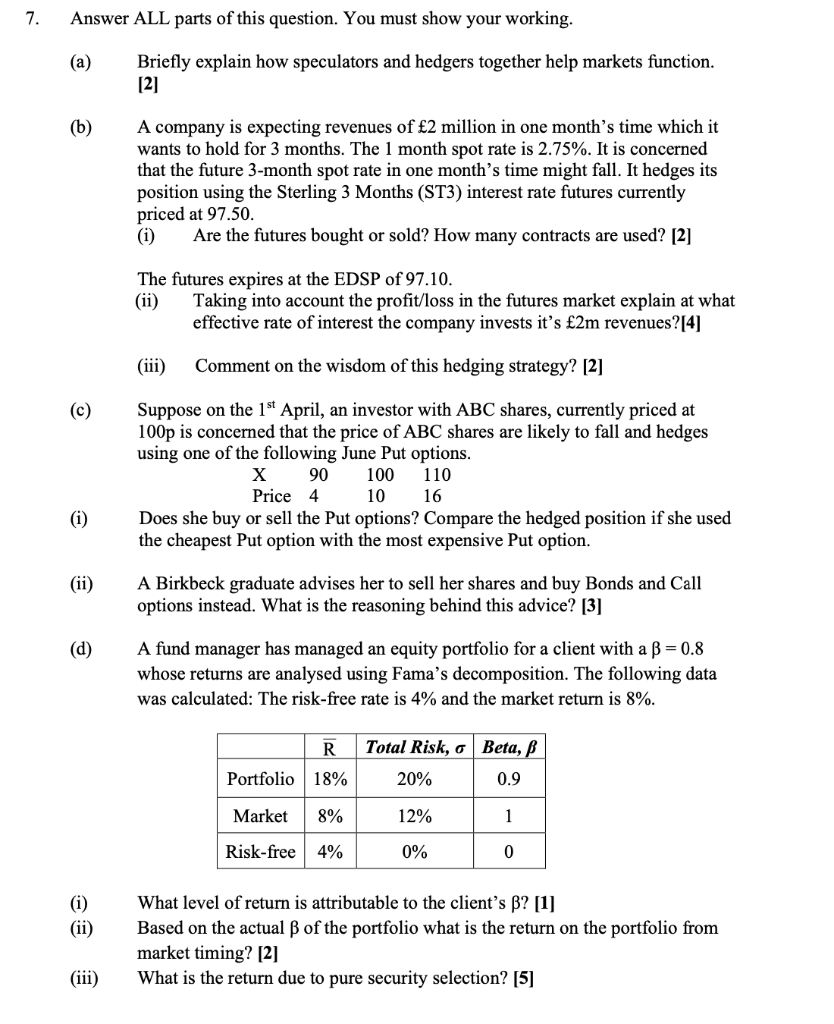

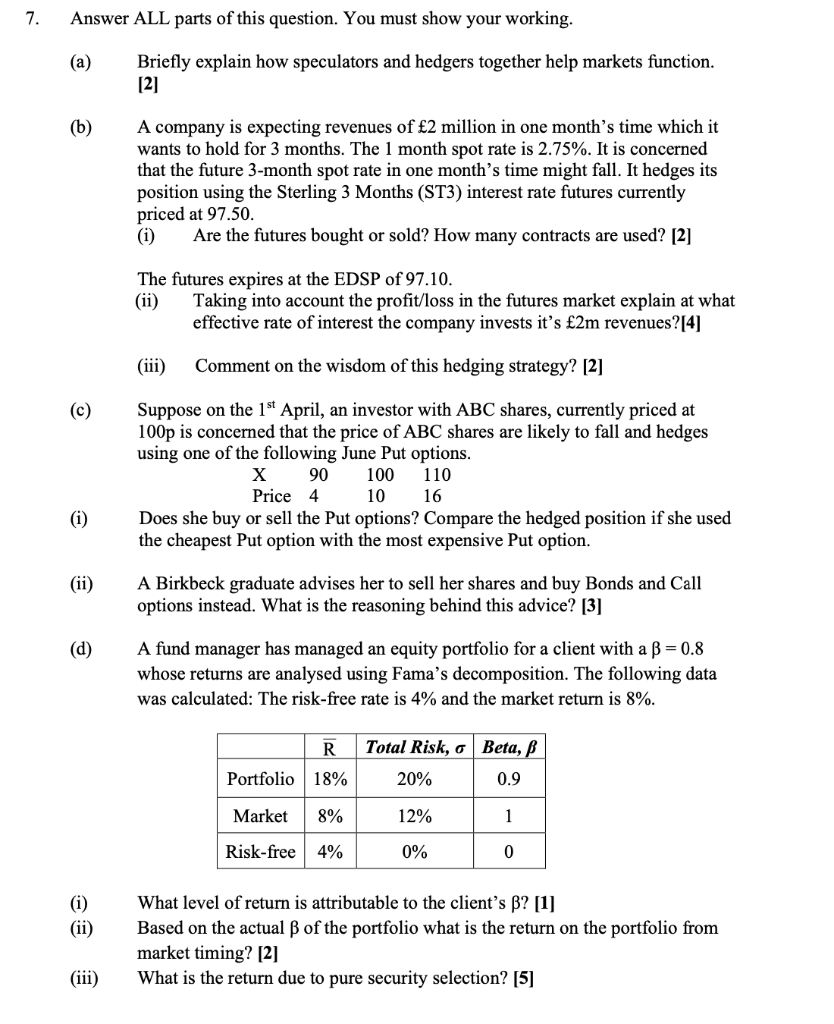

7. Answer ALL parts of this question. You must show your working. (a) Briefly explain how speculators and hedgers together help markets function. [2] (b) A company is expecting revenues of 2 million in one month's time which it wants to hold for 3 months. The 1 month spot rate is 2.75%. It is concerned that the future 3-month spot rate in one month's time might fall. It hedges its position using the Sterling 3 Months (ST3) interest rate futures currently priced at 97.50. (i) Are the futures bought or sold? How many contracts are used? [2] The futures expires at the EDSP of 97.10. (ii) Taking into account the profit/loss in the futures market explain at what effective rate of interest the company invests it's 2m revenues?[4] Comment on the wisdom of this hedging strategy? [2] (c) Suppose on the 1st April, an investor with ABC shares, currently priced at 100p is concerned that the price of ABC shares are likely to fall and hedges using one of the following June Put options. X 90 100 110 Price 4 10 16 Does she buy or sell the Put options? Compare the hedged position if she used the cheapest Put option with the most expensive Put option. (i) (ii) A Birkbeck graduate advises her to sell her shares and buy Bonds and Call options instead. What is the reasoning behind this advice? [3] (d) A fund manager has managed an equity portfolio for a client with a B = 0.8 whose returns are analysed using Fama's decomposition. The following data was calculated: The risk-free rate is 4% and the market return is 8%. R Total Risk, o Beta, 20% 0.9 Portfolio 18% Market 8% 12% 1 Risk-free 4% 0% 0 (i) (ii) What level of return is attributable to the client's B? [1] Based on the actual B of the portfolio what is the return on the portfolio from market timing? [2] What is the return