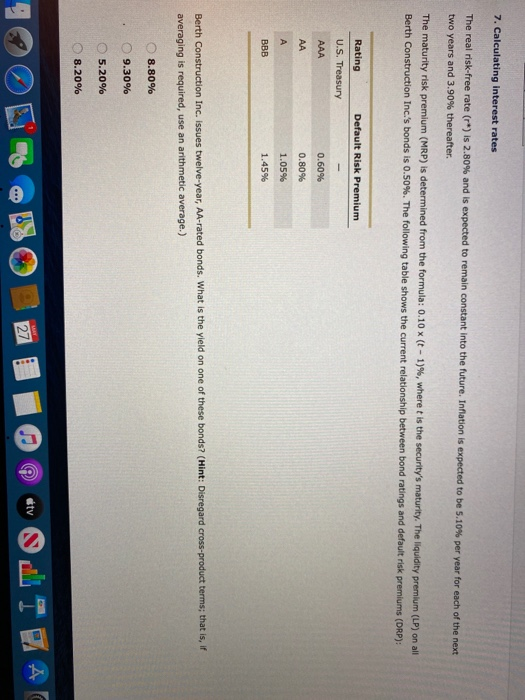

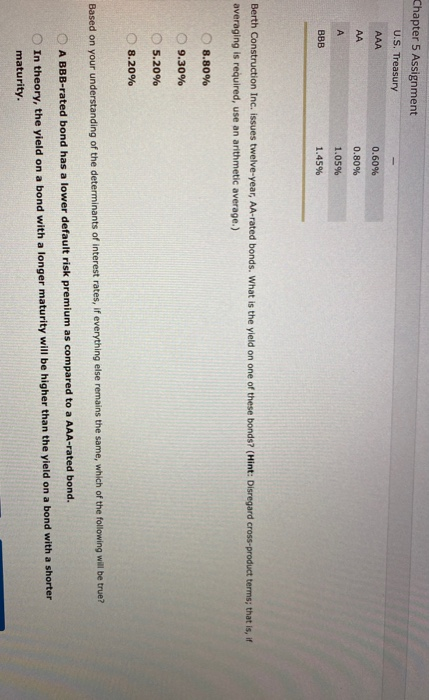

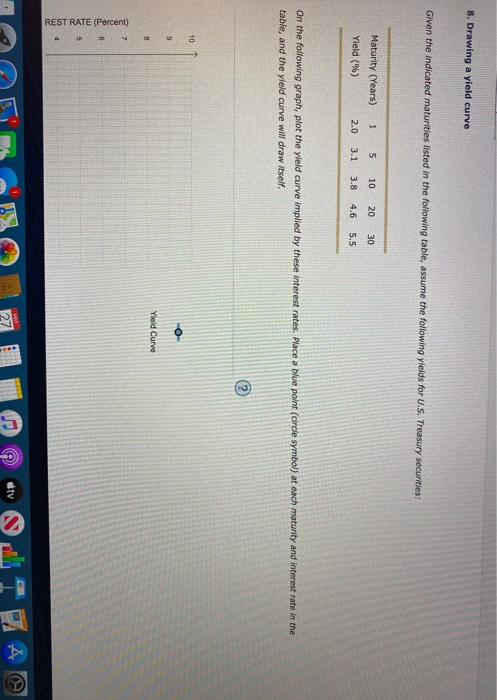

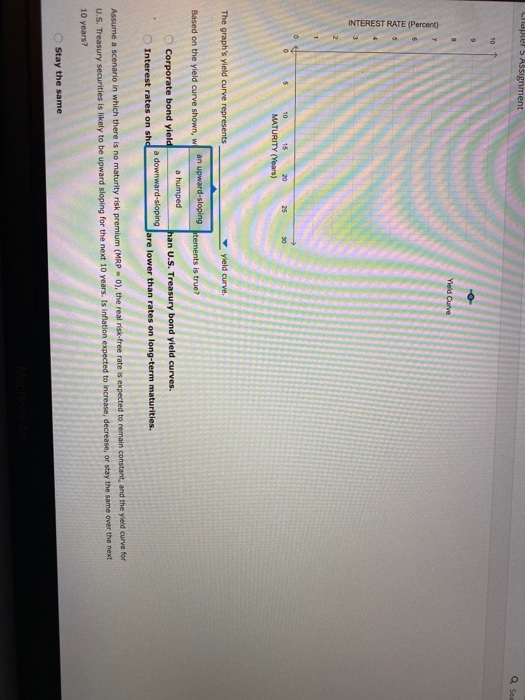

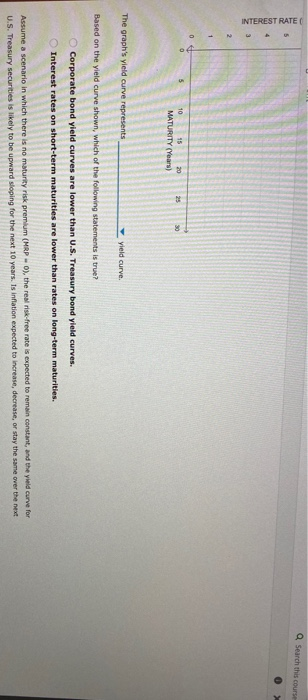

7. Calculating Interest rates The real risk-free rate (r) is 2.80% and is expected to remain constant into the future. Inflation is expected to be 5.10% per year for each of the next two years and 3.90% thereafter. The maturity risk premium (MRP) is determined from the formula: 0.10 x (t-1)%, where t is the security's maturity. The liquidity premium (LP) on all Berth Construction Inc.'s bonds is 0.50%. The following table shows the current relationship between bond ratings and default risk premiums (DRP): Default Risk Premium Rating U.S. Treasury AAA 0.60% 0.80% 1.05% BBB 1.45% Berth Construction Inc. issues twelve-year, AA-rated bonds. What is the yield on one of these bonds? (Hint: Disregard cross-product terms; that is, if averaging is required, use an arithmetic average.) 8.80% 9.30% 5.20% 8.20% . 27 etv s Chapter 5 Assignment U.S. Treasury AAA 0.60% 0.80% 1.05% 1.45% Berth Construction Inc. issues twelve-year, AA-rated bonds. What is the yield on one of these bonds? (Hint: Disregard cross-product terms; that is, if averaging is required, use an arithmetic average.) 8.80% 9.30% 5.20% 8.20% Based on your understanding of the determinants of interest rates, if everything else remains the same, which of the following will be true? A BBB-rated bond has a lower default risk premium as compared to a AAA-rated bond. In theory, the yield on a bond with a longer maturity will be higher than the yield on a bond with a shorter maturity. 