Question

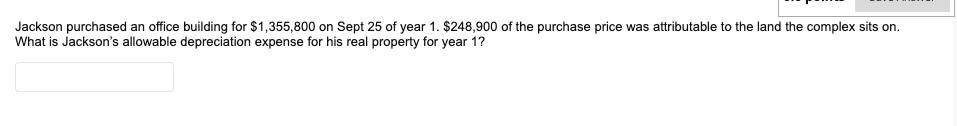

Jackson purchased an office building for $1,355,800 on Sept 25 of year 1. $248,900 of the purchase price was attributable to the land the

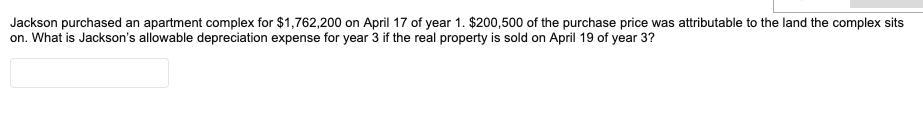

Jackson purchased an office building for $1,355,800 on Sept 25 of year 1. $248,900 of the purchase price was attributable to the land the complex sits on. What is Jackson's allowable depreciation expense for his real property for year 1? Jackson purchased an apartment complex for $1,762,200 on April 17 of year 1. $200,500 of the purchase price was attributable to the land the complex sits on. What is Jackson's allowable depreciation expense for year 3 if the real property is sold on April 19 of year 3?

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer7 Determine the value of the personal real property Asset Amount 1The total value o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland, James Sepe, Mark Nelson, Wayne Thomas

8th edition

978-1259997525, 1259997529, 978-1259548185

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App