Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7) A U.S. investor can either buy a U.S. bond, or an Australian bond. The U.S. bond pays an interest rate of 15% and the

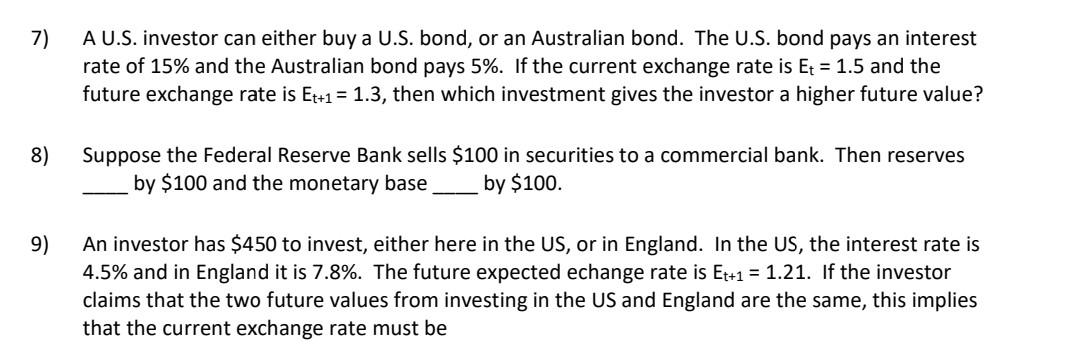

7) A U.S. investor can either buy a U.S. bond, or an Australian bond. The U.S. bond pays an interest rate of 15% and the Australian bond pays 5%. If the current exchange rate is Et = 1.5 and the future exchange rate is Et+1 = 1.3, then which investment gives the investor a higher future value? 8) Suppose the Federal Reserve Bank sells $100 in securities to a commercial bank. Then reserves by $100 and the monetary base by $100. 9) An investor has $450 to invest, either here in the US, or in England. In the US, the interest rate is 4.5% and in England it is 7.8%. The future expected echange rate is Et+1 = 1.21. If the investor claims that the two future values from investing in the US and England are the same, this implies that the current exchange rate must be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started