Question

(7). ---------------- (8). Elegant Dogs and Dogs Are Dazzling are competing canine grooming salons. Each company currently serves 4,500 customers per year. Both companies charge

(7).

----------------

(8).

Elegant Dogs and Dogs Are Dazzling are competing canine grooming salons. Each company currently serves 4,500 customers per year. Both companies charge $35 to groom a dog. Elegant Dogs pays its dog groomers fixed salaries. Salary expense totals $45,000 per year. Dogs Are Dazzling pays its groomers $10 per dog groomed. Elegant Dogs lures 2,000 customers from Dogs Are Dazzling by lowering its grooming price to $25. Dogs Are Dazzling maintains its $35 price. Which of the following is true?

a. Profits at both companies will decrease.

b. Elegant Dogs profits will increase and Dogs Are Dazzlings profits will decrease.

c. Dogs Are Dazzling will suffer a net loss

d. All the statements are false.

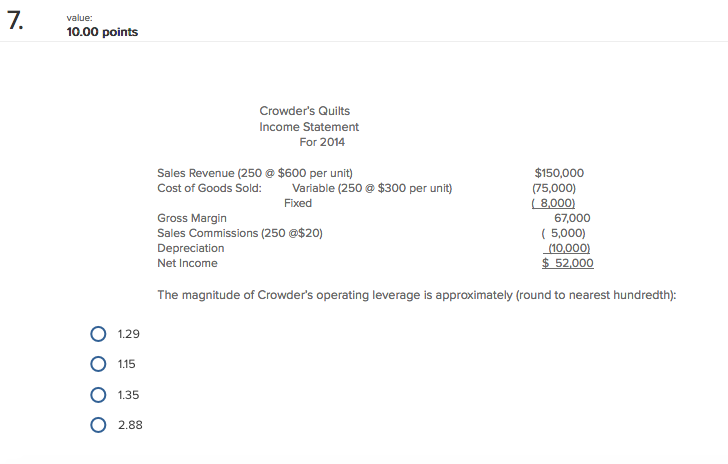

7. 10.000 points Crowder's Quilts Income Statement For 2014 $150,000 Sales Revenue (250 $600 per unit) Cost of Goods Sold: Variable (250 a $300 per unit) 75,000) Fixed 8.000 67,000 Gross Margin 5,000) Sales Commissions (250 @$20) 10,000) Depreciation 52,000 Net Income The magnitude of Crowder's operating leverage is approximately (round to nearest hundredth) O 1.29 O 1.15 O 1.35 O 2.88Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started