Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7) Beth Johnson was recently appointed Vice President of Administration in the Sigma Group, a nationwide personal financial planning services firm. Ann Garber, department

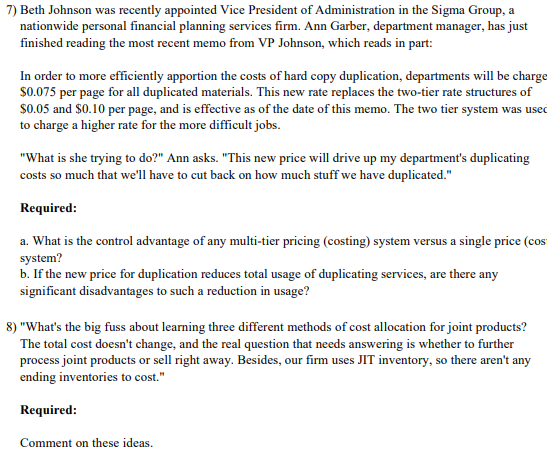

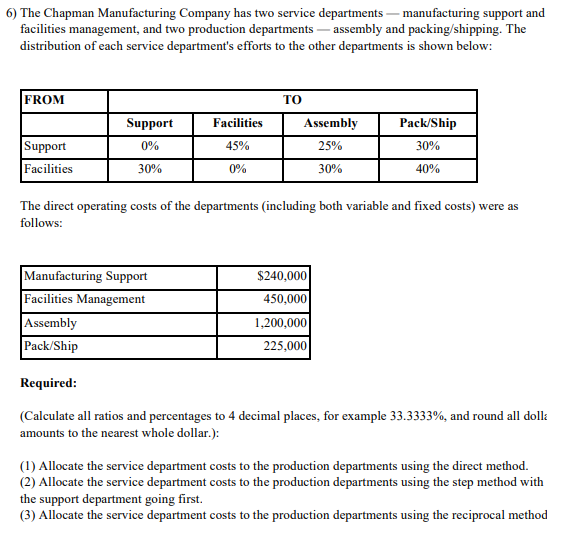

7) Beth Johnson was recently appointed Vice President of Administration in the Sigma Group, a nationwide personal financial planning services firm. Ann Garber, department manager, has just finished reading the most recent memo from VP Johnson, which reads in part: In order to more efficiently apportion the costs of hard copy duplication, departments will be charge $0.075 per page for all duplicated materials. This new rate replaces the two-tier rate structures of $0.05 and $0.10 per page, and is effective as of the date of this memo. The two tier system was used to charge a higher rate for the more difficult jobs. "What is she trying to do?" Ann asks. "This new price will drive up my department's duplicating costs so much that we'll have to cut back on how much stuff we have duplicated." Required: a. What is the control advantage of any multi-tier pricing (costing) system versus a single price (cos system? b. If the new price for duplication reduces total usage of duplicating services, are there any significant disadvantages to such a reduction in usage? 8) "What's the big fuss about learning three different methods of cost allocation for joint products? The total cost doesn't change, and the real question that needs answering is whether to further process joint products or sell right away. Besides, our firm uses JIT inventory, so there aren't any ending inventories to cost." Required: Comment on these ideas. 6) The Chapman Manufacturing Company has two service departments-manufacturing support and facilities management, and two production departments-assembly and packing/shipping. The distribution of each service department's efforts to the other departments is shown below: FROM TO Support Facilities Assembly Pack/Ship Support Facilities 0% 45% 25% 30% 30% 0% 30% 40% The direct operating costs of the departments (including both variable and fixed costs) were as follows: Manufacturing Support Facilities Management Assembly Pack/Ship Required: $240,000 450,000 1,200,000 225,000 (Calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dolla amounts to the nearest whole dollar.): (1) Allocate the service department costs to the production departments using the direct method. (2) Allocate the service department costs to the production departments using the step method with the support department going first. (3) Allocate the service department costs to the production departments using the reciprocal method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started