Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7. Carl, the owner of the Flagship Supper Club needs to produce and analyze this month's income statement. Using the following information, help Carl prepare

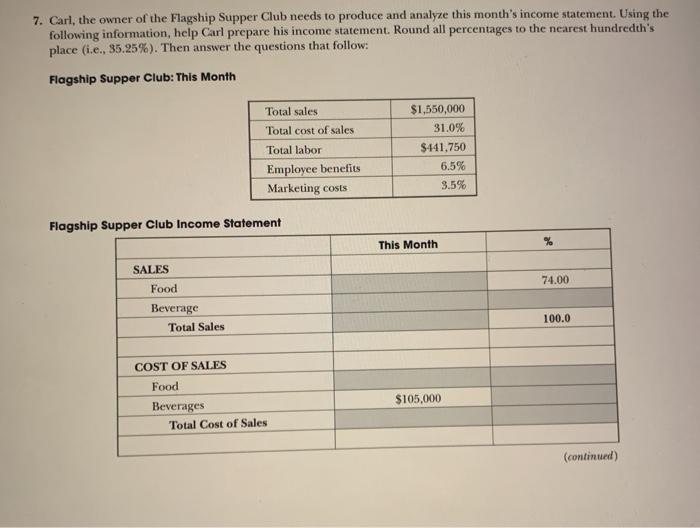

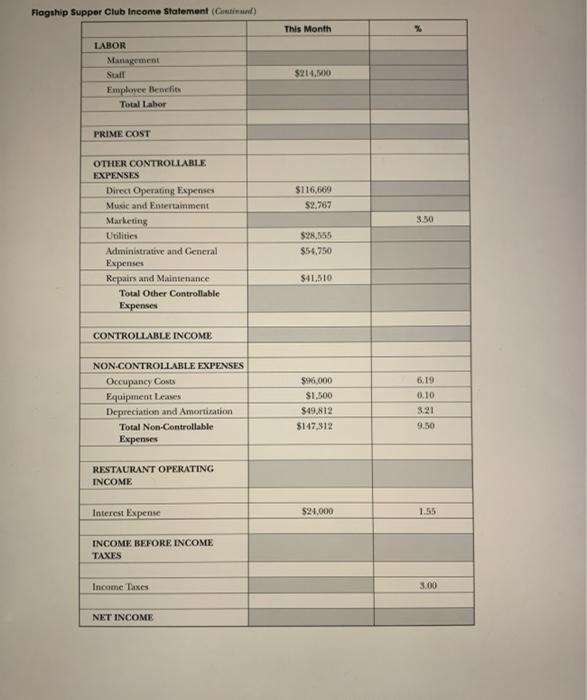

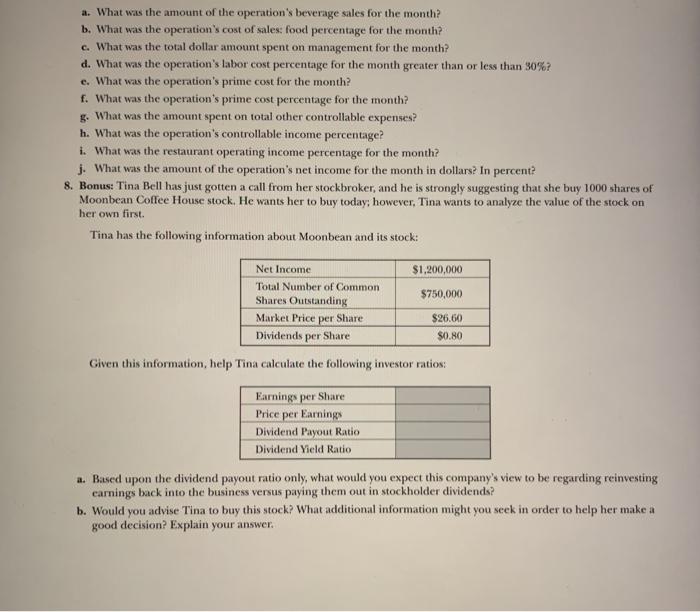

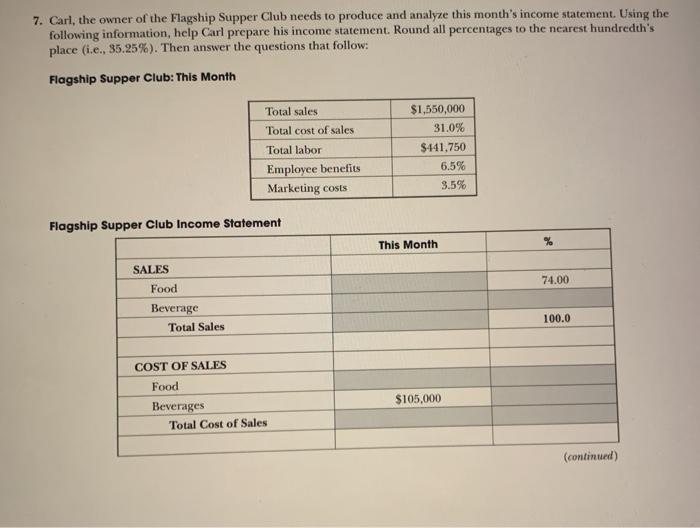

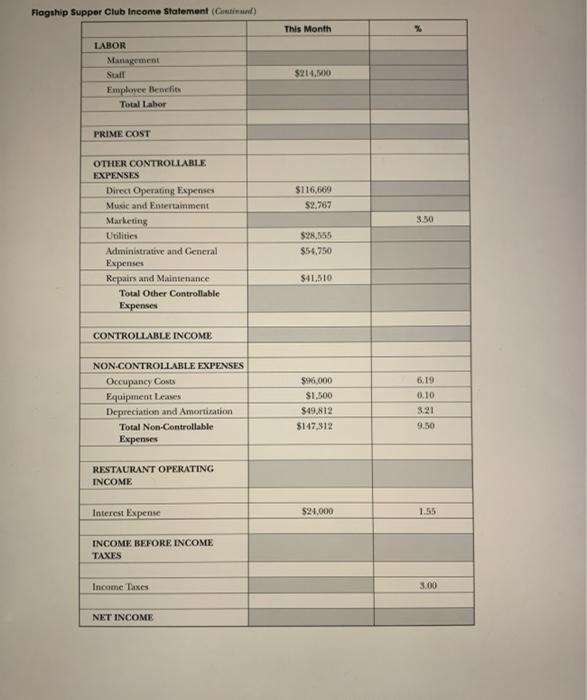

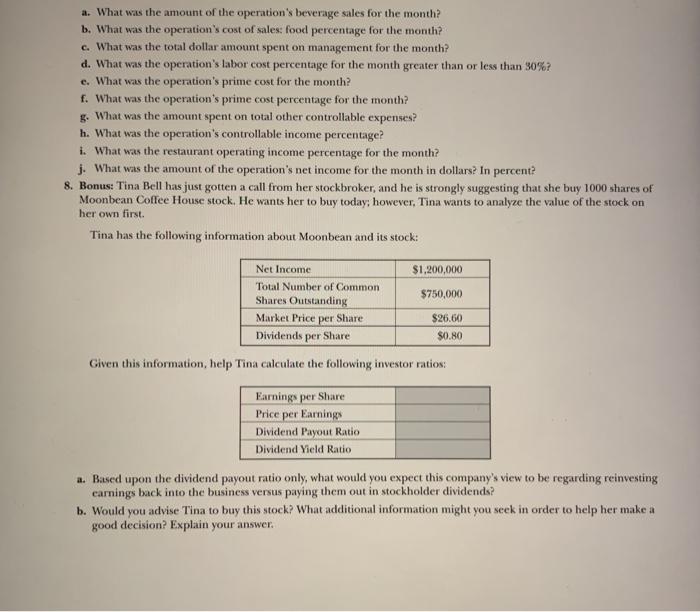

7. Carl, the owner of the Flagship Supper Club needs to produce and analyze this month's income statement. Using the following information, help Carl prepare his income statement. Round all percentages to the nearest hundredth's place (i.e., 35.25%). Then answer the questions that follow: Flagship Supper Club: This Month Total sales Total cost of sales Total labor Employee benefits Marketing costs $1,550,000 31.0% $441,750 6.5% 3.5% Flagship Supper Club Income Statement This Month 74.00 SALES Food Beverage Total Sales 100.0 COST OF SALES Food Beverages Total Cost of Sales $105,000 (continued) Flagship Supper Club Income Statement (Cat) This Month LABOR Management Stall Emplovee Benefies Total Labor $214.60 PRIME COST OTHER CONTROLLABLE EXPENSES $116,669 $2,767 3.50 Direct Operating Expenses Music and Entertainment Marketing Utilities Administrative and General Expenses Repairs and Maintenance Total Other Controllable Expenses $28,155 $54,750 $41.510 CONTROLLABLE INCOME 6.19 0.10 NON CONTROLLABLE EXPENSES Occupancy Costs Equipment Leases Depreciation and Amortization Total Non-Controllable Expenses $16.000 $1,500 $19.812 $147,312 9.50 RESTAURANT OPERATING INCOME Interest Expense $24,000 1.55 INCOME BEFORE INCOME TAXES Income Taxes 3.00 NET INCOME a. What was the amount of the operation's beverage sales for the month? b. What was the operation's cost of sales: food percentage for the month? c. What was the total dollar amount spent on management for the month? d. What was the operation's labor cost percentage for the month greater than or less than 30%? e. What was the operation's prime cost for the month? f. What was the operation's