Question

7- 7- What is the forecast value of sales for 2018? 8- What is Company Y s forecast closing book value for 2018? 9- What

7-

7- What is the forecast value of sales for 2018?

8- What is Company Y s forecast closing book value for 2018?

9- What is Company Y s forecast for property, plant and equipment for 2017?"

10- Before making any adjustments to balance Total Assets with Total Liabilities and Equity, what is Company Y s forecast value of Total Liabilities and Equity for 2017?"

11- According the 2017 forecasts for Company Y, is there needs for new financing or excess cash? Specify the value of new financing needed or excess cash available."

12- What are the estimated values of net working capital in 2017?

13- What is the estimated value of the increase in net working capital in 2017?

14- What is the estimated Free Cash Flow of the Firm in 2017?

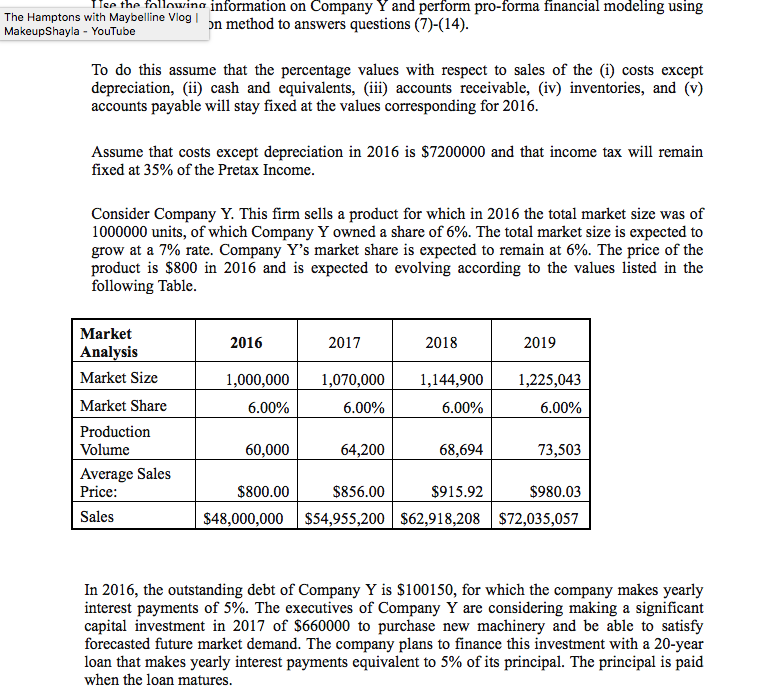

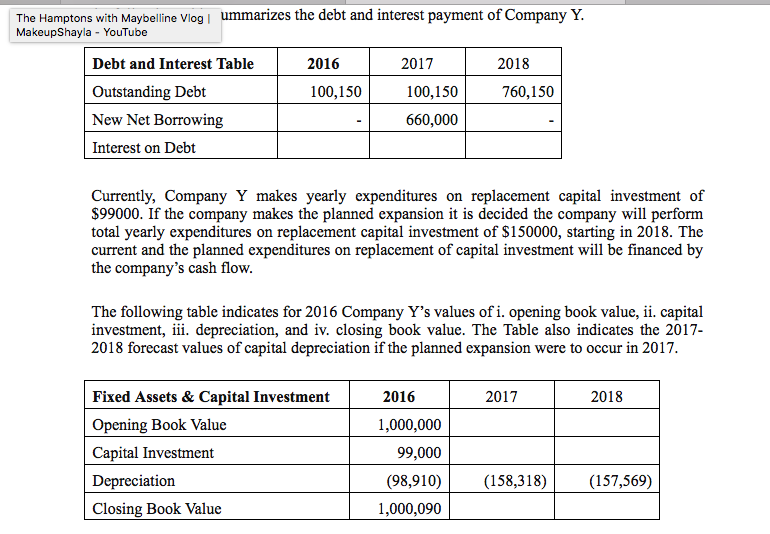

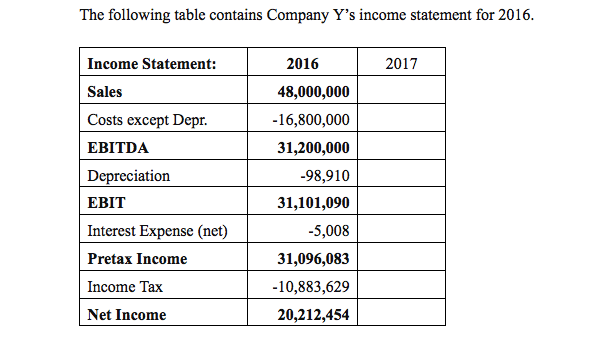

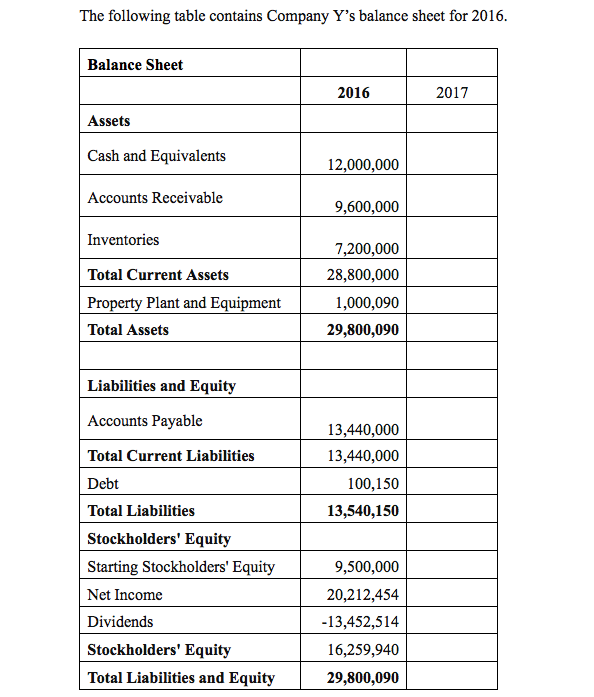

r ren the fallowina nformation on Company Y and perform pro-forma financial modeling using The Hamptons with Maybelline Vlog I MakeupShayla YouTube on method to answers questions (7)-(14) To do this assume that the percentage values with respect to sales of the (i) costs except depreciation, (ii) cash and equivalents, (iii) accounts receivable, (iv) inventories, and (v) accounts payable will stay fixed at the values corresponding for 2016 Assume that costs except depreciation in 2016 is $7200000 and that income tax will remain fixed at 35% of the Pretax Income Consider Company Y. This firm sells a product for which in 2016 the total market size was of 1000000 units, of which Company Y owned a share of 6%. The total market size is expected to grow at a 7% rate. Company Y's market share is expected to remain at 6%. The price of the product is $800 in 2016 and is expected to evolving according to the values listed in the following Table Market Analysis Market Size Market Share Production Volume Average Sales 2016 2017 2018 2019 1,000,0001,070,0001,144,9001,225,043 6.00% 73,503 $980.03 $48,000,000S54,955,200 $62,918,208$72,035,057 6.00% 64,200 $856.00 6.00% 6.00% 60,000 68,694 $800.00 S915.92 Price Sales In 2016, the outstanding debt of Company Y is S100150, for which the company makes yearly interest payments of 5%. The executives of Company Y are considering making a significant capital investment in 2017 of S660000 to purchase new machinery and be able to satisfy forecasted future market demand. The company plans to finance this investment with a 20-year loan that makes yearly interest payments equivalent to 5% of its principal. The principal is paid when the loan maturesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started