Answered step by step

Verified Expert Solution

Question

1 Approved Answer

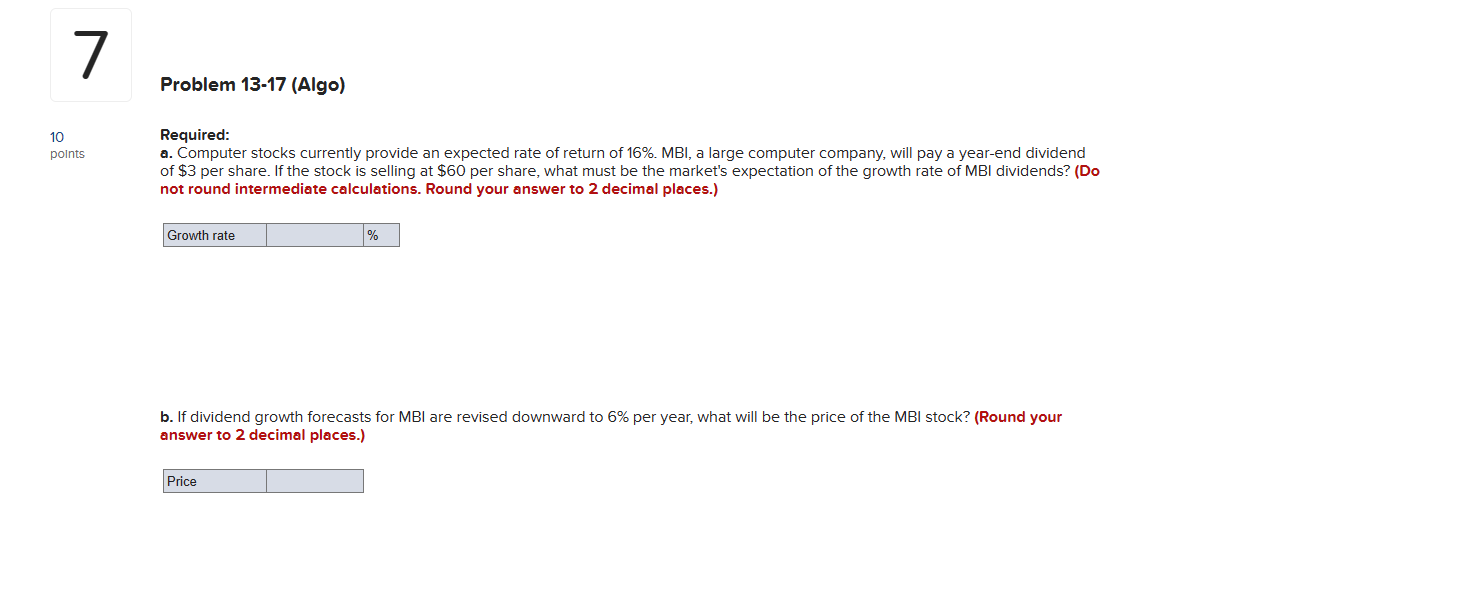

7 10 points Problem 13-17 (Algo) Required: a. Computer stocks currently provide an expected rate of return of 16%. MBI, a large computer company,

