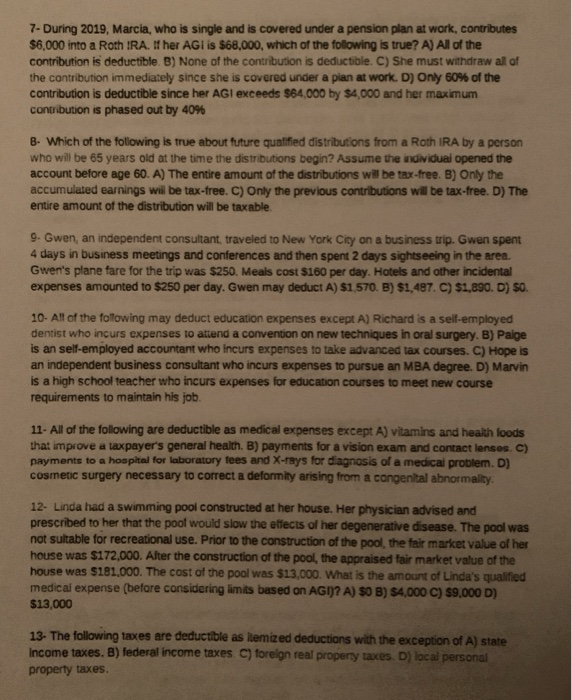

7- During 2019, Marcia, who is single and is covered under a pension plan at work, contributes $6,000 into a Roth IRA. I her AGI is $68,000, which of the following is true? A) Al of the contribution is deductible. B) None of the contribution is deductible. C) She must withdraw al of the contribution immediately since she is covered under a plan at work. D) Only 60% of the contribution is deductible since her AGI exceeds $64,000 by $4,000 and her maximum contribution is phased out by 40% 8. Which of the following is true about future qualified distributions from a Roth IRA by a person who will be 65 years old at the time the distributions begin? Assume the individual opened the account before age 60. A) The entire amount of the distributions will be tax-free. B) Only the accumulated earnings will be tax-free. C) Only the previous contributions will be tax-free. D) The entire amount of the distribution will be taxable. 9. Gwen, an independent consultant, traveled to New York City on a business trip. Gwen spent 4 days in business meetings and conferences and then spent 2 days sightseeing in the area. Gwen's plane fare for the trip was $250. Meals cost $160 per day. Hotels and other incidental expenses amounted to $250 per day. Gwen may deduct A) 51 570. B) $1,487. C) $1,890. D) SO. 10- All of the following may deduct education expenses except A) Richard is a self-employed dentist who incurs expenses to attend a convention on new techniques in oral surgery. B) Paige is an self-employed accountant who incurs expenses to take advanced tax courses. C) Hope is an independent business consultant who incurs expenses to pursue an MBA degree. D) Marvin is a high school teacher who incurs expenses for education courses to meet new course requirements to maintain his job. 11. All of the following are deductible as medical expenses except A) vitamins and health foods that improve a taxpayer's general health. B) payments for a vision exam and contact lenses. C) payments to a hospital for laboratory fees and X-rays for diagnosis of a medical problem. D) cosmetic surgery necessary to correct a deformity arising from a congenital abnormality. 12. Linda had a swimming pool constructed at her house. Her physician advised and prescribed to her that the pool would slow the effects of her degenerative disease. The pool was not suitable for recreational use. Prior to the construction of the pool, the fair market value of her house was $172,000. Alter the construction of the pool, the appraised fair market value of the house was $181,000. The cost of the pool was $13,000. What is the amount of Linda's qualified medical expense (betare considering limits based on AGI? A) SO B) $4,000 C) 59,000 D) $13,000 13. The following taxes are deductible as lemized deductions with the exception of A) state Income taxes. B) federal income taxes. C) foreign real property taxes. D) local personal property taxes