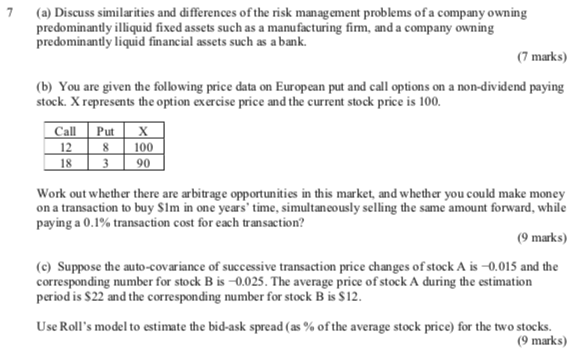

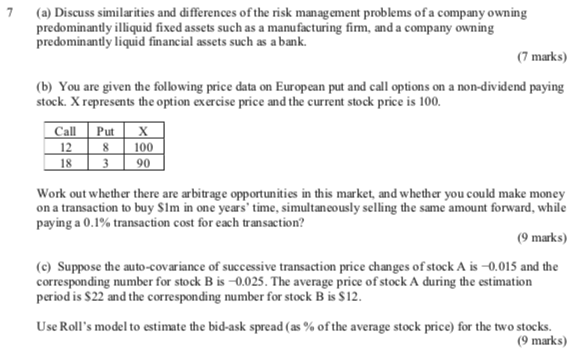

7 (a) Discuss similarities and differences of the risk management problems of a company owning predominantly illiquid fixed assets such as a manufacturing firm, and a company owning predominantly liquid financial assets such as a bank. (7 marks) (b) You are given the following price data on European put and call options on a non-dividend paying stock. X represents the option exercise price and the current stock price is 100. Call Putx 12 8 100 18 3 90 Work out whether there are arbitrage opportunities in this market, and whether you could make money on a transaction to buy Slm in one years' time, simultaneously selling the same amount forward, while paying a 0.1% transaction cost for each transaction? (9 marks) (c) Suppose the auto-covariance of successive transaction price changes of stock A is 0.015 and the corresponding number for stock B is -0.025. The average price of stock A during the estimation period is $22 and the corresponding number for stock B is $12. Use Roll's model to estimate the bid-ask spread (as % of the average stock price) for the two stocks. (9 marks) 7 (a) Discuss similarities and differences of the risk management problems of a company owning predominantly illiquid fixed assets such as a manufacturing firm, and a company owning predominantly liquid financial assets such as a bank. (7 marks) (b) You are given the following price data on European put and call options on a non-dividend paying stock. X represents the option exercise price and the current stock price is 100. Call Putx 12 8 100 18 3 90 Work out whether there are arbitrage opportunities in this market, and whether you could make money on a transaction to buy Slm in one years' time, simultaneously selling the same amount forward, while paying a 0.1% transaction cost for each transaction? (9 marks) (c) Suppose the auto-covariance of successive transaction price changes of stock A is 0.015 and the corresponding number for stock B is -0.025. The average price of stock A during the estimation period is $22 and the corresponding number for stock B is $12. Use Roll's model to estimate the bid-ask spread (as % of the average stock price) for the two stocks. (9 marks)