Question

7. A company issues a 20-year, callable bond at par with a 6% annual coupon. The bond can be called at par in three

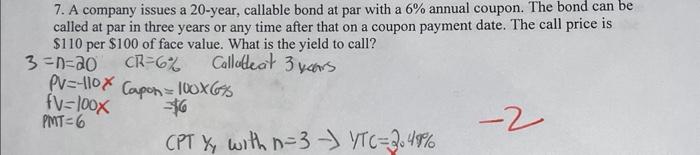

7. A company issues a 20-year, callable bond at par with a 6% annual coupon. The bond can be called at par in three years or any time after that on a coupon payment date. The call price is $110 per $100 of face value. What is the yield to call? Collatheat 3 years 3=n=20 CR=6% PV=-110x Capon = 100X6% fv-100x $6 PMT=6 CPT Y with n=3- VTC=3.49% -2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image shows a handwritten solution to a finance problem where a company issues a 20year callable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting 2014 FASB Update

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

15th edition

978-1118938782, 111893878X, 978-1118985311, 1118985311, 978-1118562185, 1118562186, 978-1118147290

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App