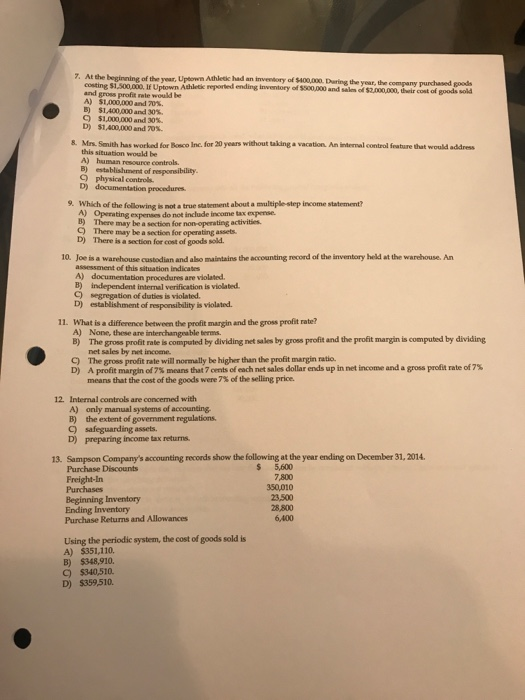

7. At the beginning of the year, Upown Athletic had a an inventory of $400,000. Daring the year, the company purchased goods costing $1,500,000. If Uptown Ahletik reported ending inventory of $500,000 and sae and gross profit rale would be A) $1,000,000 and 70% B) SIA 0,000 and 30%. C) $1,000,000 and 30%. D) $1.400,000 and 70%. of $2.000,000, hwir cost of goods sold &. Mrs. Smith has worked for Bosco Inc. for 20 years without taking a vacation An internal control feature that would address this situation would be A) human resource controls. B) establishment of responsibility- C) physical controls. D) documentation procedures 9. Which of the folowing is not a true statement about a multiple step income statement? A) Operating expenses do not inchude income tax expense B) There may be a section for non-operating activities. Q) There may be a section for operating assets D) There is a section for cost of goods sold. 10. Joe is a warehouse custodian and also maintains the accounting record of the inventory held at the warehouse. An assessment of this stuation indicates A) documentation procedures are violated. B) independent intermal verification is violated C) segregation of duties is violated. D) establishment of responsibility is violated. What is a difference between the profit margin and the gross profit rate? A) 11. None, these are interchangeable terms. The gross profit rate is computed by dividing net sales by gross profit and the profit margin is computed by dividing net sales by net income. The gross profit rate will normally be higher than the profit margin ratio. Aprofit margin of 7% means that 7 cents of each net sales dollar ends up in net income and means that the cost of the goods were 7% of the selling price. b) C) D) gross profit rate of 7% 12. Internal controls are concerned with A) only manual systems of accounting. B) the extent of govermment regulations C) safeguarding assets. D) preparing income tax returns. 13. Sampson Company's accounting records show the following at the year ending on December 31, 2014 $ 5,600 7,800 350,010 23,500 28,800 6,400 Purchase Discounts Freight-In Beginning Inventory Ending Inventory Purchase Returns and Allowances Using the periodic system, the cost of goods sold is A) $351,110. B) $348,910 $340,510. D) $359,510