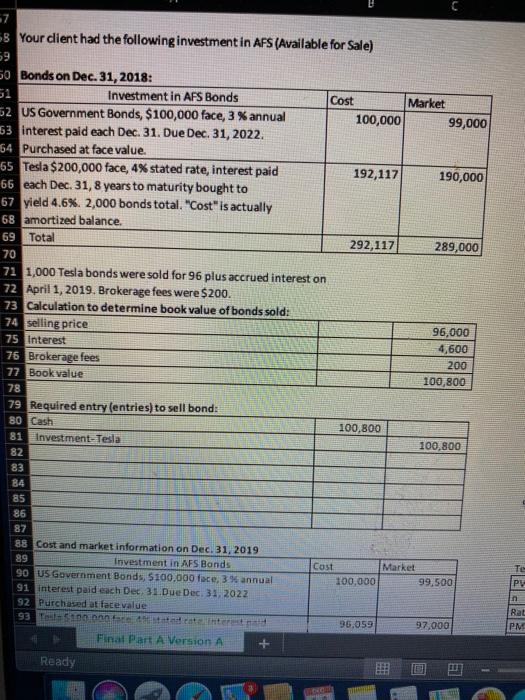

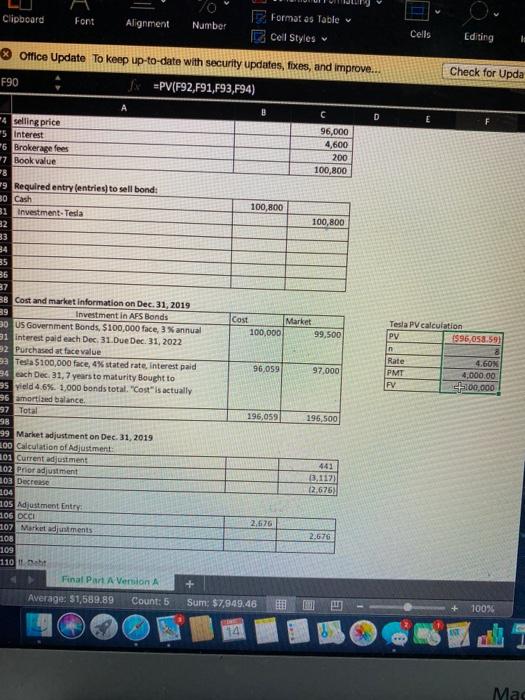

7 58 Your client had the following investment in AFS (Available for Sale) 59 50 Bonds on Dec. 31, 2018: Investment in AFS Bonds Cost Market 52 US Government Bonds, $100,000 face, 3 % annual 100,000 99,000 53 interest paid each Dec. 31. Due Dec 31, 2022. 64 Purchased at face value. 65 Tesla $ 200,000 face, 4% stated rate, interest paid 192,117 190,000 66 each Dec. 31, 8 years to maturity bought to 67 yield 4.6%. 2,000 bonds total. "Cost" is actually 68 amortized balance. 69 Total 292,117 289,000 70 71 1,000 Tesla bonds were sold for 96 plus accrued interest on 72 April 1, 2019. Brokerage fees were $200. 73 Calculation to determine book value of bonds sold: 74 selling price 96,000 75 Interest 4,600 76 Brokerage fees 200 77 Book value 100,800 78 79 Required entry (entries) to sell bond: 80 Cash 100.800 81 Investment- Tesla 100,800 82 83 84 85 86 87 88 Cost and market information on Dec. 31, 2019 89 Investment in AFS Bands Cost Market 90 US Government Bonds, 5100.000 face, 3% annual 100,000 99,500 91 interest paid each Dec, 31.Due Dec. 31, 2022 92 Purchased at face value 93 Siththa 36,059 97,000 Final Part A Version A Ready E TE PU in Rat PM Cells Editing F Format es Table Clipboard Font Alignment Number cell Styles * Office Update To keep up-to-date with security updates, fixes, and improve... F90 x=PV(F92,591,793,F94) Check for Upda D E +4 selling price +5 interest 6 Brokerage fees 17 Book value 96,000 4,600 200 100,800 r9 Required entry (entries) to sell bond: 30 Cash 31 Investment Tesla 32 33 100,800 100,800 Tesla PV calculation PV {$96,058.59) n Rate 4.60N PMT 4,000.00 FV Sh100,000 35 36 37 38 Cost and market information on Dec 31, 2019 39 Investment in AFS Bonds Cost Market 90 US Government Bonds, $100,000 face, 3% annual 100,000 99,500 31 Interest paid each Dec, 31. Due Dec 31, 2022 32 Purchased at face value 93 Tesla $100,000 face, 4% stated rate. Interest paid 96,059 97,000 94 cach Dec 31, 7 years to maturity Bought to 55 yield 4.6% 1,000 bonds total. "Cost" is actually 36 amortid balance 97 Total 196,059 196,500 98 99 Market adjustment on Dec 31, 2019 200 Calculation of Adjustment: 301 Current adjustment 302 Prior adjustment 13,117) 03 Decrease 12.675) 304 105 Adjustment Entry 106 OCCI 2,676 307 Market adjustments 2.676 108 109 110 Laht Final Part A Version A Average: 51,589.89 Count: 5 Sum: $7,949.46 DI 100% 14 Mad 7 58 Your client had the following investment in AFS (Available for Sale) 59 50 Bonds on Dec. 31, 2018: Investment in AFS Bonds Cost Market 52 US Government Bonds, $100,000 face, 3 % annual 100,000 99,000 53 interest paid each Dec. 31. Due Dec 31, 2022. 