Answered step by step

Verified Expert Solution

Question

1 Approved Answer

6The question I have is 6-7. Thanks (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and

6The question I have is 6-7.

6The question I have is 6-7.

Thanks

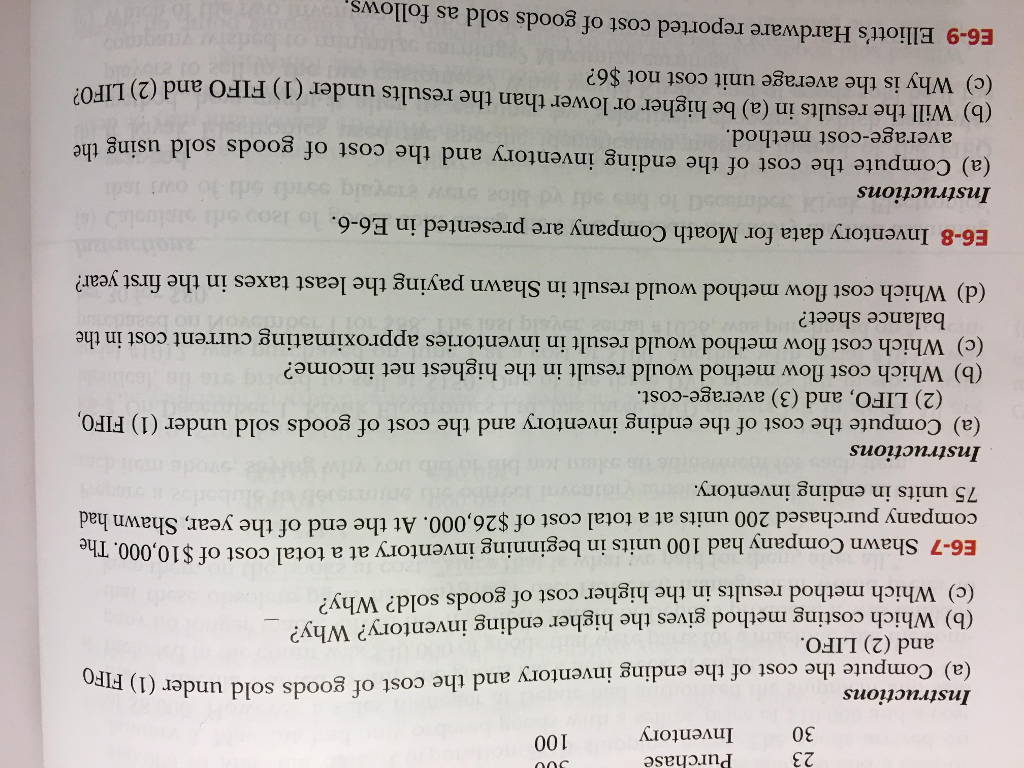

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO, (b) Which costing method gives the higher ending inventory? Why? (c) Which method results in the higher cost of goods sold? Why? Shawn Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Shawn had 75 units in ending inventory. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO (2) LIFO, and (3) average-cost. (b) Which cost flow method would result in the highest net income? (c) Which cost flow method would result in inventories approximating current cost in the balance sheet? (d) Which cost flow method would result in Shawn paying the least taxes in the first year? Inventory data for Moath Company are presented in E6-6. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold using t he average-cost method. (b) Will the results in (a) be higher or lower than the results under (1) FIFO and (2) LIFO2 (c) Why is the average unit cost not $6? Elliot's Hardware reported cost of goods sold as follows. (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO, (b) Which costing method gives the higher ending inventory? Why? (c) Which method results in the higher cost of goods sold? Why? Shawn Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Shawn had 75 units in ending inventory. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO (2) LIFO, and (3) average-cost. (b) Which cost flow method would result in the highest net income? (c) Which cost flow method would result in inventories approximating current cost in the balance sheet? (d) Which cost flow method would result in Shawn paying the least taxes in the first year? Inventory data for Moath Company are presented in E6-6. Instructions (a) Compute the cost of the ending inventory and the cost of goods sold using t he average-cost method. (b) Will the results in (a) be higher or lower than the results under (1) FIFO and (2) LIFO2 (c) Why is the average unit cost not $6? Elliot's Hardware reported cost of goods sold as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started