8. Drawing a yield curve Given the indicated maturities listed in the following table, assume the following yields for U.S. Treasury securities: 1 5 10 20 30 Maturity (Years) Yield (%) 2.0 3.1 3.8 4.6 5.5 On the following graph, plot the yield curve implied by these interest rates. Place a blue point (circle symbol) at each maturity and interest rate in the table, and the yield curve will draw itself. 10 9 void curve Yield Curve 8 REST RATE (Percent) c ty di Cildpter 5 Assignment Se 50 Yield Curve INTEREST RATE (Percent) 15 20 10 MATURITY (Years) The graph's yield curve represents yield curve Based on the yield curve shown, w an upward-sloping tements is true? a humped Corporate bond yield han U.S. Treasury bond yield curves. a downward-sloping Interest rates on shd are lower than rates on long-term maturities. Assume a scenario in which there is no maturity risk premium (MRP - 0), the real risk-free rate is expected to remain constant, and the yield curve for U.S. Treasury securities is likely to be upward sloping for the next 10 years. Is Inflation expected to increase, decrease, or stay the same over the next 10 years? Stay the same Such this course INTEREST RATE 5 25 10 15 20 MATURITY (Years) 30 The graph's yield curve represents yield curve Based on the yield curve shown, which of the following statements is true? Corporate bond yield curves are lower than U.S. Treasury bond yield curves. Interest rates on short-term maturities are lower than rates on long-term maturities. Assume a scenario in which there is no maturity risk premium (MRP - ), the real risk-free rate is expected to remain constant, and the yield curve for U.S. Treasury securities is likely to be upward sloping for the next 10 years. Is inflation expected to increase, decrease, or stay the same over the next