Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. (5 points) Your experience suggests that if USD is strong (weak), American students will be more (less) likely to study abroad. Of course,

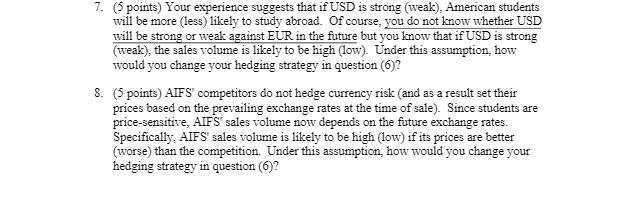

7. (5 points) Your experience suggests that if USD is strong (weak), American students will be more (less) likely to study abroad. Of course, you do not know whether USD will be strong or weak against EUR in the future but you know that if USD is strong (weak), the sales volume is likely to be high (low). Under this assumption, how would you change your hedging strategy in question (6)? 8. (5 points) AIFS' competitors do not hedge currency risk (and as a result set their prices based on the prevailing exchange rates at the time of sale). Since students are price-sensitive, AIFS' sales volume now depends on the future exchange rates. Specifically, AIFS' sales volume is likely to be high (low) if its prices are better (worse) than the competition. Under this assumption, how would you change your hedging strategy in question (6)?

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

7 If my experience suggests that a strong weak USD leads to higher lower sales volume then I would a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started