Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moe Inc. is in the manufacturing industry. The firm has 30 million common stocks with par value of $5 per share. Each stock is

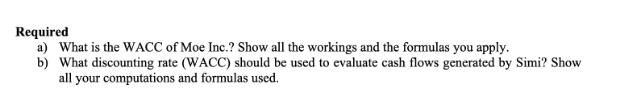

Moe Inc. is in the manufacturing industry. The firm has 30 million common stocks with par value of $5 per share. Each stock is trading at $16. The firm also has 0.67122 million 20-year zero coupon bonds issued 5 years ago. Each bond is currently trading at 47.674 and pays interest semi-annually. The firm's equity beta of 1.25. The company wants to diversify into the energy industry by acquiring Simi Inc. The acquisition will cost $200 million and will be financed as follows: 1) Issue of 5.625 million stocks at the current stock price 2) Issue a 20-year, 4.4% coupon bonds which pays interest semi-annually. Similar bonds are trading at 81.508 each. The interest rate on 20-year treasury bonds is 4% and the market premium is 8%. The tax rate is 20%. The average Energy industry beta is 1.45 with Debt-to-Equity ratio of 0.6. Required a) What is the WACC of Moe Inc.? Show all the workings and the formulas you apply. b) What discounting rate (WACC) should be used to evaluate cash flows generated by Simi? Show all your computations and formulas used.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started