Question

Sofia Lofts case, but under a new set of assumptions on page 11 of the case. First re-read the Sofia Lofts case, then click here

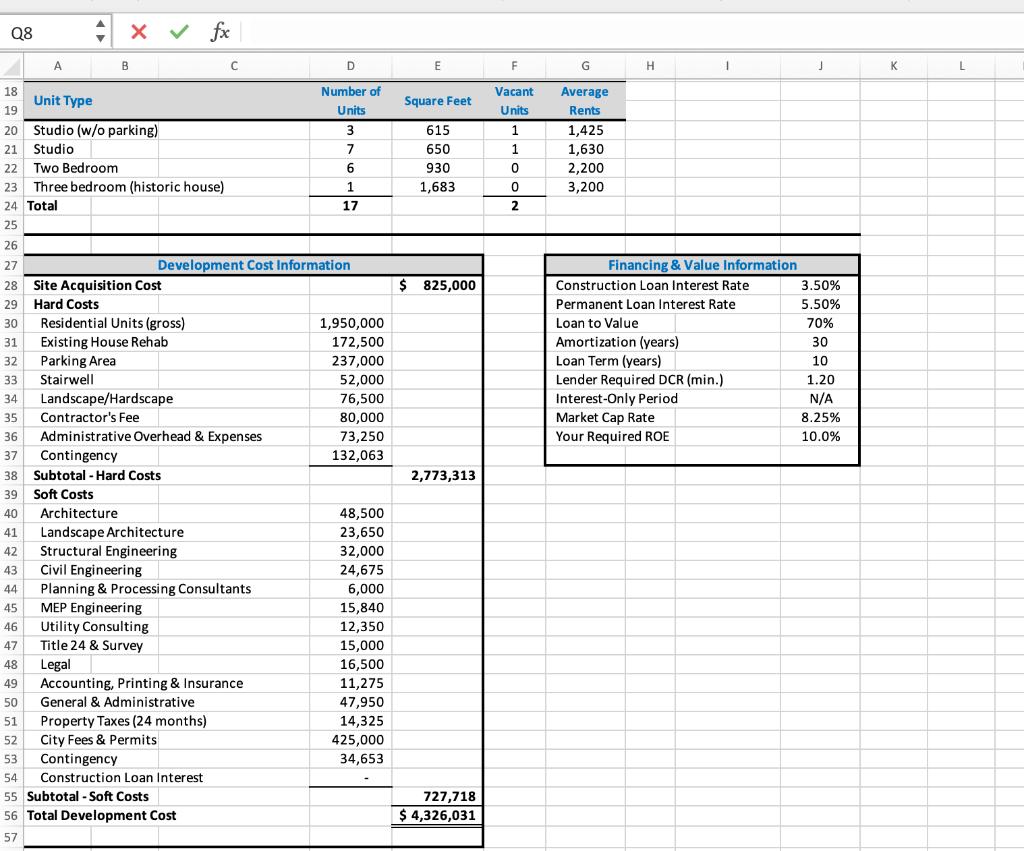

Sofia Lofts case, but under a new set of assumptions on page 11 of the case. First re-read the Sofia Lofts case, then click here to download the new page 11. Specifically, you are to write up a brief analysis of the case with this new page 11, primarily using your Toolkit in the analysis. Assume for Assignment purposes that your boss has asked you to provide an analysis of the proposed Sofia Lofts development. Your boss is considering investing in the deal, and wants your view of the project. Make a recommendation on whether you believe your boss should invest, using the tools below.

In addition to turning in a written analysis, you will also turn in an Excel file demonstrating your answers, formulas, and all work. You will upload and submit your Excel file on the next page.

Tools/items which you are required to use include:

- Market Value Today

- Gain/Loss Since Development (excl. cash flow)

- Return on Assets

- Return on Equity

- Loan Constant

- Development Cost Per Unit

- Most Profitable Unit Style

- Construction Loan Interest

Q8 * x v fx A B D E F G H K L Number of 18 Unit Type 19 Vacant Average Square Feet Units Units Rents 20 Studio (w/o parking) 3 615 1 1,425 21 Studio 7 650 1 1,630 Two Bedroom Three bedroom (historic house) 22 6 930 2,200 23 1 1,683 3,200 24 Total 17 2 25 26 27 Development Cost Information Financing & Value Information 28 Site Acquisition Cost $ 825,000 Construction Loan Interest Rate 3.50% 29 Hard Costs Permanent Loan Interest Rate 5.50% 30 Residential Units (gross) 31 Existing House Rehab 32 Parking Area 1,950,000 Loan to Value 70% 172,500 237,000 52,000 Amortization (years) Loan Term (years) 30 10 33 Stairwell Lender Required DCR (min.) 1.20 34 Landscape/Hardscape 76,500 Interest-Only Period N/A 35 Contractor's Fee 80,000 Market Cap Rate 8.25% 36 Administrative Overhead & Expenses 73,250 Your Required ROE 10.0% 37 Contingency 132,063 38 Subtotal - Hard Costs 2,773,313 39 Soft Costs Architecture 48,500 23,650 32,000 40 41 Landscape Architecture Structural Engineering Civil Engineering 42 43 24,675 Planning & Processing Consultants MEP Engineering Utility Consulting Title 24 & Survey 44 6,000 45 15,840 46 12,350 47 15,000 16,500 Legal Accounting, Printing & Insurance 48 11,275 47,950 49 50 General & Administrative Property Taxes (24 months) City Fees & Permits Contingency 51 14,325 52 425,000 53 34,653 54 Construction Loan Interest 55 Subtotal - Soft Costs 727,718 56 Total Development Cost $ 4,326,031 57

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

C Return on Assets The term return on assets refers to a financial ratio that indicates how profitab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started