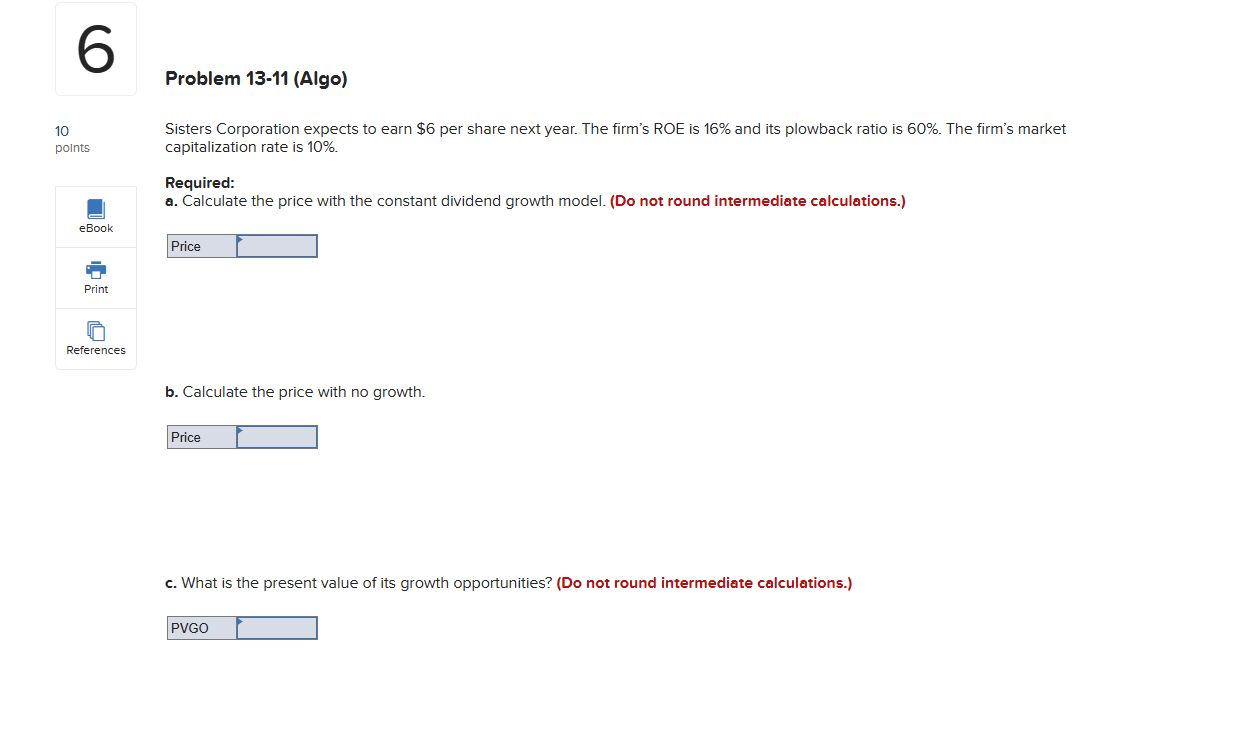

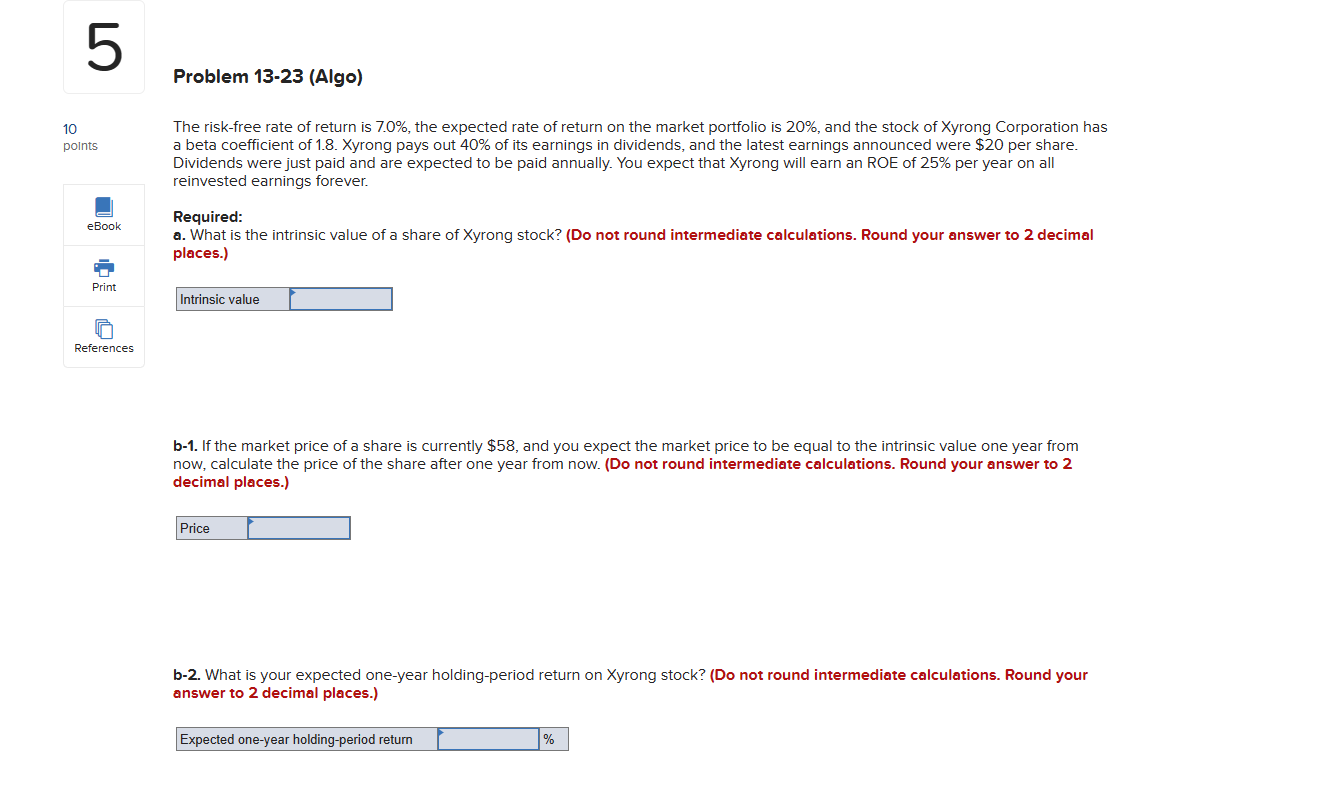

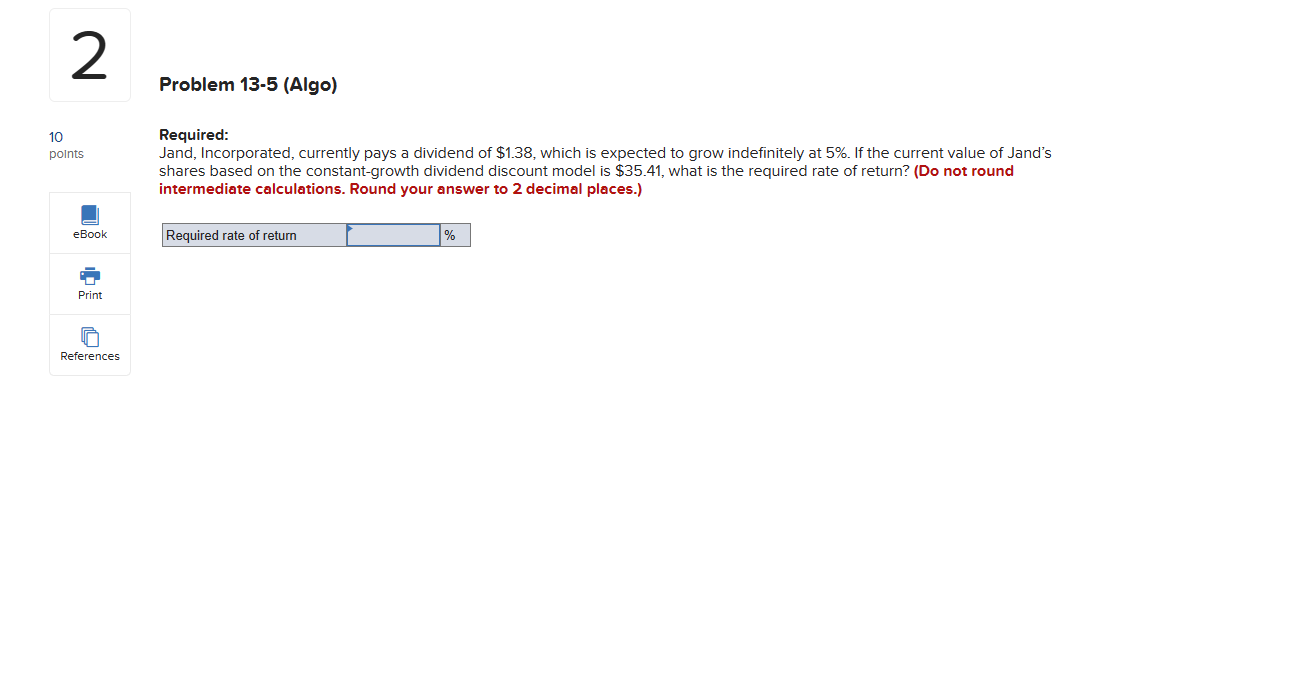

7 10 points Problem 13-17 (Algo) Required: a. Computer stocks currently provide an expected rate of return of 16%. MBI, a large computer company, will pay a year-end dividend of $3 per share. If the stock is selling at $60 per share, what must be the market's expectation of the growth rate of MBI dividends? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Growth rate % b. If dividend growth forecasts for MBI are revised downward to 6% per year, what will be the price of the MBI stock? (Round your answer to 2 decimal places.) Price 6 10 points eBook Problem 13-11 (Algo) Sisters Corporation expects to earn $6 per share next year. The firm's ROE is 16% and its plowback ratio is 60%. The firm's market capitalization rate is 10%. Required: a. Calculate the price with the constant dividend growth model. (Do not round intermediate calculations.) Print References Price b. Calculate the price with no growth. Price c. What is the present value of its growth opportunities? (Do not round intermediate calculations.) PVGO 5 Problem 13-23 (Algo) 10 points eBook Print The risk-free rate of return is 7.0%, the expected rate of return on the market portfolio is 20%, and the stock of Xyrong Corporation has a beta coefficient of 1.8. Xyrong pays out 40% of its earnings in dividends, and the latest earnings announced were $20 per share. Dividends were just paid and are expected to be paid annually. You expect that Xyrong will earn an ROE of 25% per year on all reinvested earnings forever. Required: a. What is the intrinsic value of a share of Xyrong stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Intrinsic value References b-1. If the market price of a share is currently $58, and you expect the market price to be equal to the intrinsic value one year from now, calculate the price of the share after one year from now. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price b-2. What is your expected one-year holding-period return on Xyrong stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected one-year holding-period return % 2 10 points Problem 13-5 (Algo) Required: Jand, Incorporated, currently pays a dividend of $1.38, which is expected to grow indefinitely at 5%. If the current value of Jand's shares based on the constant-growth dividend discount model is $35.41, what is the required rate of return? (Do not round intermediate calculations. Round your answer to 2 decimal places.) eBook Required rate of return % Print References

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started