Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the table below to show what Blue Sky would report on its 2 0 2 1 balance sheet. ( Enter amount in millions as

Complete the table below to show what Blue Sky would report on its balance sheet. Enter amount in millions as provided to you in the problem statement,$XX

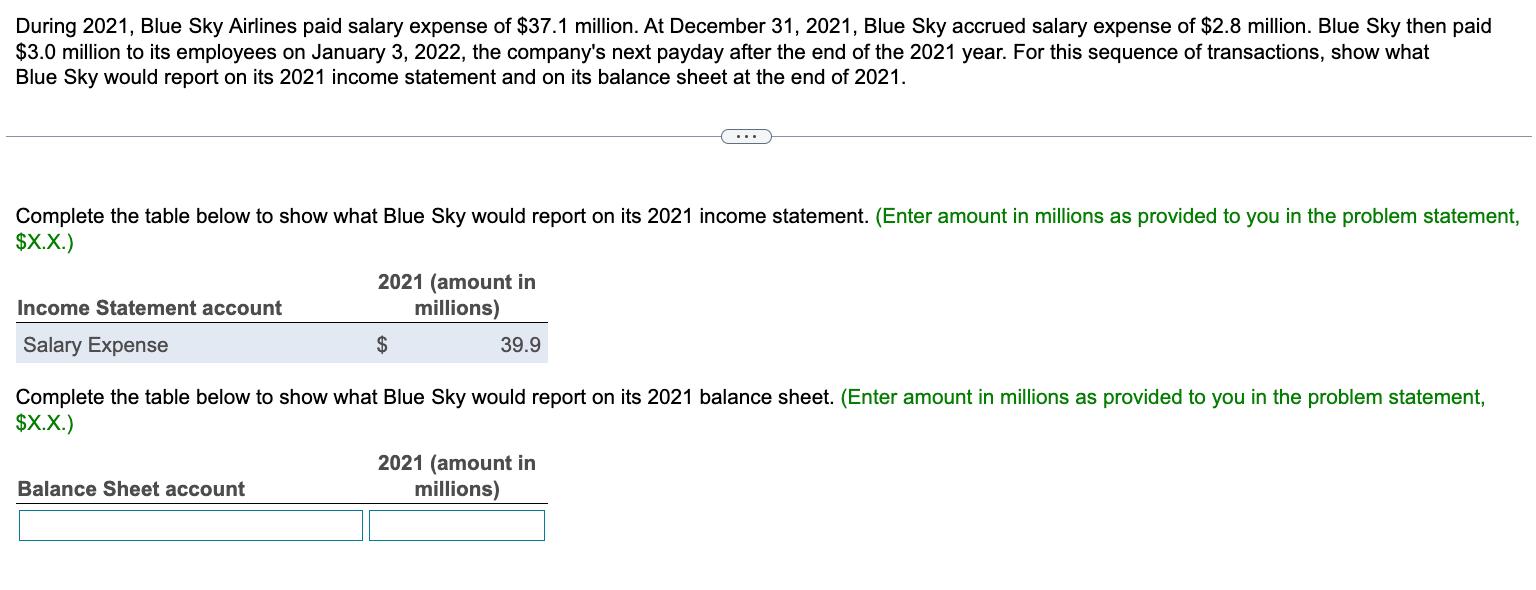

During 2021, Blue Sky Airlines paid salary expense of $37.1 million. At December 31, 2021, Blue Sky accrued salary expense of $2.8 million. Blue Sky then paid $3.0 million to its employees on January 3, 2022, the company's next payday after the end of the 2021 year. For this sequence of transactions, show what Blue Sky would report on its 2021 income statement and on its balance sheet at the end of 2021. Complete the table below to show what Blue Sky would report on its 2021 income statement. (Enter amount in millions as provided to you in the problem statement, $X.X.) Income Statement account Salary Expense 2021 (amount in millions) 39.9 Complete the table below to show what Blue Sky would report on its 2021 balance sheet. (Enter amount in millions as provided to you in the problem statement, $X.X.) Balance Sheet account 2021 (amount in millions)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the tables we need to record the salary expense transactions for Blue Sky Airlines in 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started