prime cost percentage for the month? g. What was the amount spent on total other controllable expenses? h. What was the operation's controllable income percentage? i. What was the restaurant operating income percentage for the month? j. What was the amount of the operation's net income for the month in dollars? In percent? 8. Bonus: Tina Bell has just gotten a call from her stockbroker, and he is strongly suggesting that she buy 1000 shares of Moonbean Coffee House stock. He wants her to buy today, however, Tina wants to analyze the value of the stock on her own first. Tina has the following information about Moonbean and its stock: $1,200,000 $750,000 Net Income Total Number of Common Shares Outstanding Market Price per Share Dividends per Share $26.60 $0.80 Given this information, help Tina calculate the following investor ratios: Earnings per Share Price per Earnings Dividend Payout Ratio Dividend Yield Ratio a. Based upon the dividend payout ratio only, what would you expect this company's view to be regarding reinvesting carnings back into the business versus paying them out in stockholder dividends? b. Would you advise Tina to buy this stock? What additional information might you seek in order to help her make a good decision? Explain your

7. Carl, the owner of the Flagship Supper Club needs to produce and analyze this month's income statement. Using the following information, help Carl prepare his income statement. Round all percentages to the nearest hundredth's place (i.e., 35.25%). Then answer the questions that follow: Flagship Supper Club: This Month Total sales Total cost of sales Total labor Employee benefits Marketing costs $1,550,000 31.0% $441,750 6.5% 3.5% Flagship Supper Club Income Statement This Month 74.00 SALES Food Beverage Total Sales 100.0 COST OF SALES Food Beverages Total Cost of Sales $105,000 (continued) Flagship Supper Club Income Statement (Cat) This Month LABOR Management Stall Emplovee Benefies Total Labor $214.60 PRIME COST OTHER CONTROLLABLE EXPENSES $116,669 $2,767 3.50 Direct Operating Expenses Music and Entertainment Marketing Utilities