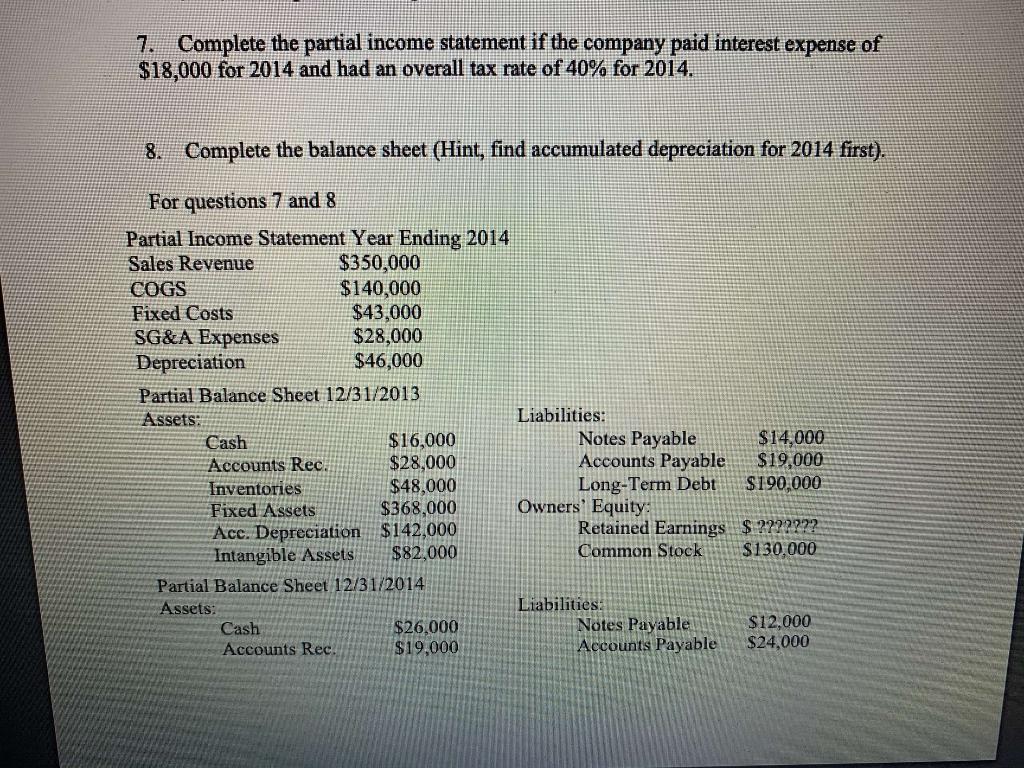

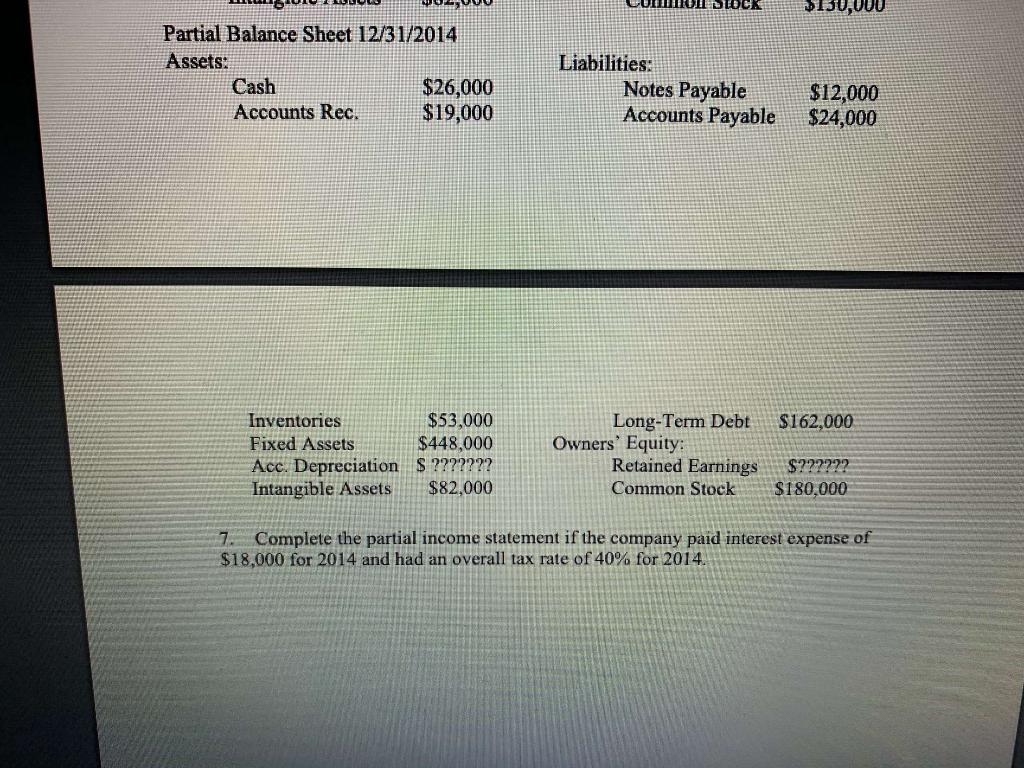

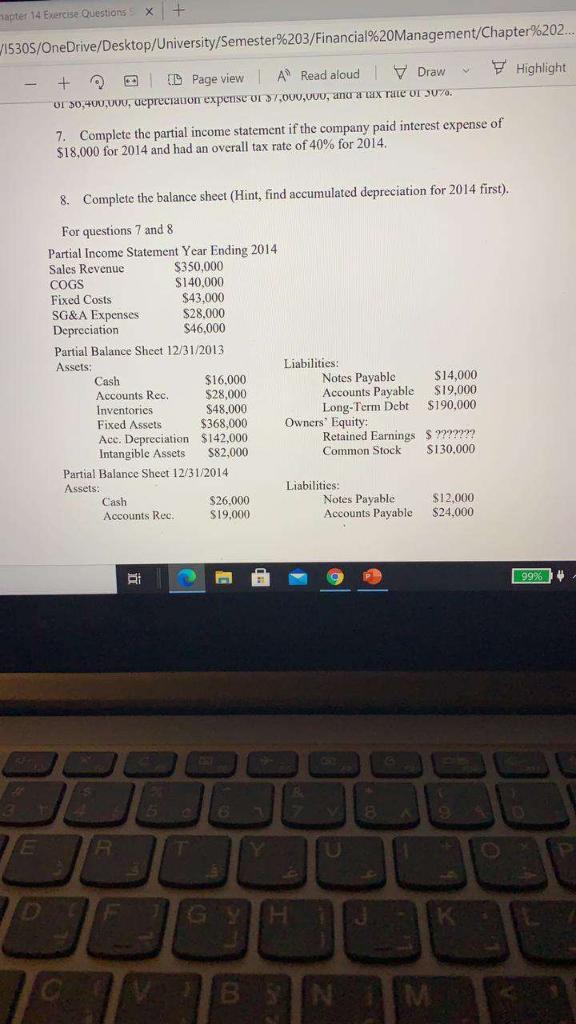

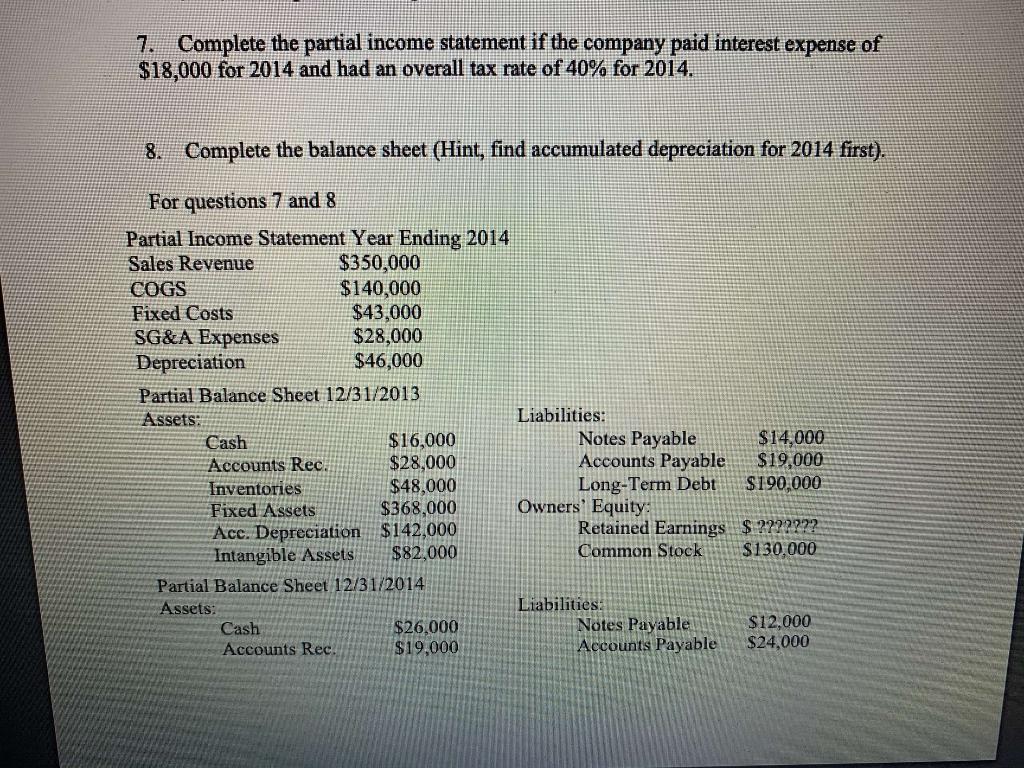

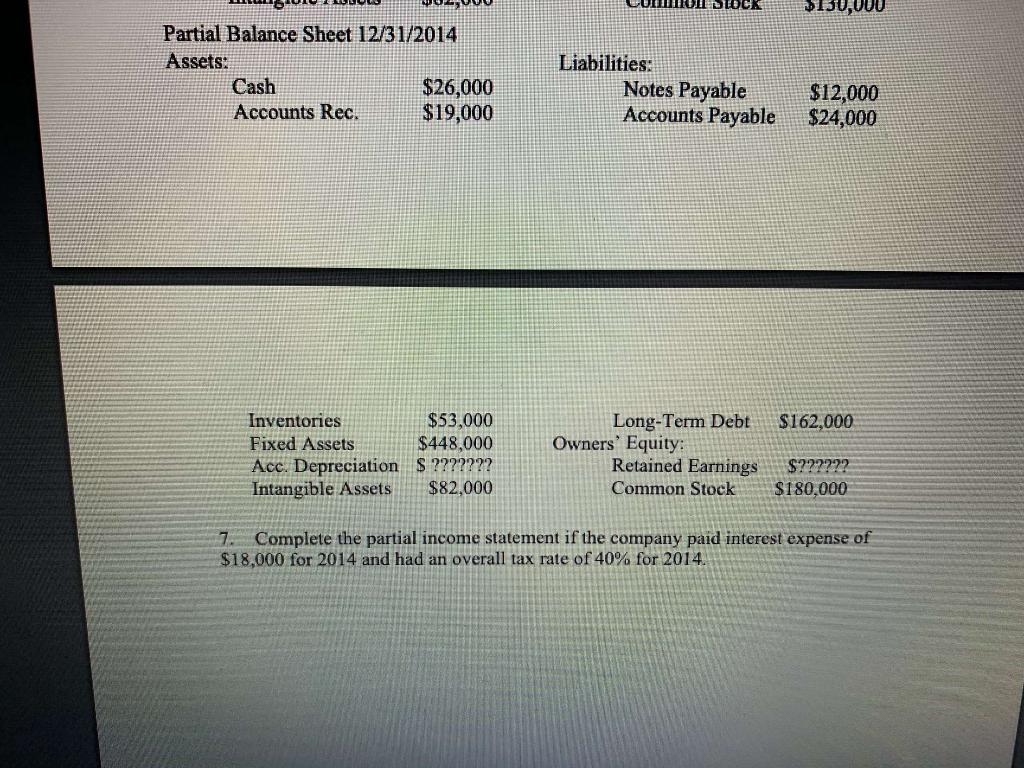

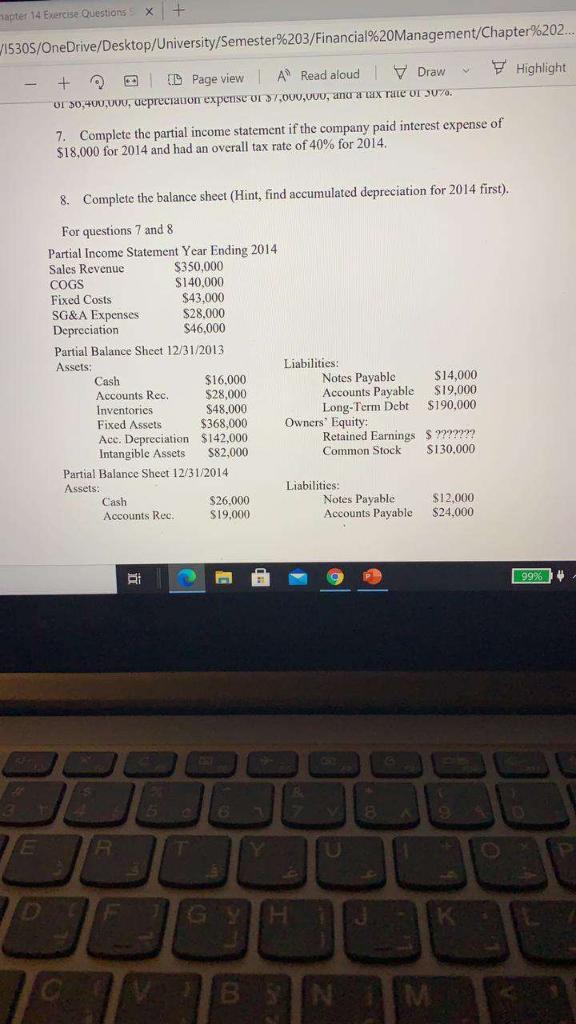

7. Complete the partial income statement if the company paid interest expense of $18,000 for 2014 and had an overall tax rate of 40% for 2014. 8. Complete the balance sheet (Hint, find accumulated depreciation for 2014 first). For questions 7 and 8 Partial Income Statement Year Ending 2014 Sales Revenue $350,000 COGS $140,000 Fixed Costs $43,000 SG&A Expenses $28,000 Depreciation $46,000 Partial Balance Sheet 12/31/2013 Assets: Liabilities: Cash $16,000 Notes Payable $14,000 Accounts Rec $28,000 Accounts Payable $19,000 Inventories $48.000 Long-Term Debt $190,000 Fixed Assets $368,000 Owners' Equity Acc. Depreciation $142.000 Retained Earnings $ ??????? Intangible Assets $82,000 Common Stock $130,000 Partial Balance Sheet 12/31/2014 Assets: Liabilities: