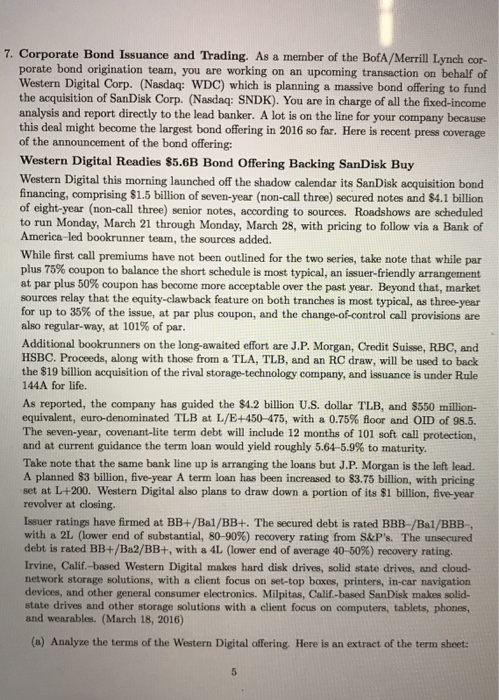

7. Corporate Bond Issuance and Trading. As a member of the BotA/Merrill Lynch cor porate bond origination team, you are working on an upcoming transaction on behalf of Western Digital Corp. (Nasdaq: WDC) which is planning a massive bond offering to fund the acquisition of SanDisk Corp. (Nasdaq: SNDK). You are in charge of all the fixed-income analysis and report directly to the lead banker. A lot is on the line for your company because this deal might become the largest bond offering in 2016 so far. Here is recent press coverage of the announcement of the bond offering: Western Digital Readies 85.6B Bond Offering Backing SanDisk Buy Western Digital this morning launched off the shadow calendar its SanDisk acquisition bond financing, comprising $1.5 billion of seven-year (non-call three) secured notes and $4.1 billion of eight-year (non-call three) senior notes, according to sources. Roadshows are scheduled to run Monday, March 21 through Monday, March 28, with pricing to follow via a Bank of America-led bookrunner team, the sources added. While first call premiums have not been outlined for the two series, take note that while par plus 75% coupon to balance the short schedule is most typical, an issuer-friendly arrangement at par plus 50% coupon has become more acceptable over the past year. Beyond that, market sources relay that the equity-clawback feature on both tranches is most typical, as three-year for up to 35% of the issue, at par plus coupon, and the change-of-control call provisions are also regular-way, at 101% of par Additional bookrunners on the long-awaited effort are J.P. Morgan, Credit Suisse, RBC, and HSBC. Proceeds, along with those from a TLA, TLB, and an RC draw, will be used to back the $19 billion acquisition of the rival storage-technology company, and issuance is under Rule 144A for life. As reported, the company has guided the $4.2 billion U.S. dollar TLB, and $550 million- equivalent, euro-denominated TLB at L/E+450-475, with a 0.75% floor and OID of 98.5. The seven-year, covenant-lite term debt will include 12 months of 101 soft call protection and at current guidance the term loan would yield roughly 564-5.9% to maturity. Take note that the same bank line up is arranging the loans but J.P. Morgan is the left lead. A planned $3 billion, five-year A term loan has been increased to 83.75 billion, with pricing set at L+200. Western Digital also plans to draw down a portion of its 81 billion, five-year revolver at closing. Issuer ratings have firmed at BB+/Bal/BB+. The secured debt is rated BBB-/Bal/BBB- with a 2L (lower end of substantial, 80-90%) recovery rating from S&P's The unsecured debt is rated BB+/Ba2/BB+, with a 4L (lower end of average 40-50%) recovery rating, Irvine, Calif.-based Western Digital makes hard disk drives, solid state drives, and cloud etwork storage solutions, with a client focus on set-top boxes, printers, in-car navigation devices, and other general consumer electronics. Milpitas, Calif.-based SanDisk makes solid- state drives and other storage solutions with a client focus on computers, tablets, phones d wearables. (March 18, 2016 (a) Analyze the terms of the Western Digital offering. Here is an extract of the term sheet 5 7. Corporate Bond Issuance and Trading. As a member of the BotA/Merrill Lynch cor porate bond origination team, you are working on an upcoming transaction on behalf of Western Digital Corp. (Nasdaq: WDC) which is planning a massive bond offering to fund the acquisition of SanDisk Corp. (Nasdaq: SNDK). You are in charge of all the fixed-income analysis and report directly to the lead banker. A lot is on the line for your company because this deal might become the largest bond offering in 2016 so far. Here is recent press coverage of the announcement of the bond offering: Western Digital Readies 85.6B Bond Offering Backing SanDisk Buy Western Digital this morning launched off the shadow calendar its SanDisk acquisition bond financing, comprising $1.5 billion of seven-year (non-call three) secured notes and $4.1 billion of eight-year (non-call three) senior notes, according to sources. Roadshows are scheduled to run Monday, March 21 through Monday, March 28, with pricing to follow via a Bank of America-led bookrunner team, the sources added. While first call premiums have not been outlined for the two series, take note that while par plus 75% coupon to balance the short schedule is most typical, an issuer-friendly arrangement at par plus 50% coupon has become more acceptable over the past year. Beyond that, market sources relay that the equity-clawback feature on both tranches is most typical, as three-year for up to 35% of the issue, at par plus coupon, and the change-of-control call provisions are also regular-way, at 101% of par Additional bookrunners on the long-awaited effort are J.P. Morgan, Credit Suisse, RBC, and HSBC. Proceeds, along with those from a TLA, TLB, and an RC draw, will be used to back the $19 billion acquisition of the rival storage-technology company, and issuance is under Rule 144A for life. As reported, the company has guided the $4.2 billion U.S. dollar TLB, and $550 million- equivalent, euro-denominated TLB at L/E+450-475, with a 0.75% floor and OID of 98.5. The seven-year, covenant-lite term debt will include 12 months of 101 soft call protection and at current guidance the term loan would yield roughly 564-5.9% to maturity. Take note that the same bank line up is arranging the loans but J.P. Morgan is the left lead. A planned $3 billion, five-year A term loan has been increased to 83.75 billion, with pricing set at L+200. Western Digital also plans to draw down a portion of its 81 billion, five-year revolver at closing. Issuer ratings have firmed at BB+/Bal/BB+. The secured debt is rated BBB-/Bal/BBB- with a 2L (lower end of substantial, 80-90%) recovery rating from S&P's The unsecured debt is rated BB+/Ba2/BB+, with a 4L (lower end of average 40-50%) recovery rating, Irvine, Calif.-based Western Digital makes hard disk drives, solid state drives, and cloud etwork storage solutions, with a client focus on set-top boxes, printers, in-car navigation devices, and other general consumer electronics. Milpitas, Calif.-based SanDisk makes solid- state drives and other storage solutions with a client focus on computers, tablets, phones d wearables. (March 18, 2016 (a) Analyze the terms of the Western Digital offering. Here is an extract of the term sheet 5