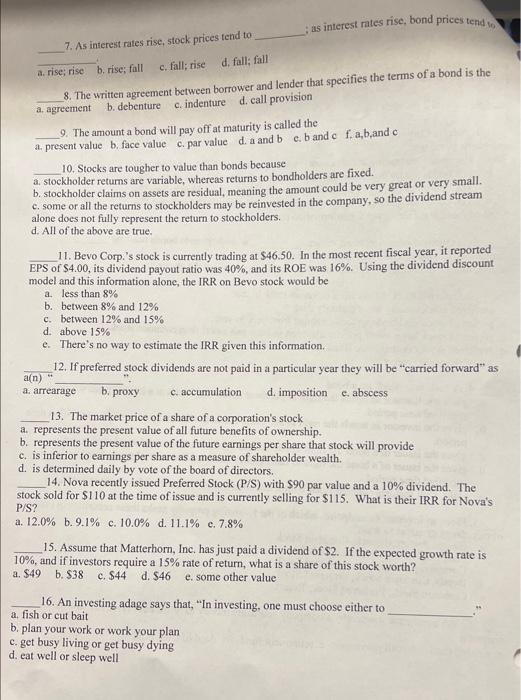

7. As interest rates rise, stock prices tend to U5 interest rates rise, bond prices tend to A. rise; rise b. rise; fall c. fall; rise d. fall: fall 8. The written agreement between borrower and lender that specifies the terms of a bond is the a. agreement b. debenture c. indenture d. call provision 9. The amount a bond will pay off at maturity is called the a. present value b. face value c. par value d. a and b c. b and c f. a,b,and c 10. Stocks are tougher to value than bonds because a. stockholder returns are variable, whereas returns to bondholders are fixed. b. stockholder claims on assets are residual, meaning the amount could be very great or very small. c. some or all the returns to stockholders may be reinvested in the company, so the dividend stream alone does not fully represent the return to stockholders. d. All of the above are true. 11. Bevo Corp.'s stock is currently trading at $46.50. In the most recent fiscal year, it reported EPS of \$4.00, its dividend payout ratio was 40%, and its ROE was 16%. Using the dividend discount model and this information alone, the IRR on Bevo stock would be a. Jess than 8% b. between 8% and 12% c. between 12% and 15% d. above 15% e. There's no way to estimate the IRR given this information. 12. If preferred stock dividends are not paid in a particular year they will be "carried forward" as a. represents the present value of all future benefits of ownership. b. represents the present value of the future earnings per share that stock will provide c. is inferior to earnings per share as a measure of shareholder wealth. d. is determined daily by vote of the board of directors. 14. Nova recently issued Preferred Stock (P/S) with $90 par value and a 10% dividend. The stock sold for $110 at the time of issue and is currently selling for $115. What is their IRR for Nova's P/S ? a.12.0%b.9.1%c.10.0%d.11.1%c.7.8% 15. Assume that Matterhorn, Inc. has just paid a dividend of \$2. If the expected growth rate is 10%, and if investors require a 15% rate of return, what is a share of this stock worth? a. 549 b. 938 c. $44 d. $46 e. some other value 16. An investing adage says that, "In investing, one must choose either to a. fish or cut bait b. plan your work or work your plan c. get busy living or get busy dying d. eat well or sleep well