due to pure security selection? [5] (iii) 7. Answer ALL parts of this question. You must show your working. (a) Briefly explain how speculators and hedgers together help markets function. [2] (b) A company is expecting revenues of 2 million in one month's time which it wants to hold for 3 months. The 1 month spot rate is 2.75%. It is concerned that the future 3-month spot rate in one month's time might fall. It hedges its position using the Sterling 3 Months (ST3) interest rate futures currently priced at 97.50. (i) Are the futures bought or sold? How many contracts are used? [2] The futures expires at the EDSP of 97.10. (ii) Taking into account the profit/loss in the futures market explain at what effective rate of interest the company invests it's 2m revenues?[4] Comment on the wisdom of this hedging strategy? [2] (c) Suppose on the 1st April, an investor with ABC shares, currently priced at 100p is concerned that the price of ABC shares are likely to fall and hedges using one of the following June Put options. X 90 100 110 Price 4 10 16 Does she buy or sell the Put options? Compare the hedged position if she used the cheapest Put option with the most expensive Put option. (i) (ii) A Birkbeck graduate advises her to sell her shares and buy Bonds and Call options instead. What is the reasoning behind this advice? [3] (d) A fund manager has managed an equity portfolio for a client with a B = 0.8 whose returns are analysed using Fama's decomposition. The following data was calculated: The risk-free rate is 4% and the market return is 8%. R Total Risk, o Beta, 20% 0.9 Portfolio 18% Market 8% 12% 1 Risk-free 4% 0% 0 (i) (ii) What level of return is attributable to the client's B? [1] Based on the actual B of the portfolio what is the return on the portfolio from market timing? [2] What is the return due to pure security selection? [5] (iii)