Answered step by step

Verified Expert Solution

Question

1 Approved Answer

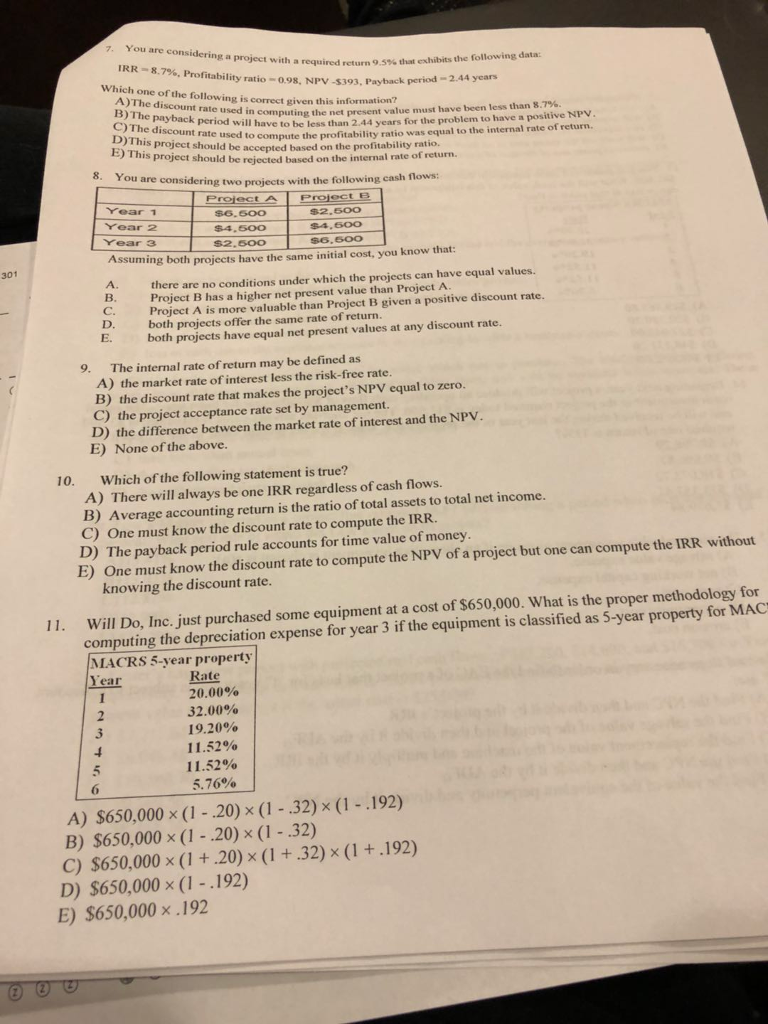

7 81011 Thanks!! 7. You are considering a project with IRR> 8.7%. Profitability ratio-098, NPV-$303, Payback period Which one of the following is correst given

7 81011

Thanks!!

7. You are considering a project with IRR> 8.7%. Profitability ratio-098, NPV-$303, Payback period Which one of the following is correst given te n vau h probe a required return 9.5% that exhibits the following data: this B) The payback period will have C)The discount rate used to D)This project should be E) This project should be of rturn to be less than 2.44 years for the problem to have a positive NPV compute the profitability ratio was equal to the internal rate of return. accepted based on the profitability ratio. rejected based on the internal rate of return. 8. You are consideri ng two projects with the following cash flows: Year Year 2 Year 3 S6.600 $4.600 $2.6O0 $2.500 $4.600 SG.soo ssuming both projects have the same initial cost, you know that: B. Project B has a higher net present value than Project A E. both projects have equal net present values at any discount rate. 301 there are no conditions under which the projects can have equal values. C. D. Project A is more valuable than Project B given a positive discount rate. both projects offer the same rate of return The internal rate of return may be defined as A) the market rate of interest less the risk-free rate B) the discount rate that makes the project's NPV equal to zero. C) the project acceptance rate set by management. D) the difference between the market rate of interest and the NPV. E) None of the above. 9. 10. Which of the following statement is true? A) There will always be one IRR regardless of cash flows. B) Average accounting return is the ratio of total assets to total net income C) One must know the discount rate to compute the IRR. D) The payback period rule accounts for time value of money E) One must know the discount rate to compute the NPV of a project but one can compute the IRR without knowing the discount rate. 11. Will Do, Inc. just purchased some equipment at a cost of $650,000. What is the proper methodology for computing the depreciation expense for year 3 if the equipment is classified as 5-year property for MAC MACRS 5-year property Rate 20.00% 32.00% 19.20% 11 .52% 11.52% 5.76% lear A) $650,000 x (1-.20) x (1-32) (1-192) B) $650,000 x (1 20) x (1- 32) C) $650.000 x (1 + .20) (1 + .32)s (1 + 192) D) $650,000 x (1 -.192) E) $650,000 x.192Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started