Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7 . Baker Company had the following balances in its accounting records as of December 3 1 , 2 0 2 0 :Assets Liabilities and

Baker Company had the following balances in its accounting records as of December :Assets Liabilities and Equity Cash $ Accounts Payable Accounts Receivable Inventory Common Stock Land Retained Earnings Total Total The following accounting events apply to Barker Companys fiscal year:May Made cash payment on accounts payable of $June Purchased $ inventory on account.August Sold $ worth of inventory for $ The customer paid $ in cash.Nov. Paid $ owed to the supplier.Dec. Received cash collections from accounts receivable amounting to $Incurred other operating expenses on account during the year that amounted to $Prepare s Income Statement and Balance Sheet for Baker Company.Note: SHOW YOUR WORK, ie the journal entries and the Taccount. Remember to use the proper format and headings for the statementsPrepare s Income Statement and Balance Sheet for Baker Company.Note: SHOW YOUR WORK, ie the journal entries and the Taccount. Remember to usethe proper format and headings for the statements.

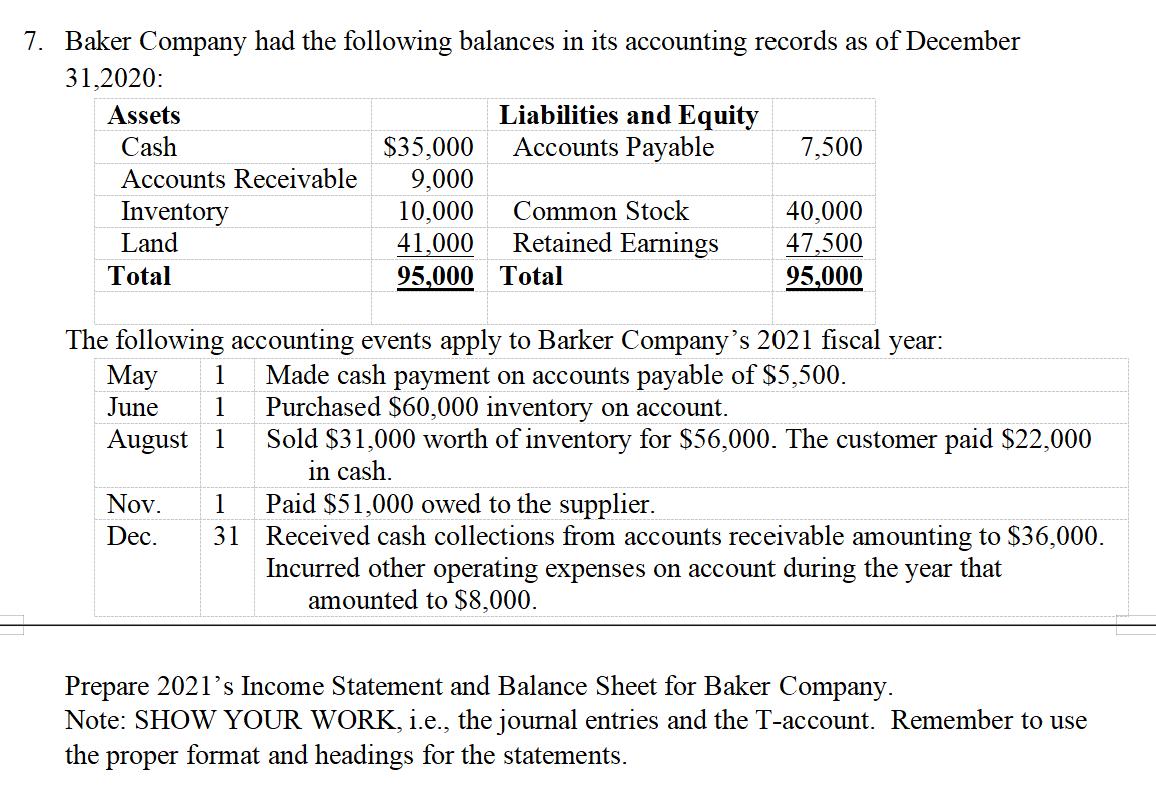

7. Baker Company had the following balances in its accounting records as of December 31,2020: Assets Liabilities and Equity Cash $35,000 Accounts Payable 7,500 Accounts Receivable 9,000 Inventory 10,000 Common Stock 40,000 Land 41,000 Retained Earnings 47,500 Total 95,000 Total 95,000 The following accounting events apply to Barker Company's 2021 fiscal May June 1 1 Made cash payment on accounts payable of $5,500. Purchased $60,000 inventory on account. August 1 Nov. 1 year: Sold $31,000 worth of inventory for $56,000. The customer paid $22,000 in cash. Paid $51,000 owed to the supplier. Dec. 31 Received cash collections from accounts receivable amounting to $36,000. Incurred other operating expenses on account during the year that amounted to $8,000. Prepare 2021's Income Statement and Balance Sheet for Baker Company. Note: SHOW YOUR WORK, i.e., the journal entries and the T-account. Remember to use the proper format and headings for the statements.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To prepare Baker Companys Income Statement and Balance Sheet for the year 2021 we need to record the following transactions 1 May 1 Cash payment on ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started