Question

7. As part of a larger plan to sell off underperforming assets, LGI is considering selling the Bowie property and using other existing facilities

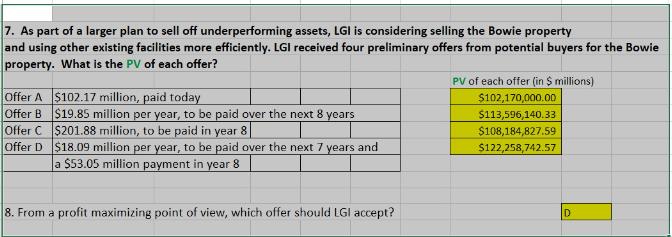

7. As part of a larger plan to sell off underperforming assets, LGI is considering selling the Bowie property and using other existing facilities more efficiently. LGI received four preliminary offers from potential buyers for the Bowie property. What is the PV of each offer? Offer A $102.17 million, paid today Offer B $19.85 million per year, to be paid over the next 8 years Offer C $201.88 million, to be paid in year 8 Offer D $18.09 million per year, to be paid over the next 7 years and a $53.05 million payment in year 8 PV of each offer (in $ millions) $102,170,000.00 $113,596,140.33 $108,184,827.59 $122,258,742.57 8. From a profit maximizing point of view, which offer should LGI accept? D

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Organizational Behavior

Authors: OpenStax

1st Edition

1593998775, 978-1593998776

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App