Question

7. Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as

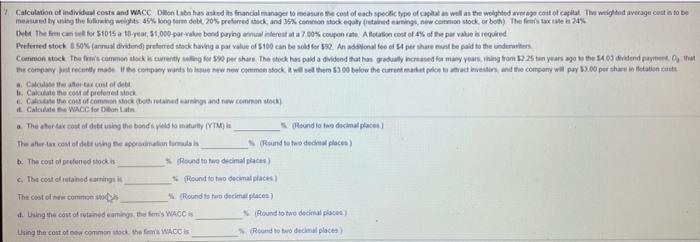

7. Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 45% long-term debt, 20% preferred stock, and 35% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 24%. Debt The firm can sell for $1015 a 18-year, $1,000-par-value bond paying annual interest at a 7.00% coupon rate. A flotation cost of 4% of the par value is required.

Preferred stock 8.50% (annual dividend) preferred stock having a par value of $100 can be sold for $92. An additional fee of $4 per

share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.25 ten years ago to the $4.03 dividend payment, D0 , that the company just recently made. If the company wants to issue new new common stock, it will sell them $3.00 below the current market price to attract investors, and the company will pay $3.00 per share in flotation costs. a. Calculate the after-tax cost of debt. b. Calculate the cost of preferred stock. c. Calculate the cost of common stock (both retained earnings and new common stock). d. Calculate the WACC for Dillon Labs. a. The after-tax cost of debt using the bond's yield to maturity (YTM) is %. (Round to two decimal places.)

The after-tax cost of debt using the approximation formula is %. (Round to two decimal places.)

b. The cost of preferred stock is %. (Round to two decimal places.)

c. The cost of retained earnings is %. (Round to two decimal places.)

The cost of new common stock is %. (Round to two decimal places.)

d. Using the cost of retained earnings, the firm's WACC is %. (Round to two decimal places.)

Using the cost of new common stock, the firm's WACC is %. (Round to two decimal places.)

Calculation of individual costs and WACC Don Labe has asked its francial manage to the cost of each specific type of capital as well as the weighted werage cost of capital The weighted average cost is to be measured by using the following weights 49% long term debt. 20% preferred shock, and 39% coton sockey dating now.com stock, or both. The festa e 21% Debt The imao 51015 a 16-year 51.000 parte band paying an interest at a 700% coipon ate. A fotion cost of 4% of the per value is required Preferred stock arus dividend preferred to having a par value of 5100 can be sold for 92. Andional fee of pershere be paid to the unders Common stock The common stock is coming for peshare. The stock has paid a dividend that his gradually increased for many years thing from stanyers ago to the S403 didend pay that To company and recently made the company wants to be new how common stock well them $300 below the current andet end etors and the company will pay $3.00 per she station code theater ex cost of all I. Calculate the com o preferred stock Cho com of common stock (both retained and now.common stock Cale WACC foton & The store cost of ditt using the bonds to maturity) Round for two decimal place The sur la cost of debt sing the comis Rund to ho decimal places) The cost of preferred stockis Round to two decimale) The cost of retained angi Roonid to two decimal places The cost of com Roundt two decimal place) 4. Using the cost of and caring the WACCS Round to two decimal place) Using the cost of common stock the WACCI Roond tot decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started