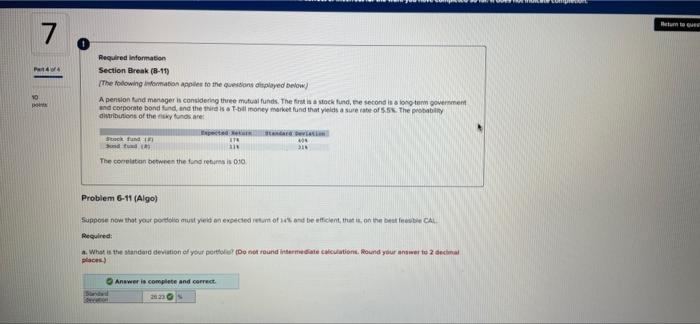

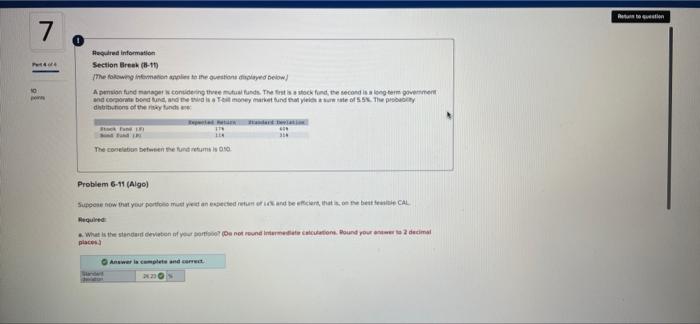

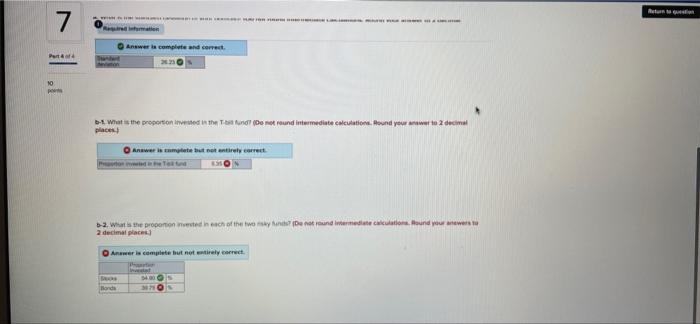

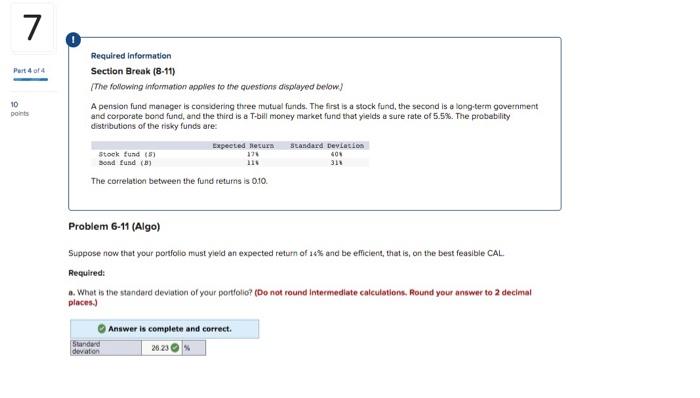

7 44 Required information Section Break (B-15) The following information applies to the questions displayed below) A pension and manager in considering three mutual funds. The first is a stock tund, e second is a long term government and corporate bond fund, and the abil money market fund that is a surerate of St. The probly dirbtions of the sky fons are SER Sond IT The corelation between the fond return is 010 Problem 6-11 (Algo) Support now that your portfolio muut yet an expected returot and be eficient, that is on the bebe CAL Required: What is the standard deviation of your port (Do not found intamatection. Round your answer to 2 decimal places) Answer is complete and correct 22 7 1 Hered information Section Break (8-11 The flowing intomation and to the option below) A person fund conditive funds. The stock find the second is long term government ma cor bond tund, metsa Timoney marvet und hatte. The probably chons of them and 10 31 The corelation betwee uretum 090 Problem 6-11 (190) Suppose now that your portion must en certum recent that be CAL Required What is the second even if you not run intermediate action. Round you to 2 decimal places Answer la complete and correct 22 Net 7 Answer to complete and correct Part 10 bu What is the proporton invented in the Ten (De niet round intermediate calculation. Found your answer to 2 decimal places Answer is met het entirely correct 2. What is the proportioned in each of the westen und intermediate calculation. Hound your newest 2 decimal place Anwwer is complete but not entirely correct SAN 30 Honda 7 Part 4 of 4 10 points Required information Section Break (8-11) The following information applies to the questions displayed below) A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bil money market fund that yields a sure rate of 5.5%. The probability distributions of the risky funds are: Expected return Standard deviation stock fund (5) 120 400 sond fund (3) 110 311 The correlation between the fund teturns is 0.10 Problem 6-11 (Algo) Suppose now that your portfolio must yleid an expected return of 10% and be efficient, that is, on the best feasible CAL Required: 1. What is the standard deviation of your portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Standard devation Answer is complete and correct. 26230