7.

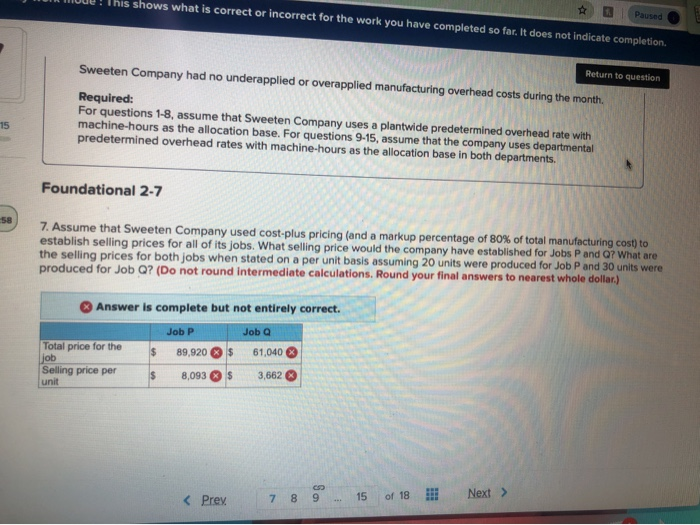

8.

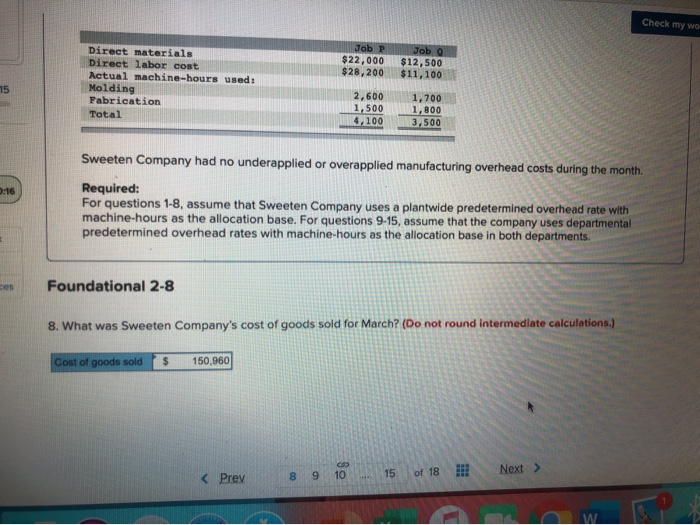

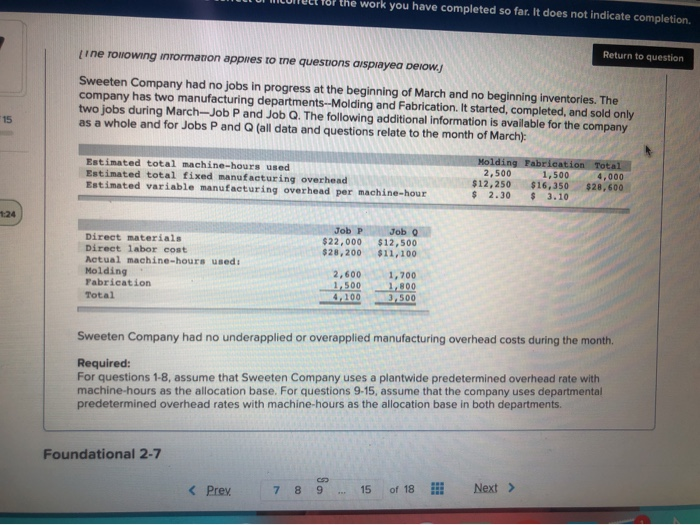

10.