64 Purchased at face value. 65 Tesla $ 200,000 face, 4% stated rate, interest paid 192,117 190,000 66 each Dec. 31, 8 years to maturity bought to 67 yield 4.6%. 2,000 bonds total. "Cost" is actually 68 amortized balance. 69 Total 292,117 289,000 70 71 1,000 Tesla bonds were sold for 96 plus accrued interest on 72 April 1, 2019. Brokerage fees were $200. 73 Calculation to determine book value of bonds sold: 74 selling price 96,000 75 Interest 4,600 76 Brokerage fees 200 77 Book value 100,800 78 79 Required entry (entries) to sell bond: 80 Cash 100.800 81 Investment- Tesla 100,800 82 83 84 85 86 87 88 Cost and market information on Dec. 31, 2019 89 Investment in AFS Bands Cost Market 90 US Government Bonds, 5100.000 face, 3% annual 100,000 99,500 91 interest paid each Dec, 31.Due Dec. 31, 2022 92 Purchased at face value 93 Siththa 36,059 97,000 Final Part A Version A Ready E TE PU in Rat PM Cells Editing F Format es Table Clipboard Font Alignment Number cell Styles * Office Update To keep up-to-date with security updates, fixes, and improve... F90 x=PV(F92,591,793,F94) Check for Upda D E +4 selling price +5 interest 6 Brokerage fees 17 Book value 96,000 4,600 200 100,800 r9 Required entry (entries) to sell bond: 30 Cash 31 Investment Tesla 32 33 100,800 100,800 Tesla PV calculation PV {$96,058.59) n Rate 4.60N PMT 4,000.00 FV Sh100,000 35 36 37 38 Cost and market information on Dec 31, 2019 39 Investment in AFS Bonds Cost Market 90 US Government Bonds, $100,000 face, 3% annual 100,000 99,500 31 Interest paid each Dec, 31. Due Dec 31, 2022 32 Purchased at face value 93 Tesla $100,000 face, 4% stated rate. Interest paid 96,059 97,000 94 cach Dec 31, 7 years to maturity Bought to 55 yield 4.6% 1,000 bonds total. "Cost" is actually 36 amortid balance 97 Total 196,059 196,500 98 99 Market adjustment on Dec 31, 2019 200 Calculation of Adjustment: 301 Current adjustment 302 Prior adjustment 13,117) 03 Decrease 12.675) 304 105 Adjustment Entry 106 OCCI 2,676 307 Market adjustments 2.676 108 109 110 Laht Final Part A Version A Average: 51,589.89 Count: 5 Sum: $7,949.46 DI 100% 14 Mad