Question

7. Call options on a stock are available with strike prices K = $15, K, = $17.5 and K3 = $20 and are selling

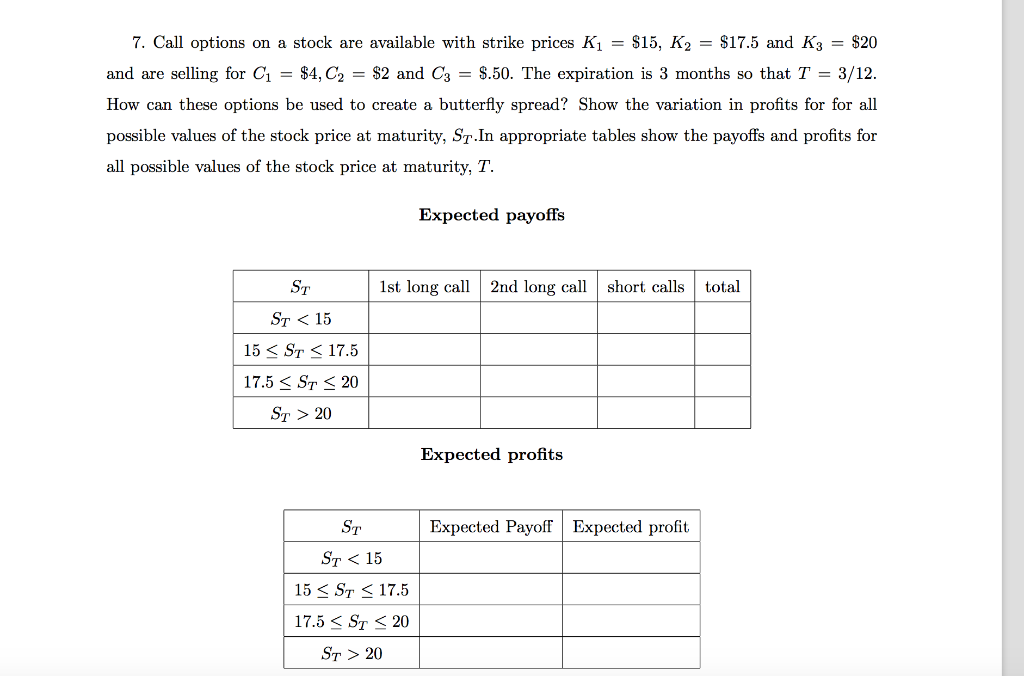

7. Call options on a stock are available with strike prices K = $15, K, = $17.5 and K3 = $20 and are selling for C = $4, C2 = $2 and C3 = $.50. The expiration is 3 months so that T = 3/12. How can these options be used to create a butterfly spread? Show the variation in profits for for all possible values of the stock price at maturity, ST.In appropriate tables show the payoffs and profits for all possible values of the stock price at maturity, T. Expected payoffs ST 1st long call 2nd long call short calls total ST < 15 15 < Sr < 17.5 17.5 < ST < 20 ST > 20 Expected profits ST Expected Payoff Expected profit ST < 15 15 < ST < 17.5 17.5 < ST < 20 ST > 20

Step by Step Solution

3.28 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Butterfly spread Butterfly spread can be created by buying a call option at low exercise pric...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Futures and Options Markets

Authors: John C. Hull

8th edition

978-1292155036, 1292155035, 132993341, 978-0132993340

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App