Answered step by step

Verified Expert Solution

Question

1 Approved Answer

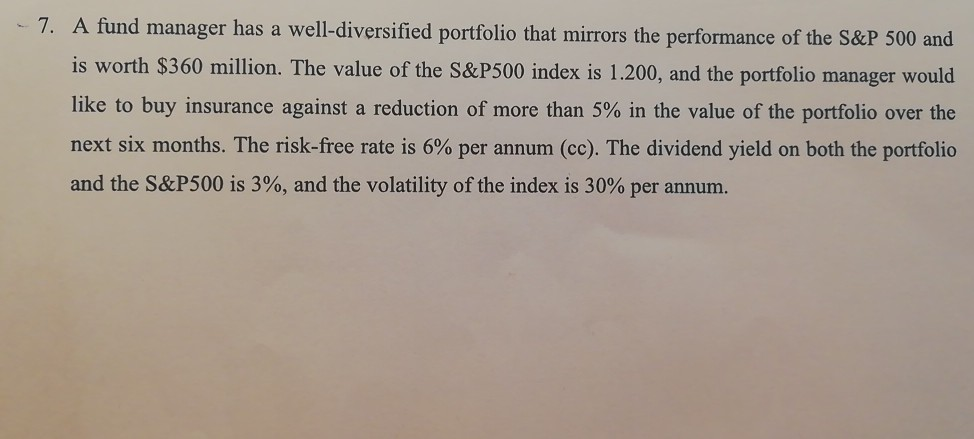

- 7. A fund manager has a well-diversified portfolio that mirrors the performance of the S&P 500 and is worth $360 million. The value of

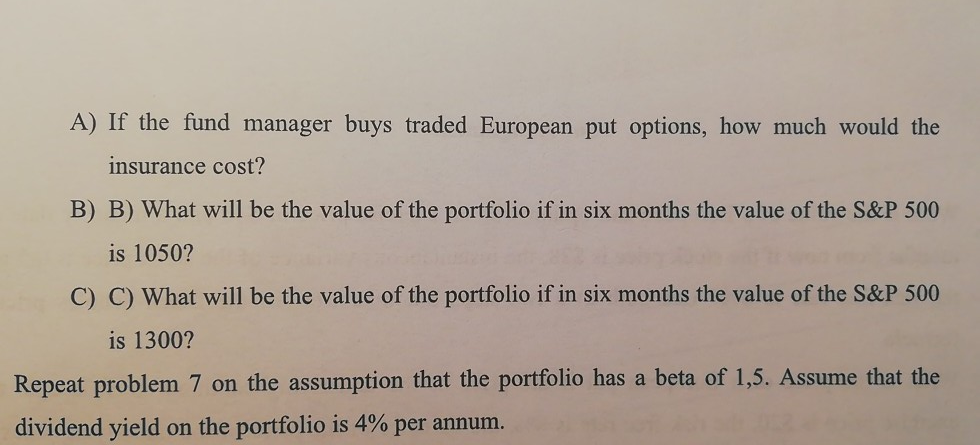

- 7. A fund manager has a well-diversified portfolio that mirrors the performance of the S&P 500 and is worth $360 million. The value of the S&P500 index is 1.200, and the portfolio manager would like to buy insurance against a reduction of more than 5% in the value of the portfolio over the next six months. The risk-free rate is 6% per annum (cc). The dividend yield on both the portfolio and the S&P500 is 3%, and the volatility of the index is 30% per annum. A) If the fund manager buys traded European put options, how much would the insurance cost? B) B) What will be the value of the portfolio if in six months the value of the S&P 500 is 1050? C) C) What will be the value of the portfolio if in six months the value of the S&P 500 is 1300? Repeat problem 7 on the assumption that the portfolio has a beta of 1,5. Assume that the dividend yield on the portfolio is 4% per annum. - 7. A fund manager has a well-diversified portfolio that mirrors the performance of the S&P 500 and is worth $360 million. The value of the S&P500 index is 1.200, and the portfolio manager would like to buy insurance against a reduction of more than 5% in the value of the portfolio over the next six months. The risk-free rate is 6% per annum (cc). The dividend yield on both the portfolio and the S&P500 is 3%, and the volatility of the index is 30% per annum. A) If the fund manager buys traded European put options, how much would the insurance cost? B) B) What will be the value of the portfolio if in six months the value of the S&P 500 is 1050? C) C) What will be the value of the portfolio if in six months the value of the S&P 500 is 1300? Repeat problem 7 on the assumption that the portfolio has a beta of 1,5. Assume that the dividend yield on the portfolio is 4% per annum

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started