Cash $26.000 Notes Payable $12.000 Accounts Rec. $19.000 Accounts Payable $24,000 IJU,000 Partial Balance Sheet 12/31/2014 Assets: Cash $26,000 Accounts Rec. $19,000 Liabilities: Notes Payable Accounts Payable $12,000 $24,000 $162,000 Inventories $53,000 Fixed Assets $448,000 Ace. Depreciation S ??????? Intangible Assets $82,000 Long-Term Debt Owners' Equity: Retained Earnings Common Stock $??2222 $180,000 7. Complete the partial income statement if the company paid interest expense of $18,000 for 2014 and had an overall tax rate of 40% for 2014. apter 14 Exercise Questions X 1530S/OneDrive/Desktop/University/Semester%203/Financial%20Management/Chapter%202.. Highlight + D Page view | A Read aloud | Draw Or 30,400,000, depreciation expense or 37,000,000, andra X TULE OF JU%. 7. Complete the partial income statement if the company paid interest expense of $18,000 for 2014 and had an overall tax rate of 40% for 2014 8. Complete the balance sheet (Hint, find accumulated depreciation for 2014 first). For questions 7 and 8 Partial Income Statement Year Ending 2014 Sales Revenue $350,000 COGS $140,000 Fixed Costs $43,000 SG&A Expenses $28,000 Depreciation $46,000 Partial Balance Sheet 12/31/2013 Assets: Liabilities: Cash $16,000 Notes Payable $14,000 Accounts Rec. $28,000 Accounts Payable $19.000 Inventories $48.000 Long-Term Debt $190,000 Fixed Assets $368,000 Owners' Equity: Acc. Depreciation $142,000 Retained Earnings $??????? Intangible Assets $82,000 Common Stock S130,000 Partial Balance Sheet 12/31/2014 Assets. Liabilities: Cash $26.000 Notes Payable $12.000 Accounts Rec $19,000 Accounts Payable $24.000 Bi 99% E K M 7. Complete the partial income statement if the company paid interest expense of $18,000 for 2014 and had an overall tax rate of 40% for 2014. 8. Complete the balance sheet (Hint, find accumulated depreciation for 2014 first). For questions 7 and 8 Partial Income Statement Year Ending 2014 Sales Revenue $350,000 COGS $140,000 Fixed Costs $43,000 SG&A Expenses $28,000 Depreciation $46,000 Partial Balance Sheet 12/31/2013 Assets: Liabilities: Cash $16,000 Notes Payable $14,000 Accounts Rec $28,000 Accounts Payable $19,000 Inventories $48.000 Long-Term Debt $190,000 Fixed Assets $368,000 Owners' Equity Acc. Depreciation $142.000 Retained Earnings $ ??????? Intangible Assets $82,000 Common Stock $130,000 Partial Balance Sheet 12/31/2014 Assets: Liabilities: Cash $26.000 Notes Payable $12.000 Accounts Rec. $19.000 Accounts Payable $24,000 IJU,000 Partial Balance Sheet 12/31/2014 Assets: Cash $26,000 Accounts Rec. $19,000 Liabilities: Notes Payable Accounts Payable $12,000 $24,000 $162,000 Inventories $53,000 Fixed Assets $448,000 Ace. Depreciation S ??????? Intangible Assets $82,000 Long-Term Debt Owners' Equity: Retained Earnings Common Stock $??2222 $180,000 7. Complete the partial income statement if the company paid interest expense of $18,000 for 2014 and had an overall tax rate of 40% for 2014. apter 14 Exercise Questions X 1530S/OneDrive/Desktop/University/Semester%203/Financial%20Management/Chapter%202.. Highlight + D Page view | A Read aloud | Draw Or 30,400,000, depreciation expense or 37,000,000, andra X TULE OF JU%. 7. Complete the partial income statement if the company paid interest expense of $18,000 for 2014 and had an overall tax rate of 40% for 2014 8. Complete the balance sheet (Hint, find accumulated depreciation for 2014 first). For questions 7 and 8 Partial Income Statement Year Ending 2014 Sales Revenue $350,000 COGS $140,000 Fixed Costs $43,000 SG&A Expenses $28,000 Depreciation $46,000 Partial Balance Sheet 12/31/2013 Assets: Liabilities: Cash $16,000 Notes Payable $14,000 Accounts Rec. $28,000 Accounts Payable $19.000 Inventories $48.000 Long-Term Debt $190,000 Fixed Assets $368,000 Owners' Equity: Acc. Depreciation $142,000 Retained Earnings $??????? Intangible Assets $82,000 Common Stock S130,000 Partial Balance Sheet 12/31/2014 Assets. Liabilities: Cash $26.000 Notes Payable $12.000 Accounts Rec $19,000 Accounts Payable $24.000 Bi 99% E K M