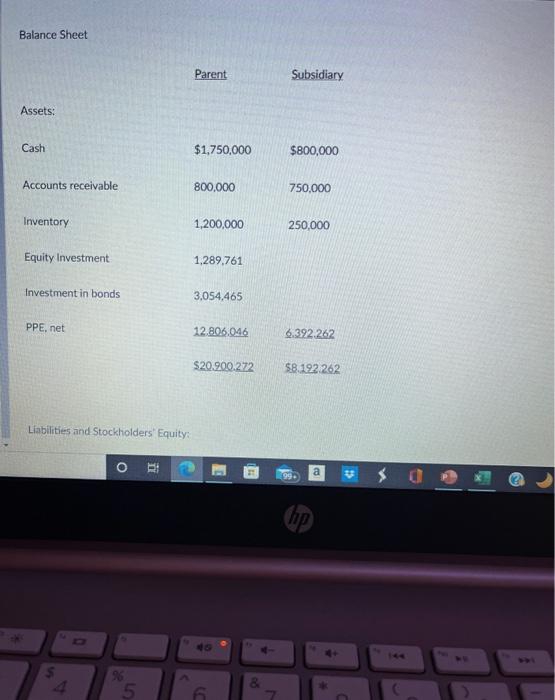

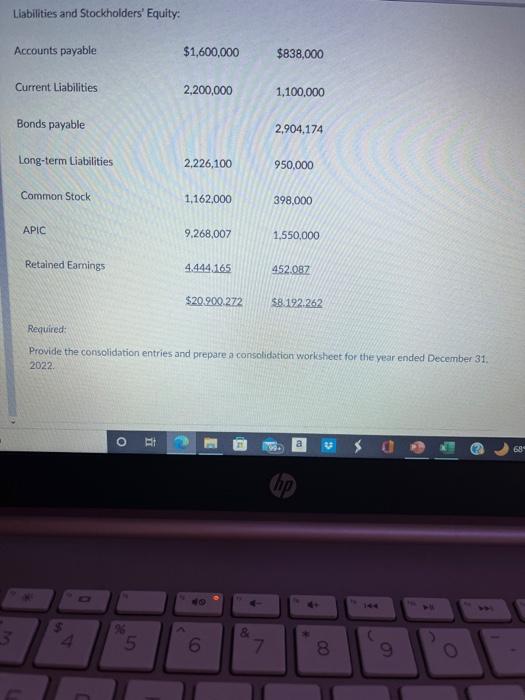

6-Assume that a Parent company acquires a 60% interest in its Subsidiary on January 1, 2020. On the date of acquisition, the fair value of the 60% controlling interest was $1,440,000 and the fair value of the 40% noncontrolling interest was $960,000. On January 1,2020 , the book value of net assets equaled $2,400,000 and the fair value of the identifiable net assets equaled the book value of identifiable net assets (i.e. there was no AAP or Goodwili). The parent uses the equity method to account for its investment in the subsidiary. On December 31, 2021, the Subsidiary company issued $3,000,000 (face) 5 percent, five-year bonds to an unaffliated company for $2.760,436. The bonds pay interest annually on December 31 , and the bond discount is amortized using the straight-line method. This results in annual bond-payable discount amortization equal to $47,913 per year. On December 31, 2023, the Parent paid $3,081,698 to purchase all of the outstanding Subsidiary company bonds. The bond premium is amortized using the straight-line method, which results in annual bondinvestment premium amortization equal to $27,233 per year. The Parent and the Subsidiary report the following financial statements for the year ended December 31 , 2024: Income Statement Statement of Retained Eamings Balance Sheet Liabilities and Stockholders' Equity: Liabilities and Stockholders' Equity: Reguired: Provide the consolidation entries and prepare a consolidation worksheet for the year ended December 31 . 2022 6-Assume that a Parent company acquires a 60% interest in its Subsidiary on January 1, 2020. On the date of acquisition, the fair value of the 60% controlling interest was $1,440,000 and the fair value of the 40% noncontrolling interest was $960,000. On January 1,2020 , the book value of net assets equaled $2,400,000 and the fair value of the identifiable net assets equaled the book value of identifiable net assets (i.e. there was no AAP or Goodwili). The parent uses the equity method to account for its investment in the subsidiary. On December 31, 2021, the Subsidiary company issued $3,000,000 (face) 5 percent, five-year bonds to an unaffliated company for $2.760,436. The bonds pay interest annually on December 31 , and the bond discount is amortized using the straight-line method. This results in annual bond-payable discount amortization equal to $47,913 per year. On December 31, 2023, the Parent paid $3,081,698 to purchase all of the outstanding Subsidiary company bonds. The bond premium is amortized using the straight-line method, which results in annual bondinvestment premium amortization equal to $27,233 per year. The Parent and the Subsidiary report the following financial statements for the year ended December 31 , 2024: Income Statement Statement of Retained Eamings Balance Sheet Liabilities and Stockholders' Equity: Liabilities and Stockholders' Equity: Reguired: Provide the consolidation entries and prepare a consolidation worksheet for the year ended December 31 . 2022