Administrative and General Expenses Repairs and Maintenance Total Other Controllable Expenses $28,155 $54,750 $41.510 CONTROLLABLE INCOME 6.19 0.10 NON CONTROLLABLE EXPENSES Occupancy Costs Equipment Leases Depreciation and Amortization Total Non-Controllable Expenses $16.000 $1,500 $19.812 $147,312 9.50 RESTAURANT OPERATING INCOME Interest Expense $24,000 1.55 INCOME BEFORE INCOME TAXES Income Taxes 3.00 NET INCOME a. What was the amount of the operation's beverage sales for the month? b. What was the operation's cost of sales: food percentage for the month? c. What was the total dollar amount spent on management for the month? d. What was the operation's labor cost percentage for the month greater than or less than 30%? e. What was the operation's prime cost for the month? f. What was the operation's prime cost percentage for the month? g. What was the amount spent on total other controllable expenses? h. What was the operation's controllable income percentage? i. What was the restaurant operating income percentage for the month? j. What was the amount of the operation's net income for the month in dollars? In percent? 8. Bonus: Tina Bell has just gotten a call from her stockbroker, and he is strongly suggesting that she buy 1000 shares of Moonbean Coffee House stock. He wants her to buy today, however, Tina wants to analyze the value of the stock on her own first. Tina has the following information about Moonbean and its stock: $1,200,000 $750,000 Net Income Total Number of Common Shares Outstanding Market Price per Share Dividends per Share $26.60 $0.80 Given this information, help Tina calculate the following investor ratios: Earnings per Share Price per Earnings Dividend Payout Ratio Dividend Yield Ratio a. Based upon the dividend payout ratio only, what would you expect this company's view to be regarding reinvesting carnings back into the business versus paying them out in stockholder dividends? b. Would you advise Tina to buy this stock? What additional information might you seek in order to help her make a good decision? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started