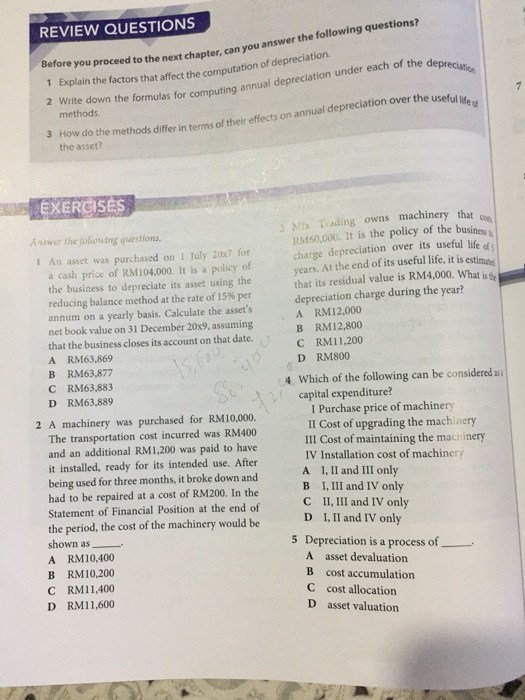

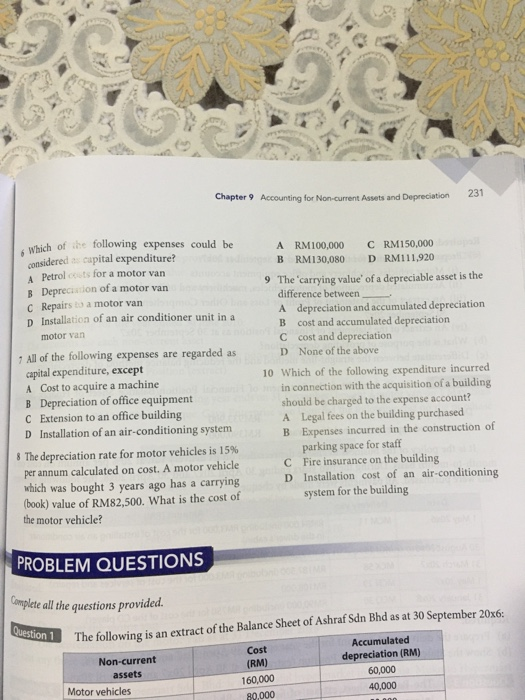

7 3. Mis Trading owns Before you proceed to the next chapter, can you answer the following questions? 1 Explain the factors that affect the computation of depreciation. 2 Write down the formulas for computing annual depreciation under each of the depreciati 3 How do the methods differ in terms of their effects on annual depreciation over the useful life RM60,000. It is the policy of the business charge depreciation over its useful life of years. At the end of its useful life, it is estimate REVIEW QUESTIONS methods the asset EXERCISES machinery that com Awe the following questions. 1 An asset was purchased on 1 July 20x7 for a cash price of RM104,000. It is a policy of the business to depreciate its asset using the that its residual value is RM4,000. What is reducing balance method at the rate of 15% per depreciation charge during the year? annum on a yearly basis. Calculate the asset's A RM12,000 net book value on 31 December 20x9, assuming B RM12,800 that the business closes its account on that date. C RM11.200 A RM63,869 D RM800 B RM63,877 CRM63,883 4 Which of the following can be considered as D RM63,889 capital expenditure? I Purchase price of machinery 2 A machinery was purchased for RM10,000. Il Cost of upgrading the machinery The transportation cost incurred was RM400 and an additional RM1,200 was paid to have III Cost of maintaining the machinery IV Installation cost of machinery it installed, ready for its intended use. After being used for three months, it broke down and A I, II and III only had to be repaired at a cost of RM200. In the B I, III and IV only Statement of Financial Position at the end of C II, III and IV only the period, the cost of the machinery would be D I, II and IV only shown as 5 Depreciation is a process of A RM10,400 A asset devaluation B RM10,200 B cost accumulation CRM11,400 C cost allocation D RM11,600 Dasset valuation 15.00 yo So 6 Which of be following expenses could be Chapter 9 Accounting for Non-current Assets and Depreciation 231 A RM100,000 C RM150,000 considered a capital expenditure? B RM130,080 D RM111.920 A Petrol costs for a motor van B Depreciation of a motor van 9 The carrying value of a depreciable asset is the difference between C Repairs to a motor van D Installation of an air conditioner unit in a A depreciation and accumulated depreciation B cost and accumulated depreciation motor van C cost and depreciation 1 All of the following expenses are regarded as D None of the above capital expenditure, except 10 Which of the following expenditure incurred A Cost to acquire a machine in connection with the acquisition of a building B Depreciation of office equipment should be charged to the expense account? C Extension to an office building A Legal fees on the building purchased D Installation of an air-conditioning system B Expenses incurred in the construction of 8 The depreciation rate for motor vehicles is 15% parking space for staff per annum calculated on cost. A motor vehicle C Fire insurance on the building which was bought 3 years ago has a carrying D Installation cost of an air-conditioning (book) value of RM82,500. What is the cost of system for the building the motor vehicle? PROBLEM QUESTIONS Complete all the questions provided. Destion 1 The following is an extract of the Balance Sheet of Ashraf Sdn Bhd as at 30 September 20x6: Non-current assets Motor vehicles Cost (RM) 160,000 80,000 Accumulated depreciation (RM) 60,000 40,000