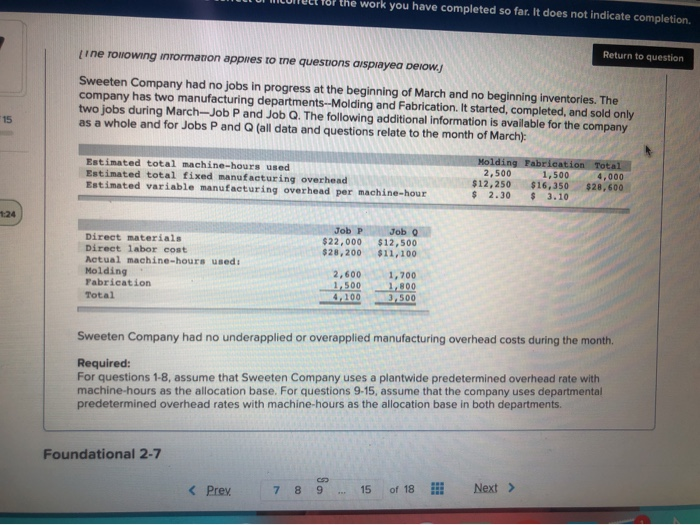

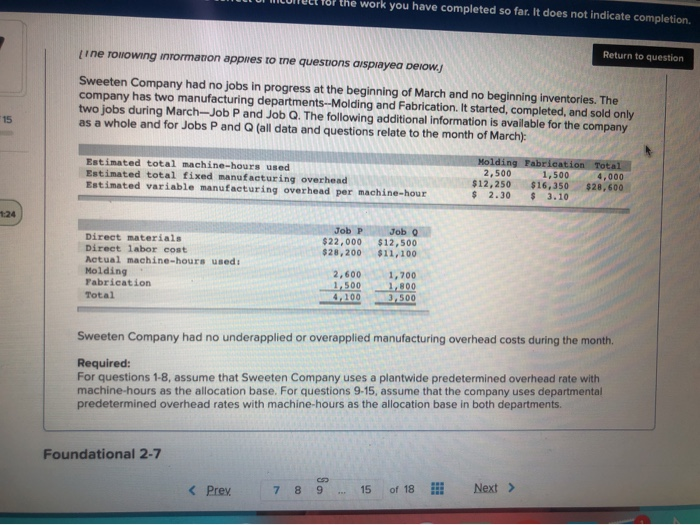

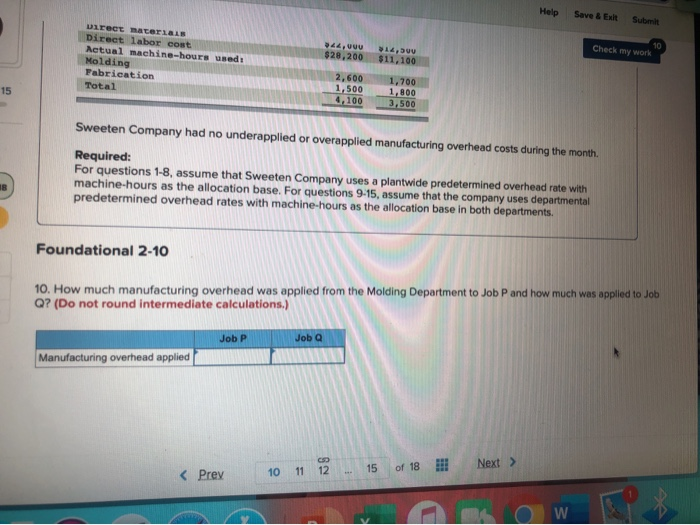

LUNUL For the work you have completed so far. It does not indicate completion Line Tolowing informaron applies to the questions displayed below.J Return to question Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments --Molding and Fabrication. It started, completed, and sold only two jobs during March-Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Estimated total machine-hours used Estimated total fixed manufacturing overhead Estimated variable manufacturing overhead per machine-hour Molding Fabrication Total 2,500 1,500 4,000 $12,250 $16,350 $28,600 $ 2.30 $ 3.10 Job P $22,000 $28,200 Job o $12,500 $11,100 Direct materials Direct labor cost Actual machine-hours used: Molding Fabrication Total 2,600 1,500 4,100 1,700 1,800 3,500 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. Foundational 2-7 e his shows what is correct or incorrect for the work you have completed so far. It does not indicate completion # Paused Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Return to question Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. Foundational 2-7 7. Assume that Sweeten Company used cost.plus pricing and a markup percentage of 80% of total manufacturing cost to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the selling prices for both jobs when stated on a per unit basis assuming 20 units were produced for Job P and 30 units were produced for Job Q? (Do not round Intermediate calculations. Round your final answers to nearest whole dollar.) Answer is complete but not entirely correct. Job P Job Q Total price for the job $ 89,920 $ 61,040 Selling price per 8,093 $ 3,662 unit Check my wo Job P $22,000 $28,200 Job O $12,500 $11,100 Direct materials Direct labor cost Actual machine-hours used: Molding Fabrication Total 2,600 1,500 4,100 1,700 1,800 3,500 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments. ces Foundational 2-8 8. What was Sweeten Company's cost of goods sold for March? (Do not round intermediate calculations.) Cost of goods sold $ 150,960 Help Save & Exit Submit Direct MATBILAL Direct labor cost Actual machine-hours used Molding Fabrication Total 44, $28,200 14, $11,100 Check my work 2,600 1.500 4.100 1,700 1,800 2.500 Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. For questions 9-15. assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments Foundational 2-10 10. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q? (Do not round Intermediate calculations.) Job P JobQ Manufacturing overhead applied arow