Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7 7 Retirement of common shares, S Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years

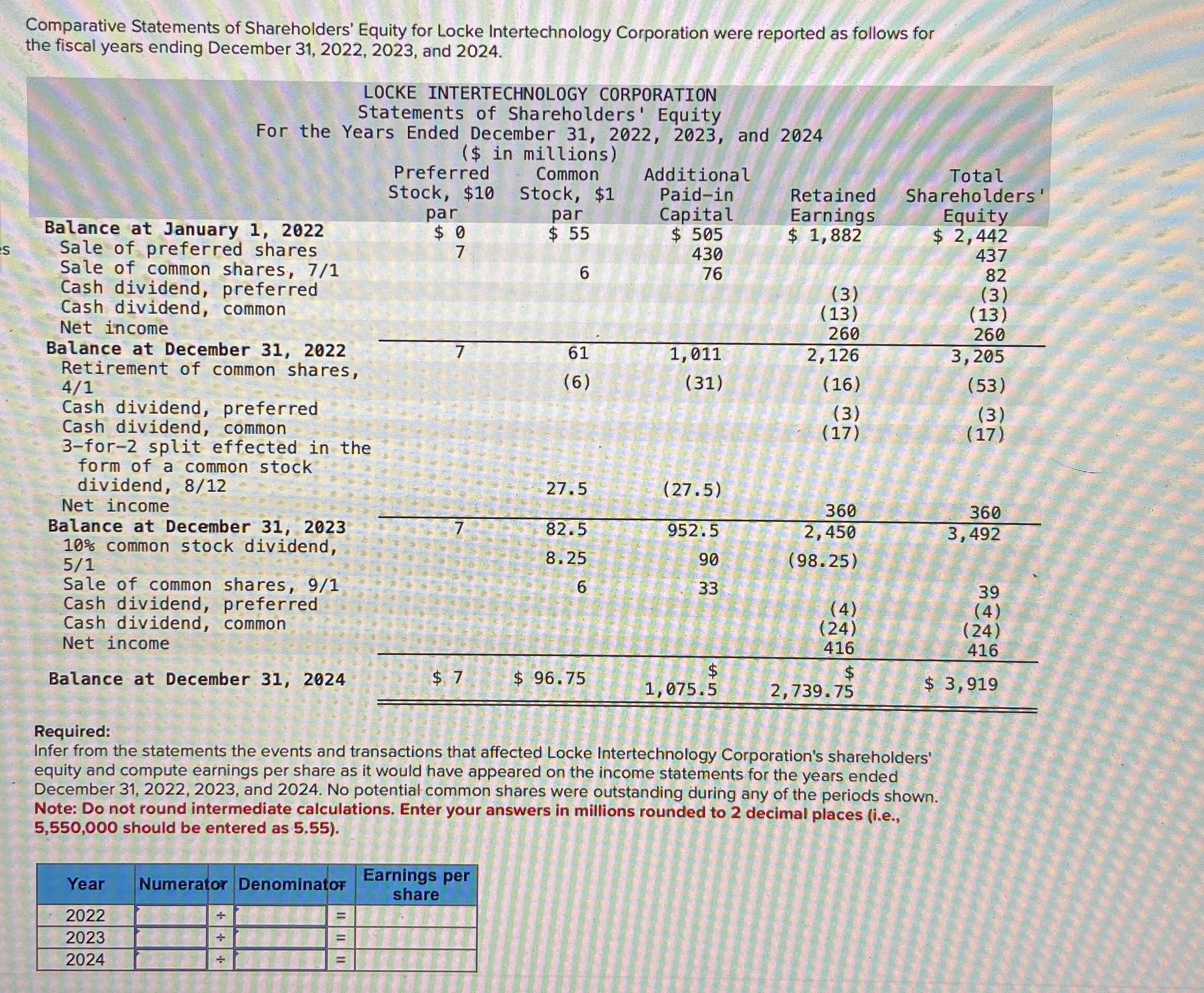

7 7 Retirement of common shares, S Comparative Statements of Shareholders' Equity for Locke Intertechnology Corporation were reported as follows for the fiscal years ending December 31, 2022, 2023, and 2024. LOCKE INTERTECHNOLOGY CORPORATION Statements of Shareholders' Equity For the Years Ended December 31, 2022, 2023, and 2024 ($ in millions) Common Balance at January 1, 2022 Sale of preferred shares Sale of common shares, 7/1 Cash dividend, preferred Cash dividend, common Net income Balance at December 31, 2022 4/1 Preferred Stock, $10 Stock, $1 par $ 0 Additional Paid-in par $ 55 6 Capital $ 505 430 76 Retained Earnings $ 1,882 Total Shareholders' Equity $ 2,442 437 82 (3) (3) (13) (13) 260 260 61 1,011 2,126 3,205 (6) (31) (16) (53) Cash dividend, preferred (3) (3) Cash dividend, common (17) (17) 3-for-2 split effected in the form of a common stock dividend, 8/12 27.5 (27.5) Net income Balance at December 31, 2023 7 82.5 952.5 360 2,450 360 3,492 10% common stock dividend, 8.25 90 (98.25) 5/1 Sale of common shares, 9/1 LO 33 39 Cash dividend, preferred Cash dividend, common Net income (4) (24) (4) (24) 416 416 HA Balance at December 31, 2024 $ 7 $ 96.75 1,075.5 2,739.75 $ 3,919 Required: Infer from the statements the events and transactions that affected Locke Intertechnology Corporation's shareholders' equity and compute earnings per share as it would have appeared on the income statements for the years ended December 31, 2022, 2023, and 2024. No potential common shares were outstanding during any of the periods shown. Note: Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places (i.e., 5,550,000 should be entered as 5.55). Year Numerator Denominator Earnings per share 2022 2023 2024 +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started