Answered step by step

Verified Expert Solution

Question

1 Approved Answer

7) Dunder Mifflin Paper Co. expects to have an increase in sales this upcoming year. Therefore, they invest in a new storage facility to hold

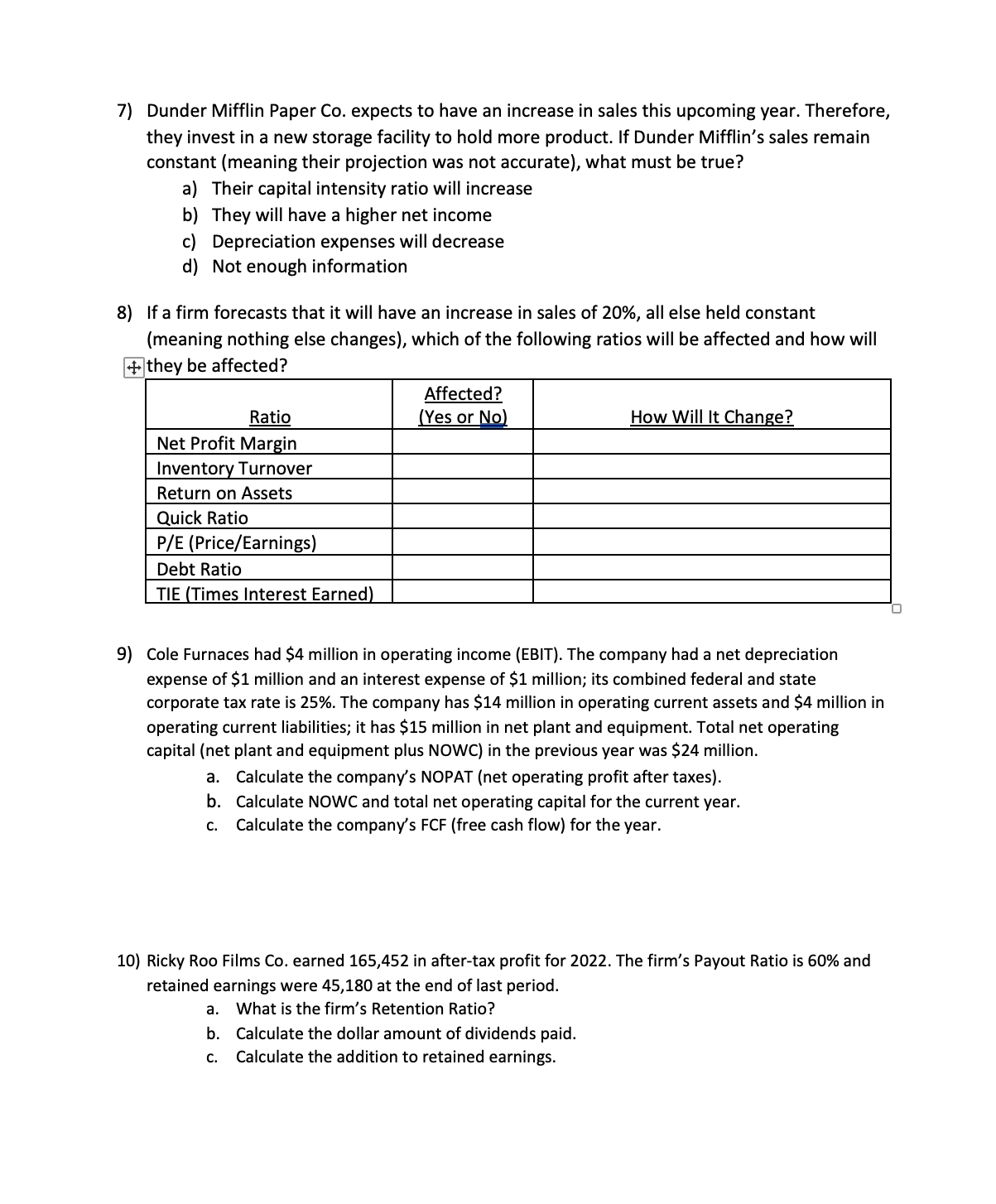

7) Dunder Mifflin Paper Co. expects to have an increase in sales this upcoming year. Therefore, they invest in a new storage facility to hold more product. If Dunder Mifflin's sales remain constant (meaning their projection was not accurate), what must be true? a) Their capital intensity ratio will increase b) They will have a higher net income c) Depreciation expenses will decrease d) Not enough information 8) If a firm forecasts that it will have an increase in sales of 20%, all else held constant (meaning nothing else changes), which of the following ratios will be affected and how will \$they be affected? 9) Cole Furnaces had $4 million in operating income (EBIT). The company had a net depreciation expense of $1 million and an interest expense of $1 million; its combined federal and state corporate tax rate is 25%. The company has $14 million in operating current assets and $4 million in operating current liabilities; it has $15 million in net plant and equipment. Total net operating capital (net plant and equipment plus NOWC) in the previous year was $24 million. a. Calculate the company's NOPAT (net operating profit after taxes). b. Calculate NOWC and total net operating capital for the current year. c. Calculate the company's FCF (free cash flow) for the year. 10) Ricky Roo Films Co. earned 165,452 in after-tax profit for 2022 . The firm's Payout Ratio is 60% and retained earnings were 45,180 at the end of last period. a. What is the firm's Retention Ratio? b. Calculate the dollar amount of dividends paid. c. Calculate the addition to retained earnings

7) Dunder Mifflin Paper Co. expects to have an increase in sales this upcoming year. Therefore, they invest in a new storage facility to hold more product. If Dunder Mifflin's sales remain constant (meaning their projection was not accurate), what must be true? a) Their capital intensity ratio will increase b) They will have a higher net income c) Depreciation expenses will decrease d) Not enough information 8) If a firm forecasts that it will have an increase in sales of 20%, all else held constant (meaning nothing else changes), which of the following ratios will be affected and how will \$they be affected? 9) Cole Furnaces had $4 million in operating income (EBIT). The company had a net depreciation expense of $1 million and an interest expense of $1 million; its combined federal and state corporate tax rate is 25%. The company has $14 million in operating current assets and $4 million in operating current liabilities; it has $15 million in net plant and equipment. Total net operating capital (net plant and equipment plus NOWC) in the previous year was $24 million. a. Calculate the company's NOPAT (net operating profit after taxes). b. Calculate NOWC and total net operating capital for the current year. c. Calculate the company's FCF (free cash flow) for the year. 10) Ricky Roo Films Co. earned 165,452 in after-tax profit for 2022 . The firm's Payout Ratio is 60% and retained earnings were 45,180 at the end of last period. a. What is the firm's Retention Ratio? b. Calculate the dollar amount of dividends paid. c. Calculate the addition to retained earnings Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started